Sharing knowledge about finance

24 Charts -What is going on in Spain in corporate finance September- October 2021

RS Corporate Finance analyses the Spanish financial market during the months of September and October, as well as the most relevant Private Equity and M&A transactions.

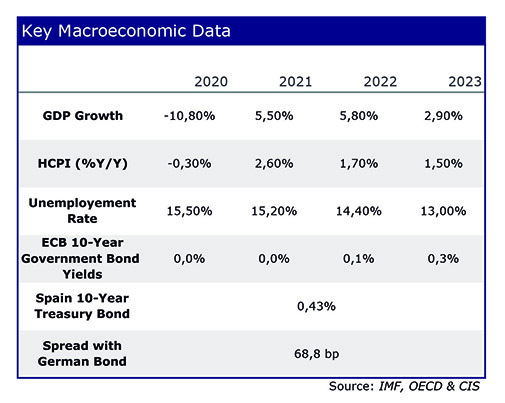

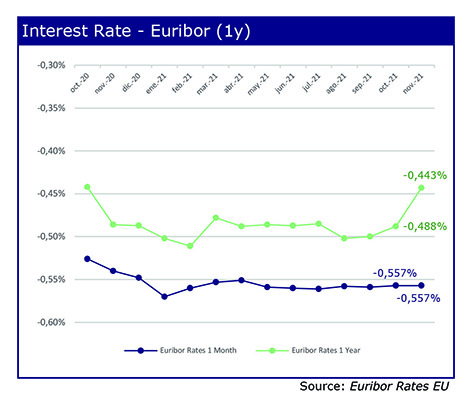

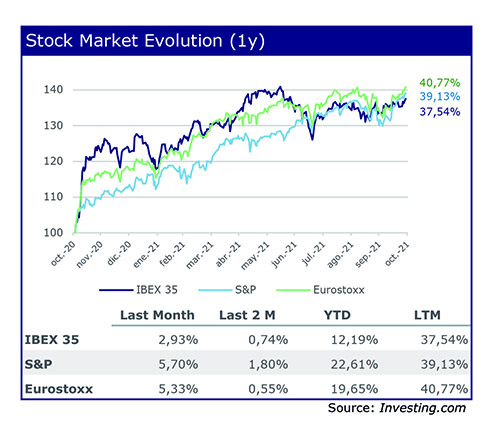

In the 24 Graphs we analyze what happened in Spain during the months of September and October both from a financial point of view and in terms of mergers and acquisitions. Throughout the first 12 graphs we can observe the evolution that the macroeconomic data have maintained, as well as the Euribor and the evolution of the stock market during the last year and a comparison is made with the months of September and October.

During the last two months, we have witnessed high volatility in the markets. During September, the world’s stock markets suffered a correction due to the collapse of the Chinese real estate company Evergrande and supply chain problems. During October, however, the stock market had a strong rebound.

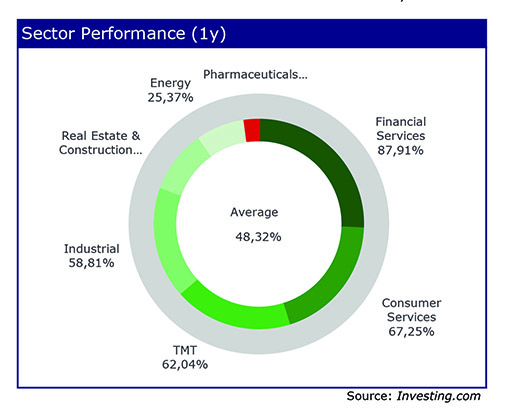

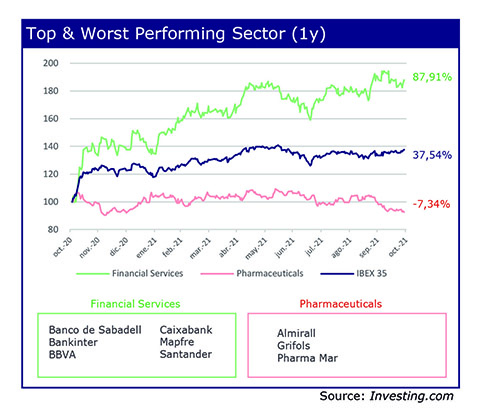

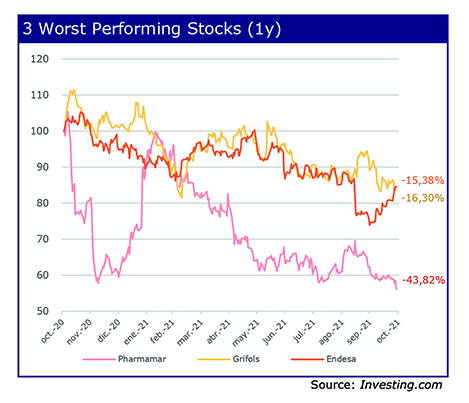

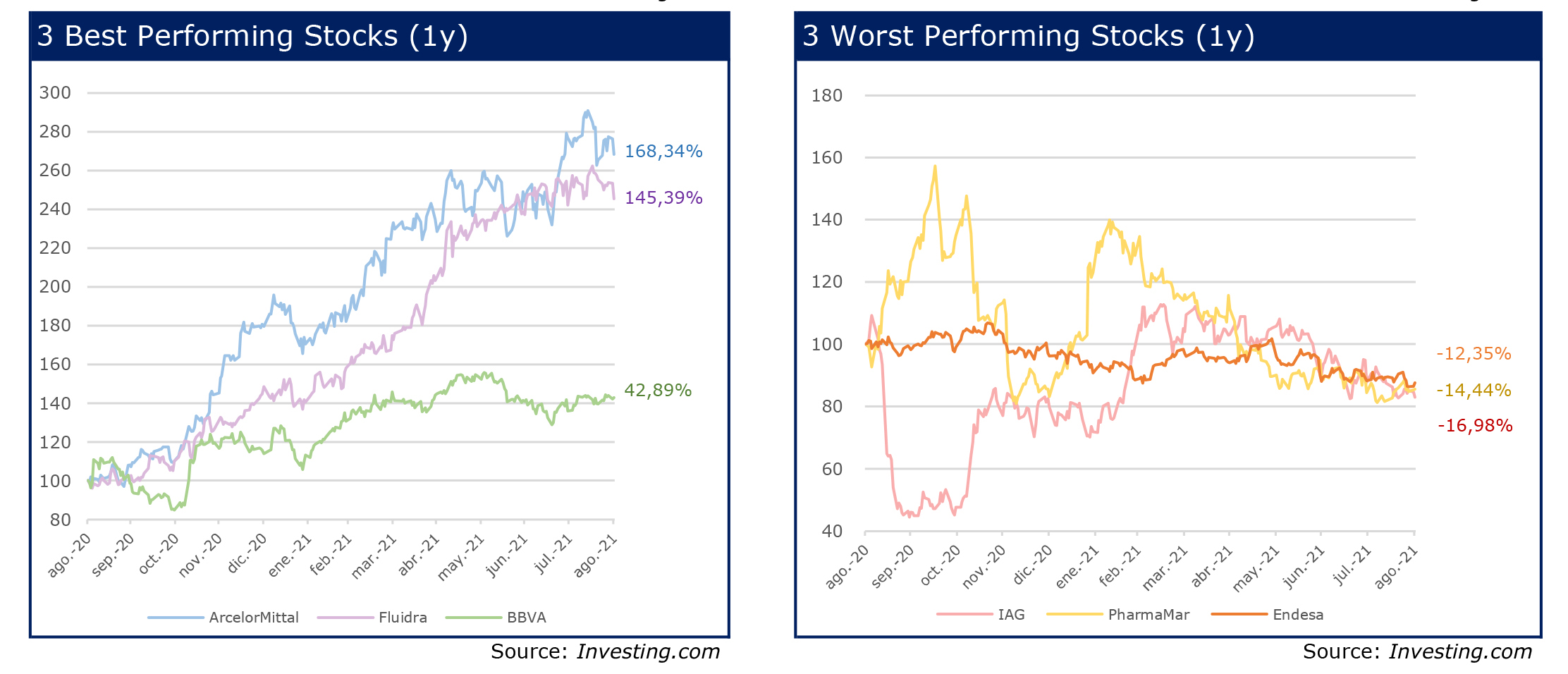

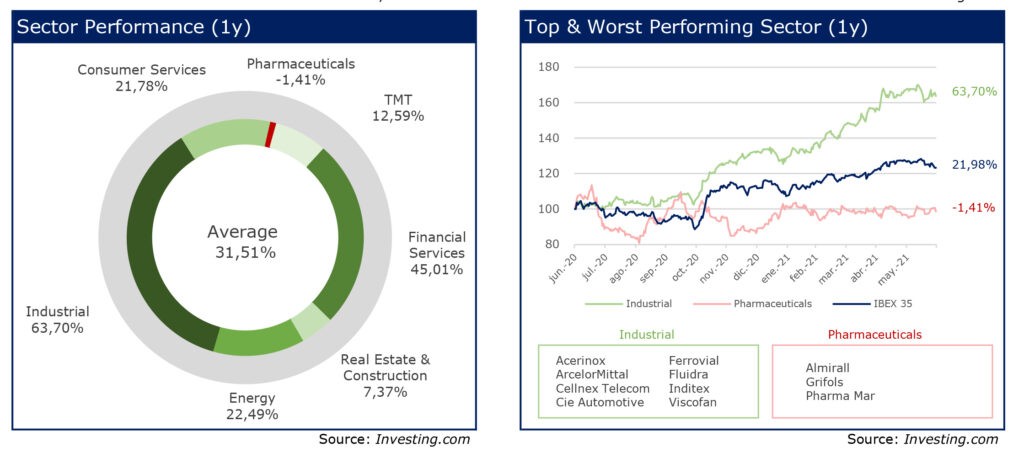

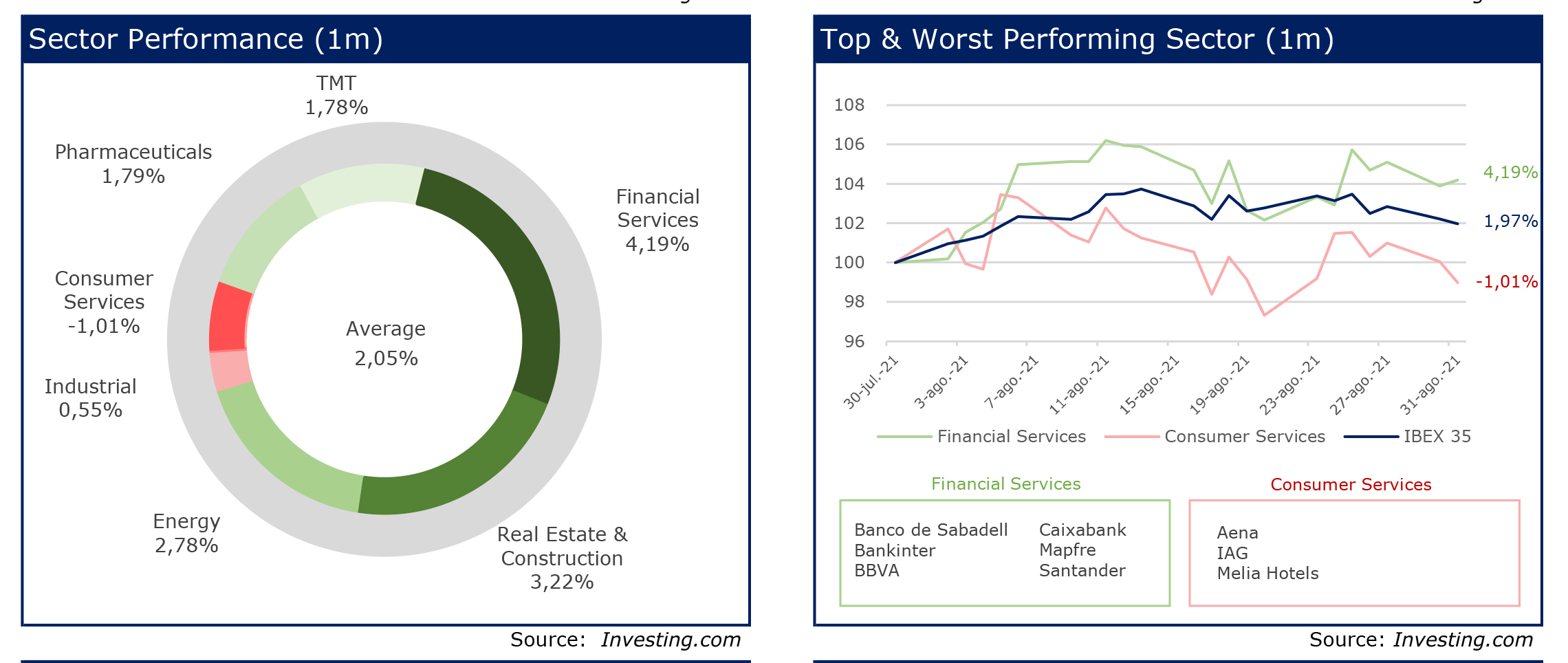

If we analyze the evolution by sector, we can see that the sector with the greatest strength during the last year is the financial services sector followed by the consumer sector. The sector that has performed the worst in the last 12 months has been the pharmaceutical sector, which had experienced a significant growth at the beginning of the pandemic which has gradually been fading.

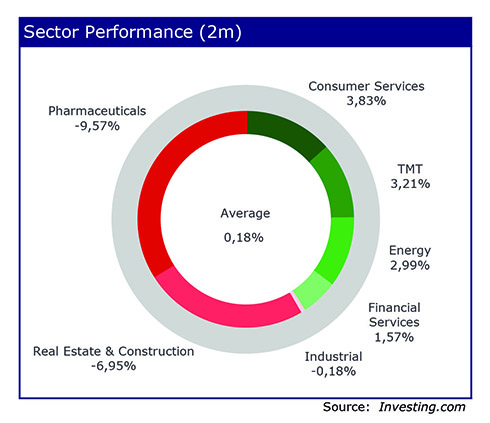

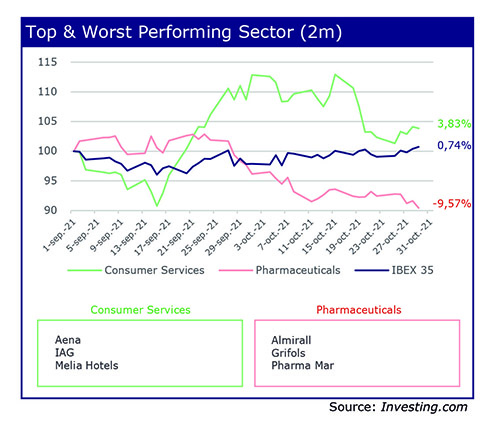

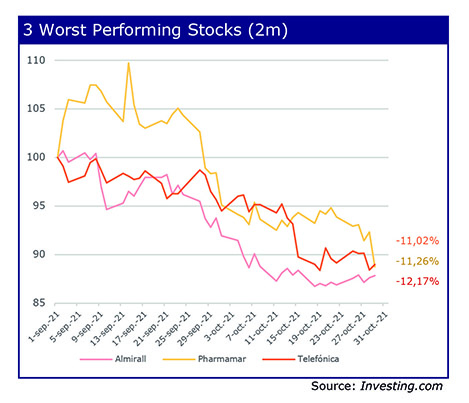

While analyzing the industry sectors within the IBEX during September and October, we can see that the one with the best performance is the services sector with a rise of 3.83%, followed by the technology and energy sectors, and finally the financial services sector, which rose 1.57%. The most burdened sectors have been the pharmaceutical and the construction sectors. The pharmaceutical sector’s downtrend persists.

Specifically, the companies with the best performance on the IBEX in the last two months have been Acciona, Repsol and Banco Sabadell. On the other hand, the companies that have suffered the greatest losses have been Almirall, Pharmamar and Telefónica.

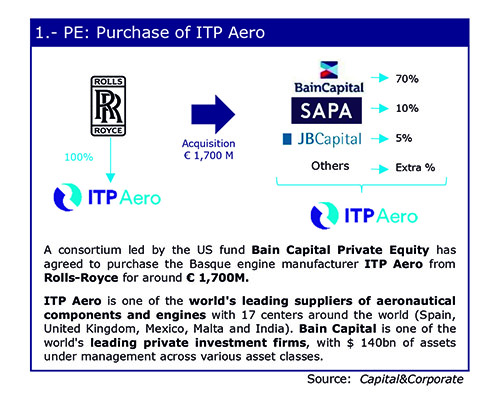

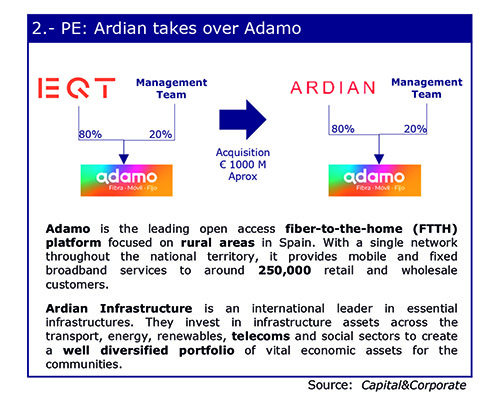

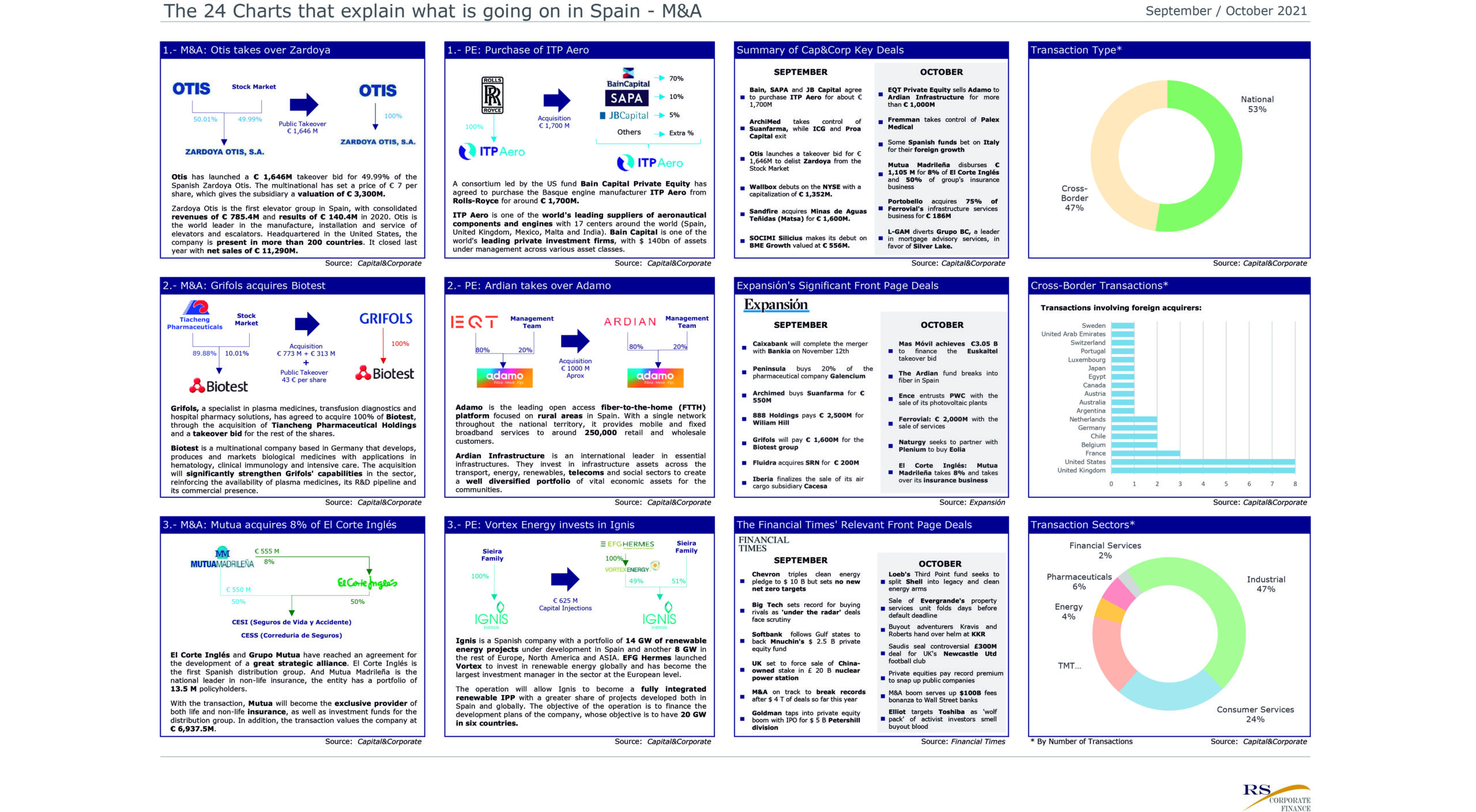

Within the M&A and Private Equity markets, 6 relevant transactions are analyzed after being announced during the past 2 months

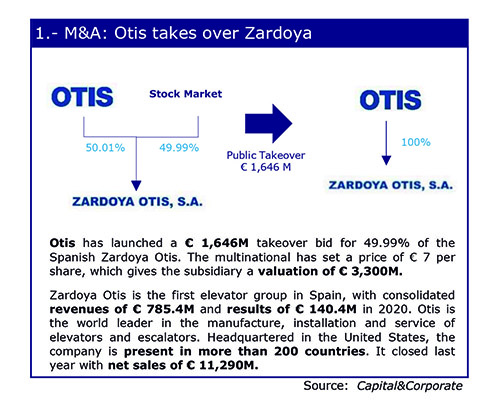

- In the first place, we have Otis’ takeover of Zardoya Otis of the 49.99% that it did not own with the aim of delisting the company from the stock market.

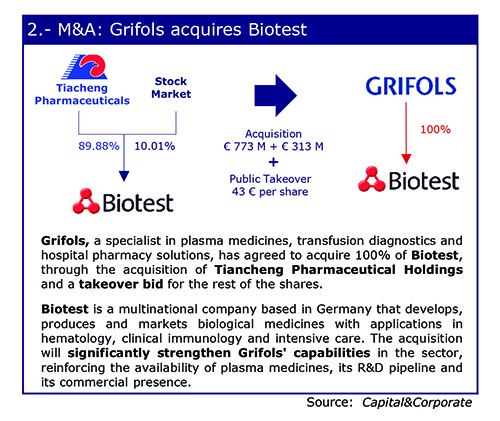

- In the pharmaceutical sector, Grifols has agreed to acquire 100% of Biotest, 89% through the acquisition of a holding company and the rest through a takeover bid.

- And finally, in the M&A market, Mutua Madrileña’s acquisition of 8% of El Corte Inglés valuing the company at 6,937 Million Euros.

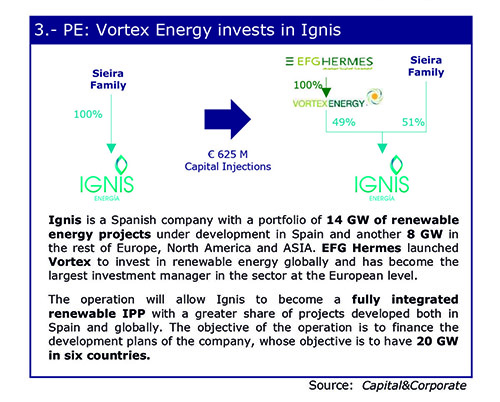

On the other hand, Private Equities made significant transactions such as:

In the Private Equity market we can highlight the continued ambition for the renewable energy market, an example of which is Vortex Energy’s purchase of 49% of Ignis.

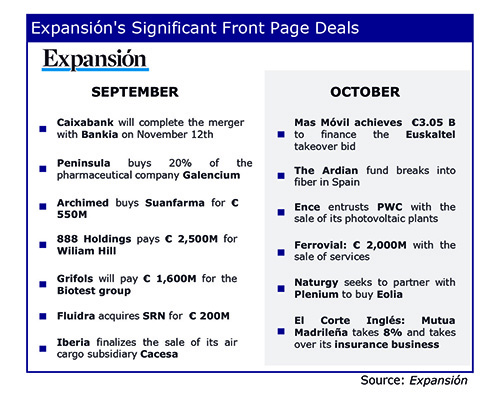

Next, after analyzing three medias with a financial focus: Capital & Corporate, Expansión and The Financial Times, on what happened in the Spanish and global market during the last two months, the following operations should be highlighted:

Capital & Corporate:

- Wallbox’s debut on the NYSE stands out with a capitalization of € 1,325M in the month of September.

- And in October, Mutua Madrileña’s acquisition of 8% of El Corte Inglés and 50% of its insurance business.

In Expansión, the following transactions can be highlighted:

- In September the aforementioned acquisition of Biotest Group by Grifols for € 1,600 million. And the acquisition of SRN by Fluidra for € 200m.

- And in October the news of Naturgy and Plenium partnering up for the acquisition of Eolia.

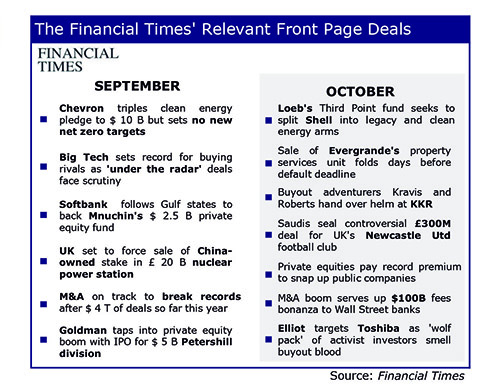

Regarding the global market, The Financial Timeshighlights the following news on the front page: in September the news about mergers and acquisitions, which beats records, reaching agreements worth 4 trillion so far this year. Additionally, in October we highlight the failure of Evergrande in the sale of its real estate services unit.

24 Charts -What is going on in Spain in corporate finance summer 2021

RS Corporate Finance analyzes the situation of the Spanish financial market during the summer, as well as the most relevant Private Equity and M&A transactions.

The 24 Graphs analyse what happened in Spain during the summer months both from a financial point of view and with respect to mergers and acquisitions.

On this occasion, the report is bimonthly, therefore, the first 24 graphs it contains are related to the financial markets, which highlight and analyse which stocks and sectors have performed better or worse from a shareholder’s point of view, and then, another 24 graphs which focus on several M&A transactions that occurred in Spain, compare 3 newspapers’ coverage on M&A transactions an analyse the transactions that ocurr3ed during the summer months.

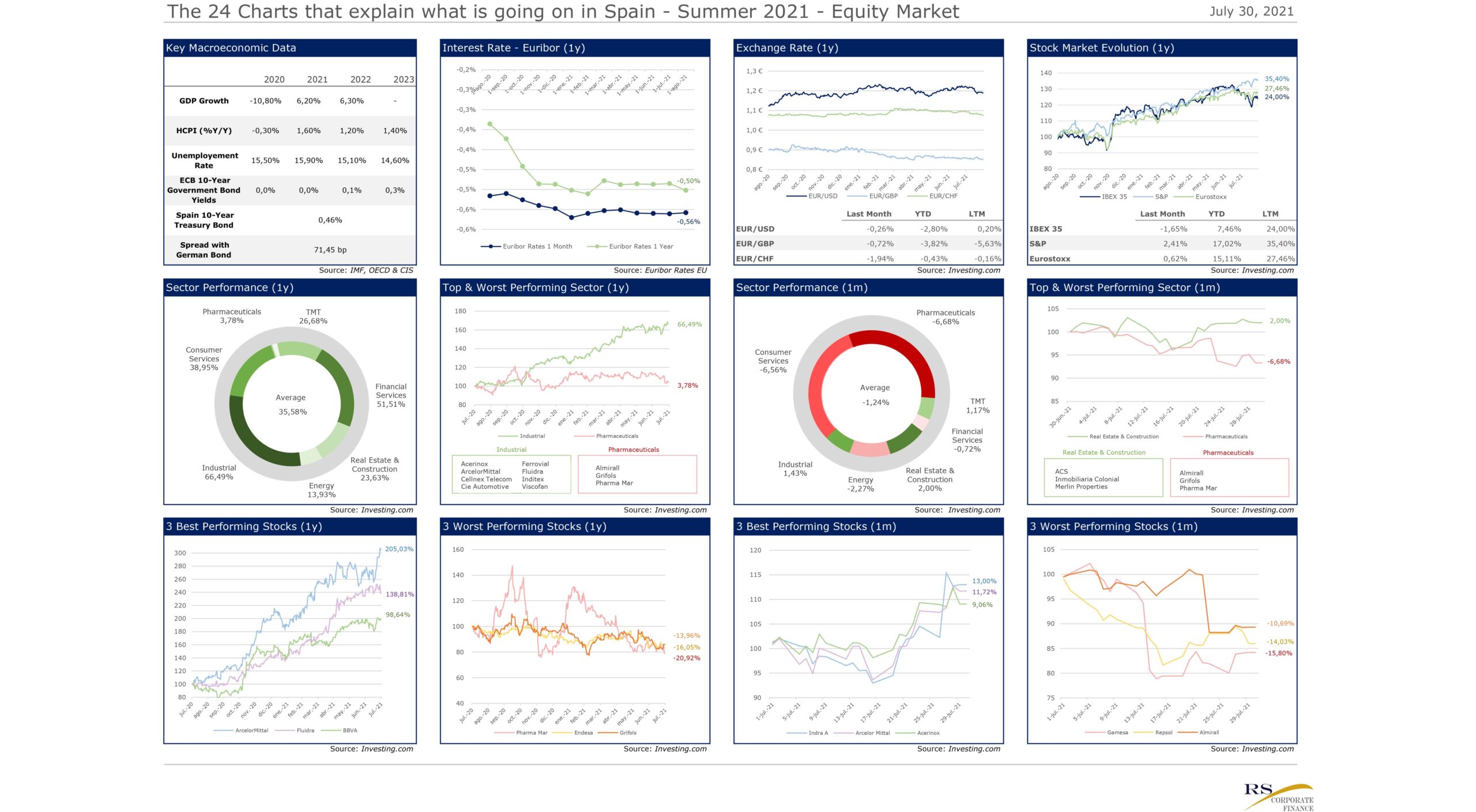

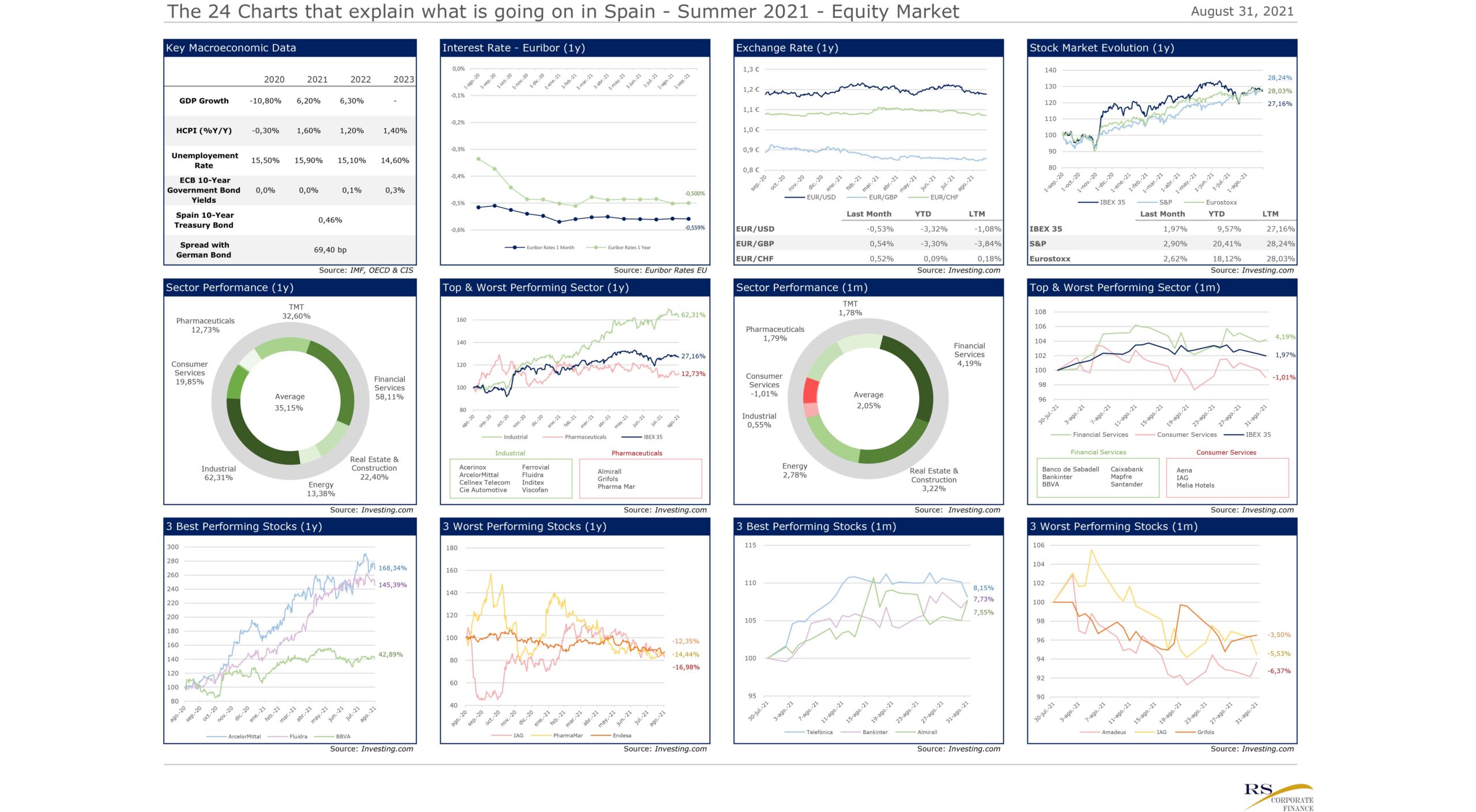

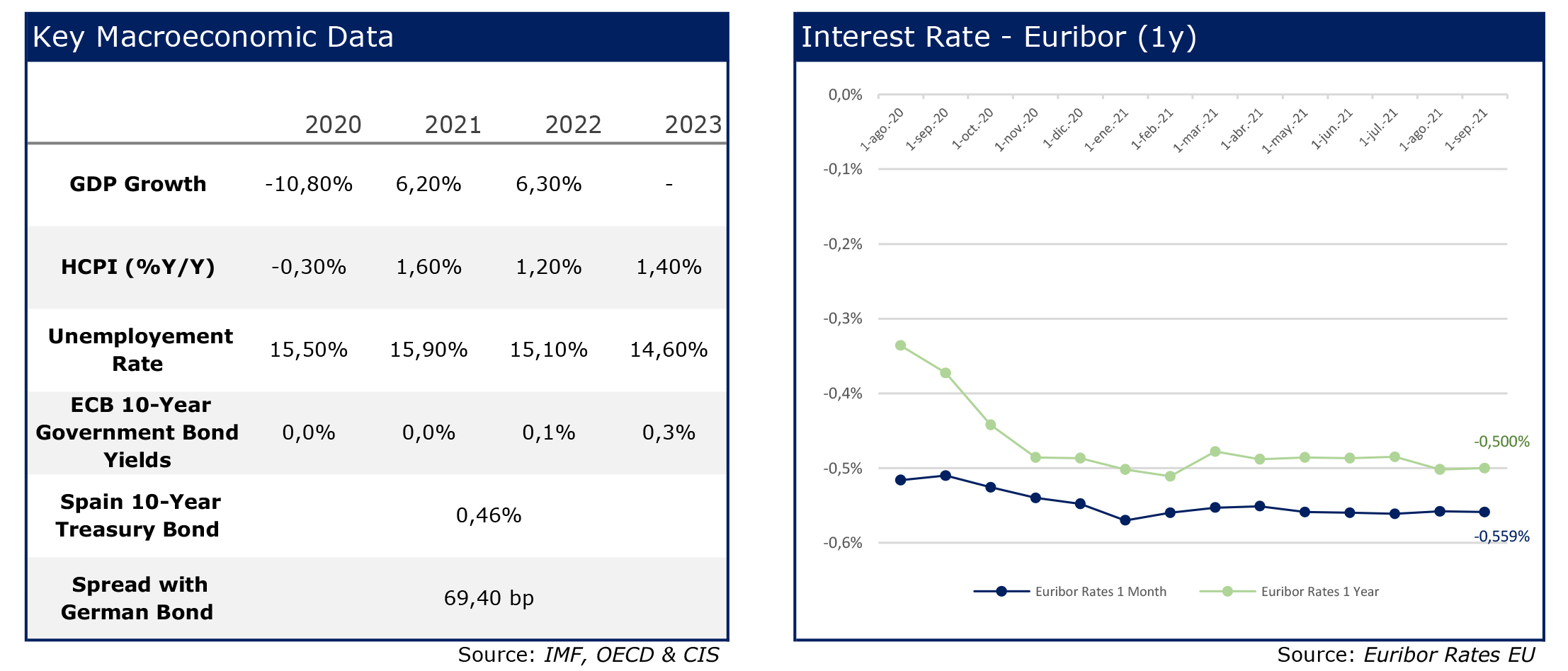

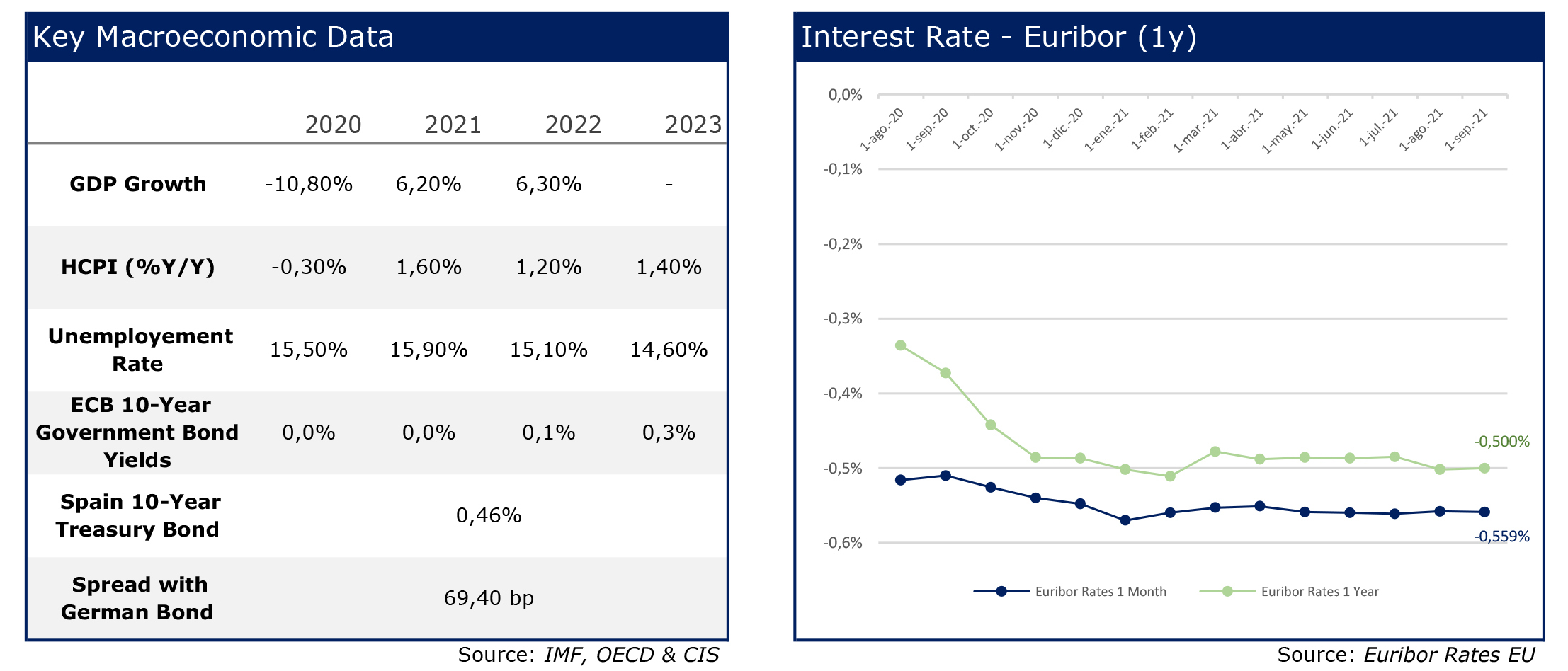

During the month of July, the macroeconomic indicators have remained constant except for the growth prospects of the Spanish economy, which have been revised upwards for 2022 and the EURIBOR continues the downward trend it has had in recent months. During the month of August, the indicators have remained constant, showing strong GDP growth and a progressive drop in the unemployment rate and for another month the EURIBOR continues its downward trend.

July 2021

August 2021

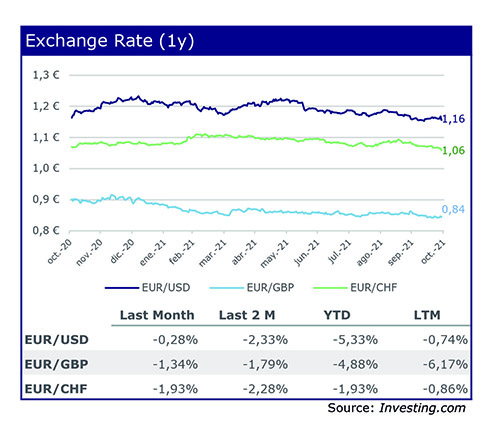

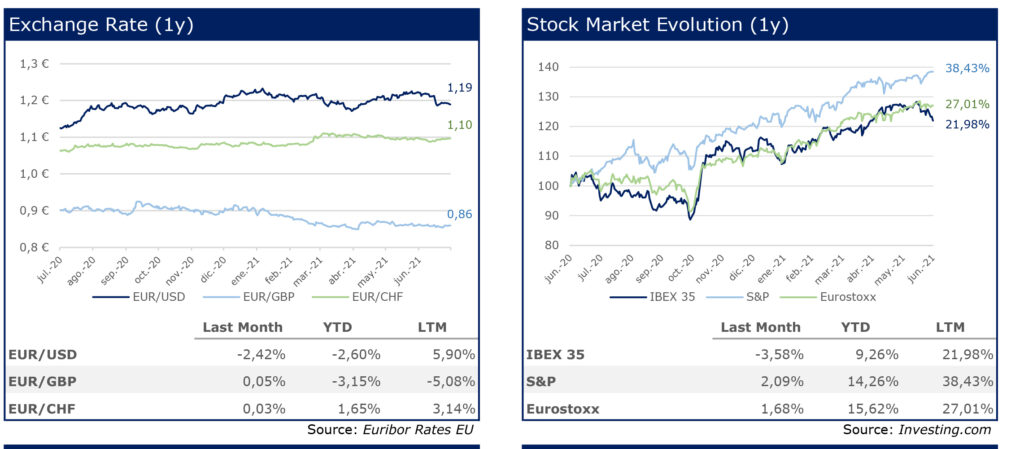

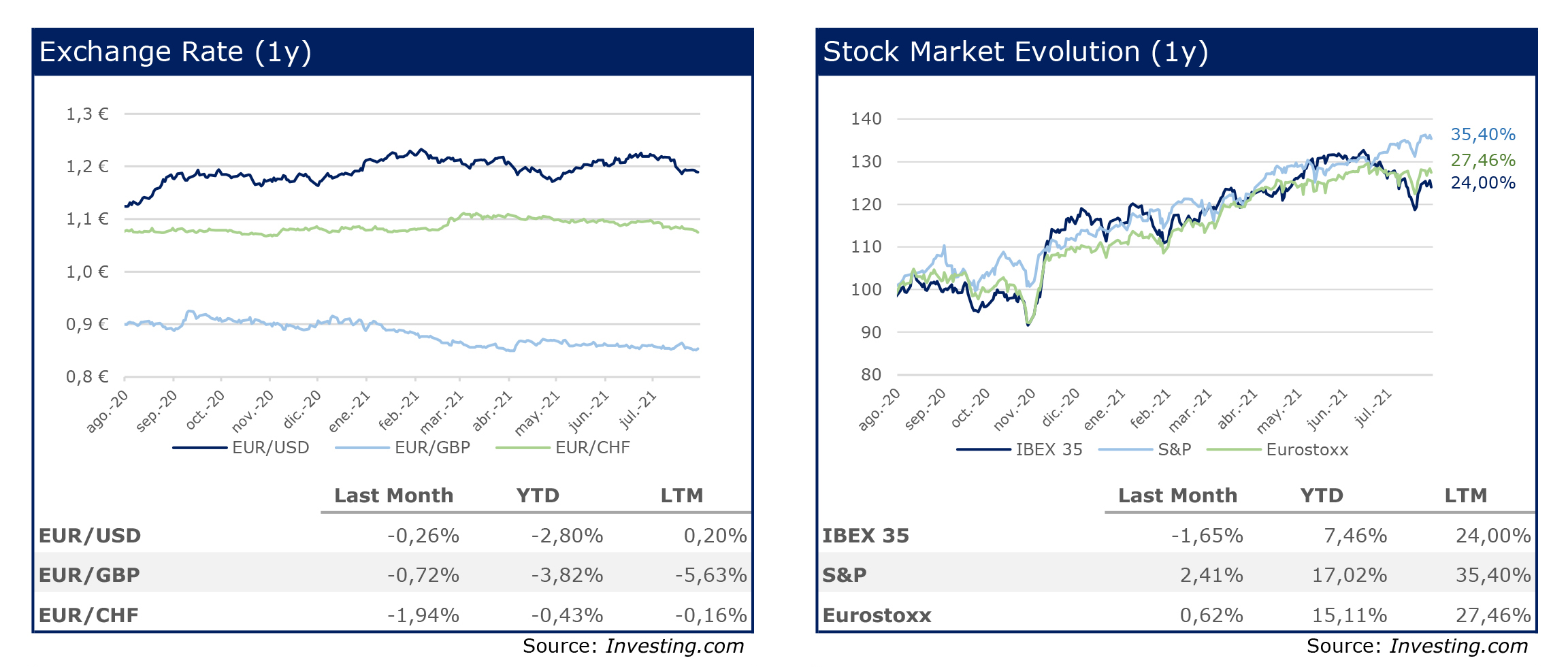

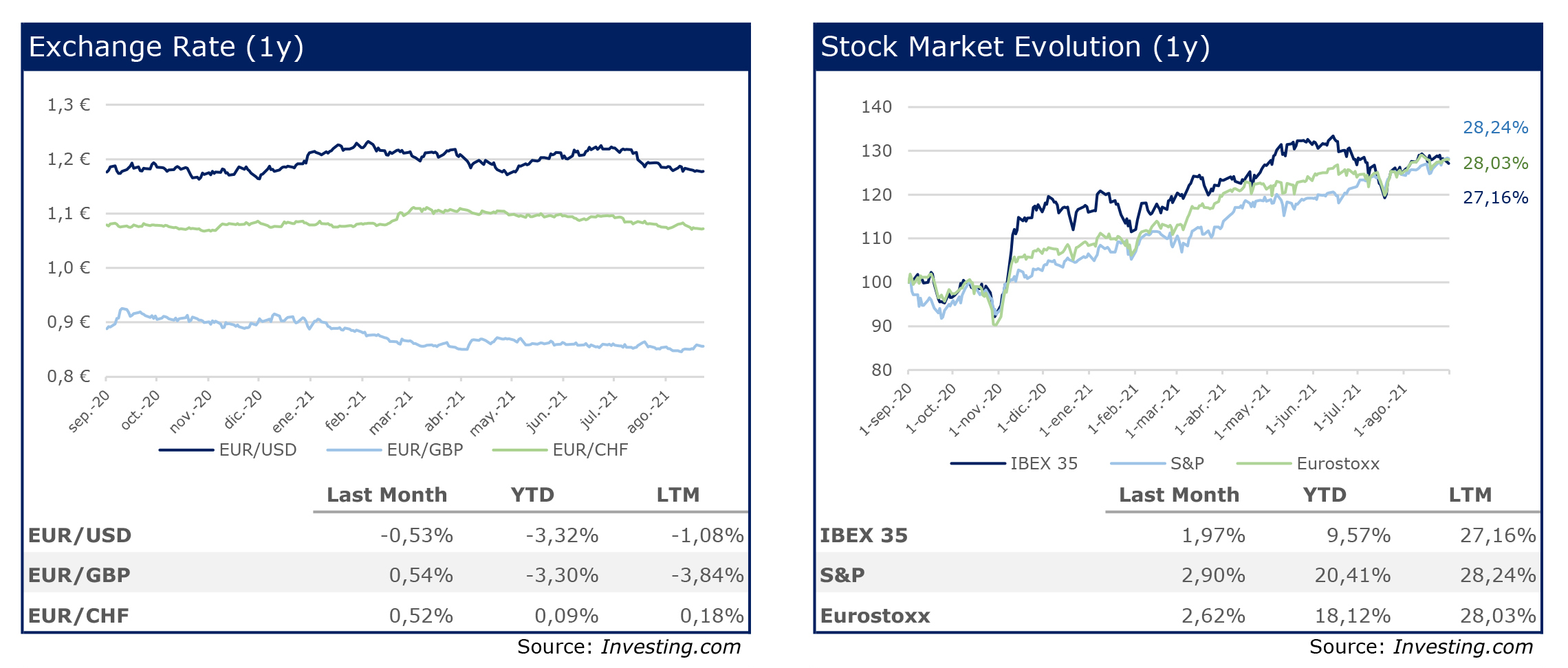

During the month of July, the Euro slightly depreciated against the main currencies and during the month of August although it continued to depreciate against the US dollar, it recovered against the British Pound and the Swiss Franc.

Regarding the stock markets, both the American and European markets have appreciated, as indicated by the S&P500 and Euro Stoxx indexes, while the Spanish index depreciated during the month of July. The month of August was a month of appreciations in world stock markets with the US at the forefront, which continues to reach maximum levels week by week. The Ibex, for its part, barely appreciated a few tenths during the summer.

July 2021

August 2021

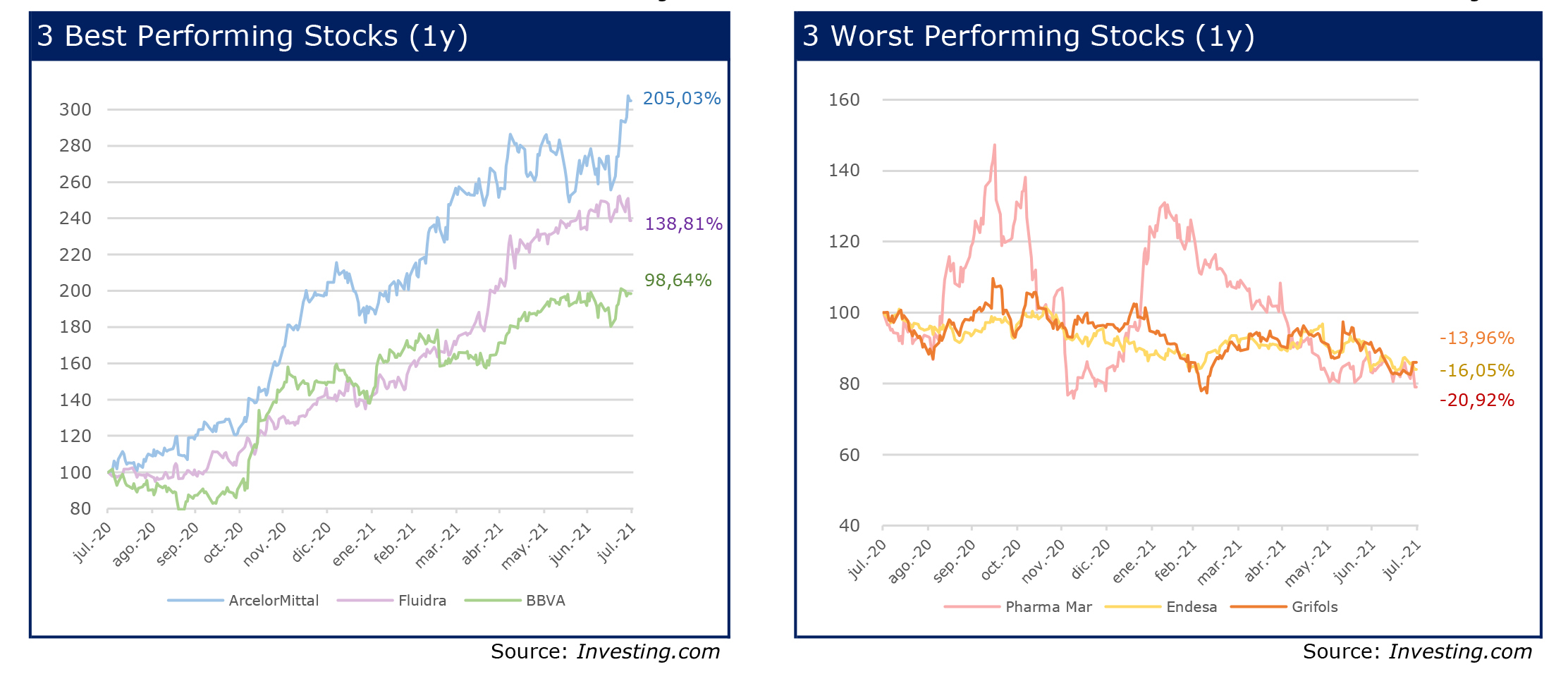

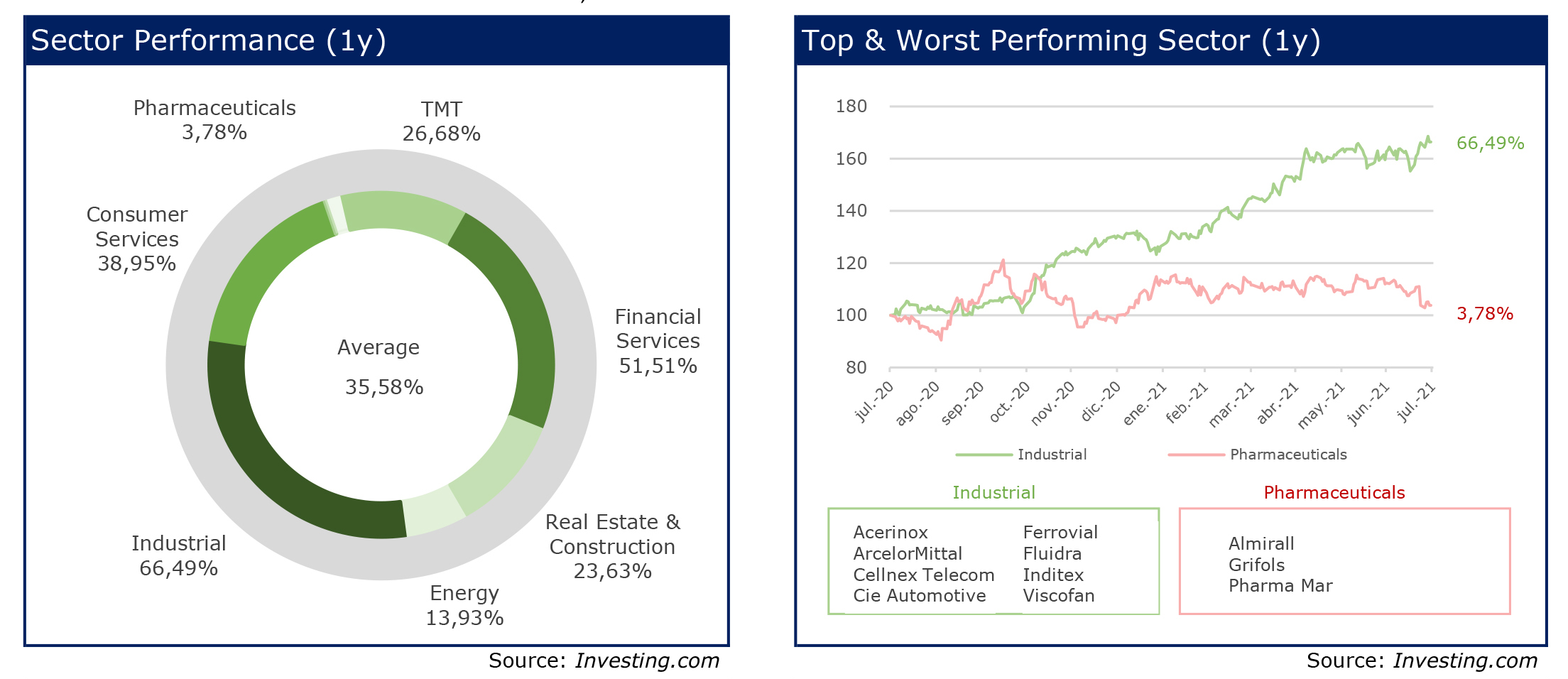

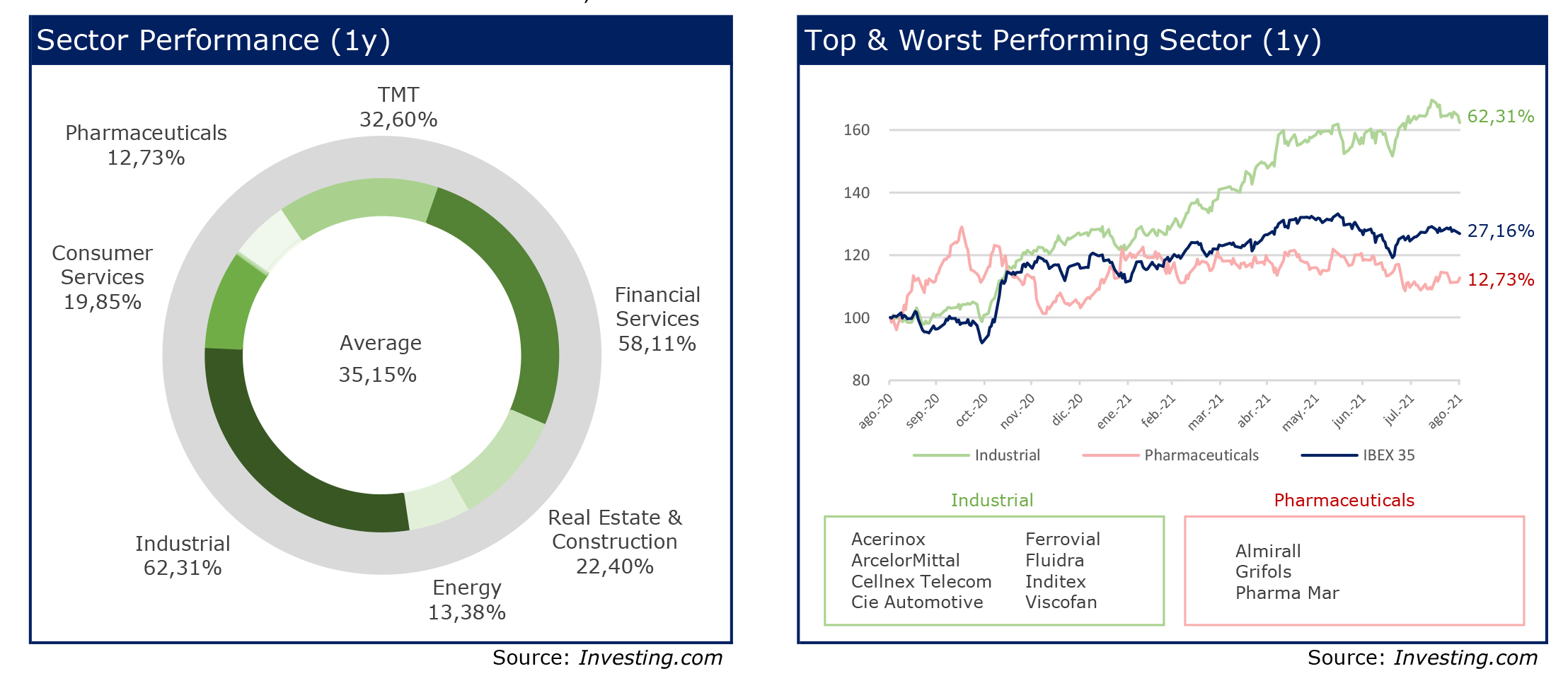

When analysing the differentsectors’ evolution in the Spanish stock market during the last 12 months, the industrial sector has been the strongest sector with the most growth while the pharmaceutical sector has had the worst performance.

July 2021

August 2021

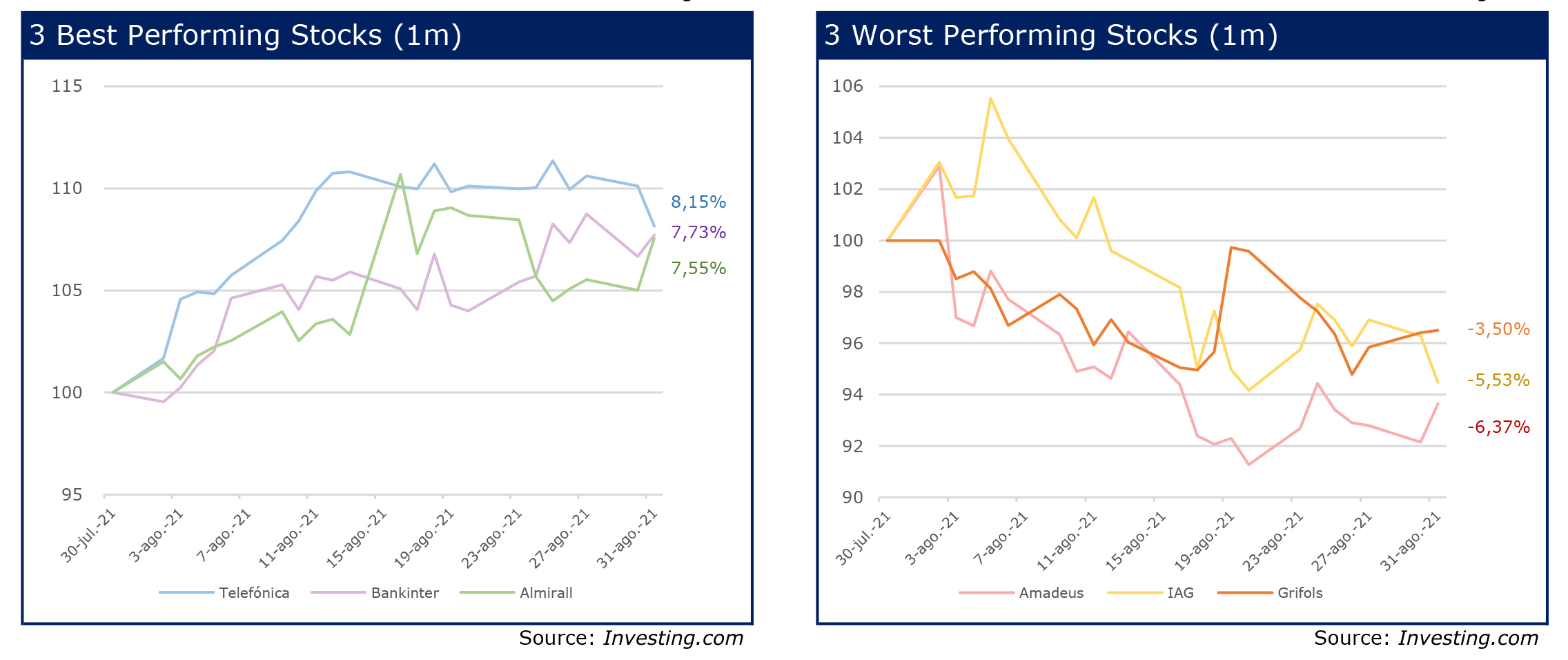

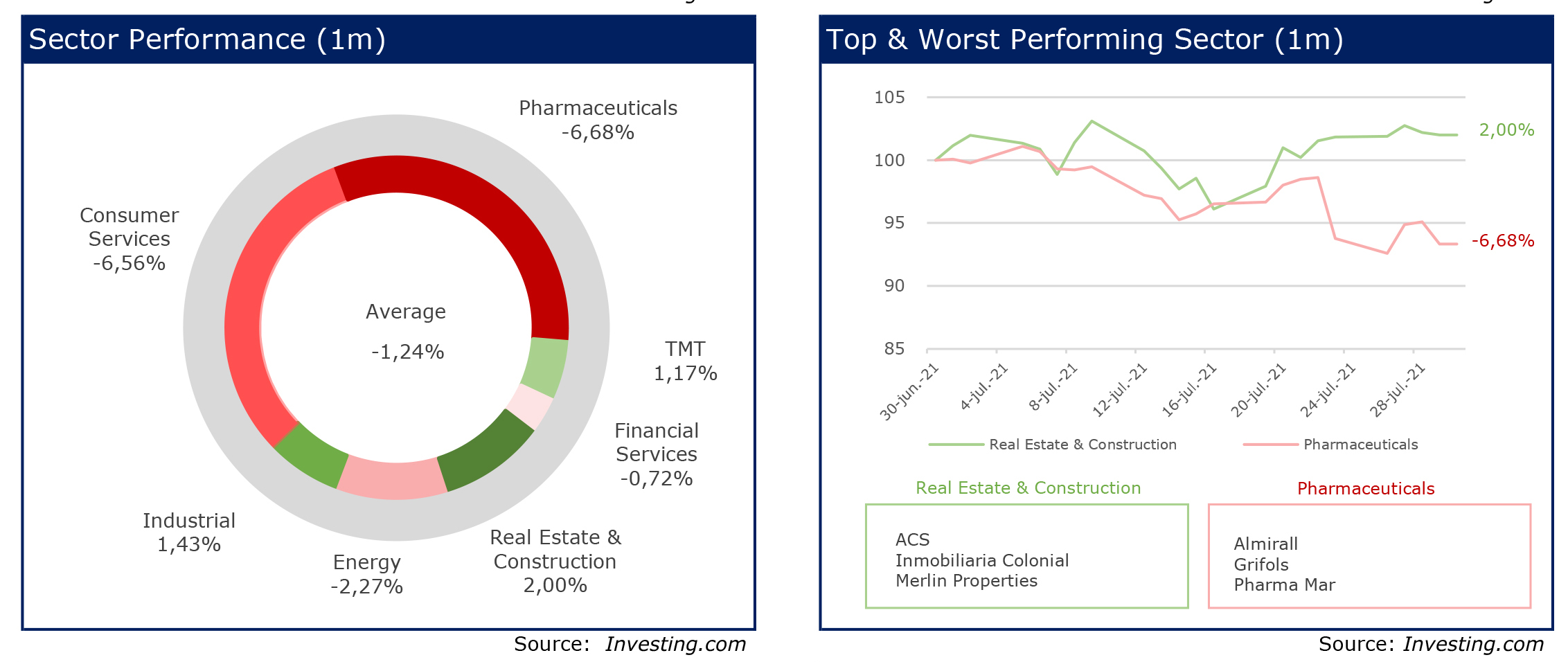

The Spanish stock market experienced a generalized decrease during July, especially in the pharmaceutical and consumer sectors. The technological, industrial and construction sectors were spared from this decrease and in fact had a slight increase. However, during the month of

The IBEX sectors that have grown the most have been the construction, technology and financial sectors, while the most affected sectors have been the pharmaceutical and consumer sectors.

July 2021

August 2021

During the last 12 months, the remarkable growth of the industrial sector is mainly due to Fluidra and ArcelorMittal. BBVA’s performance can also be highlighted as it was the best in its sector. On the other hand, the most troubled companies have been the pharmaceutical companies Pharma Mar, the electricity company Endesa; Grifols and IAG shared one position in July and another in August.

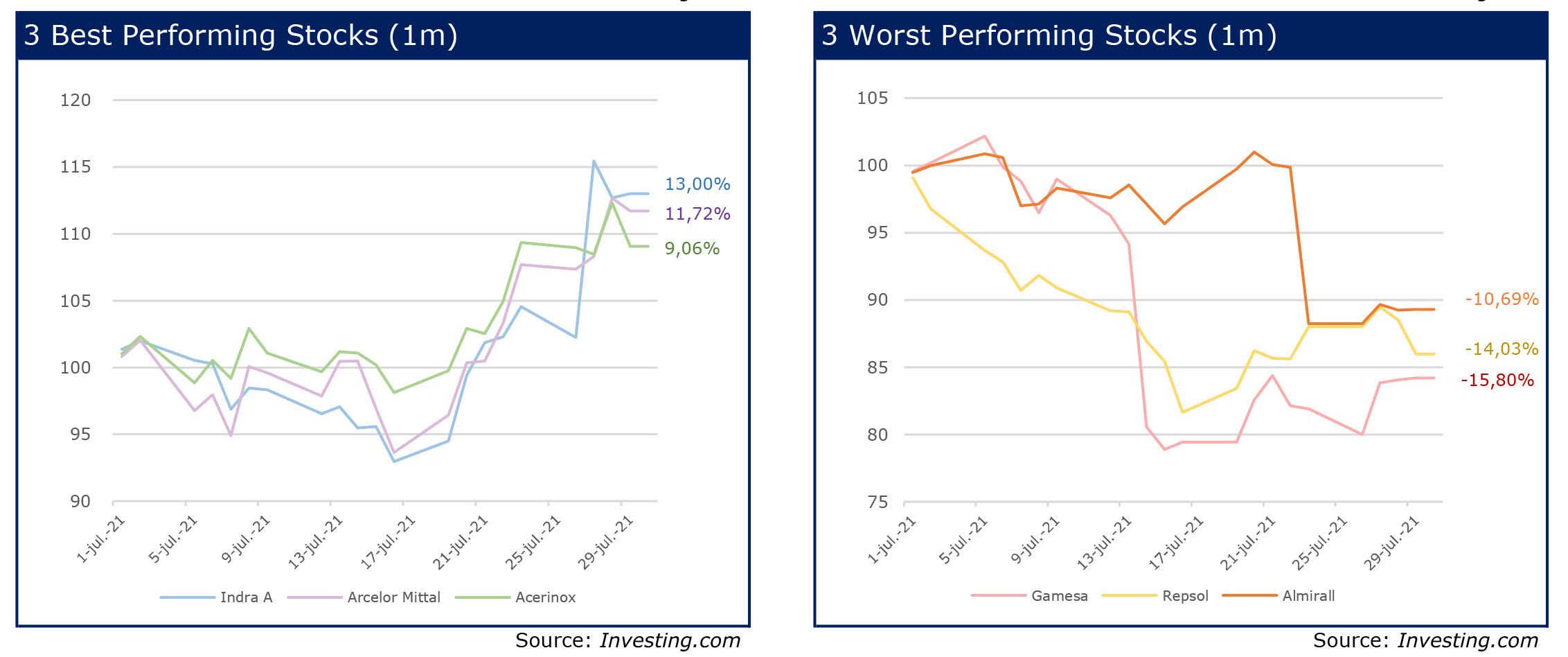

TDuring the month of July, Indra, Arcelor and Acerinox were the companies with the greatest increases while Gamesa, Repsol and Almirall were the companies with the most significant decreases. On the other hand, during the month of

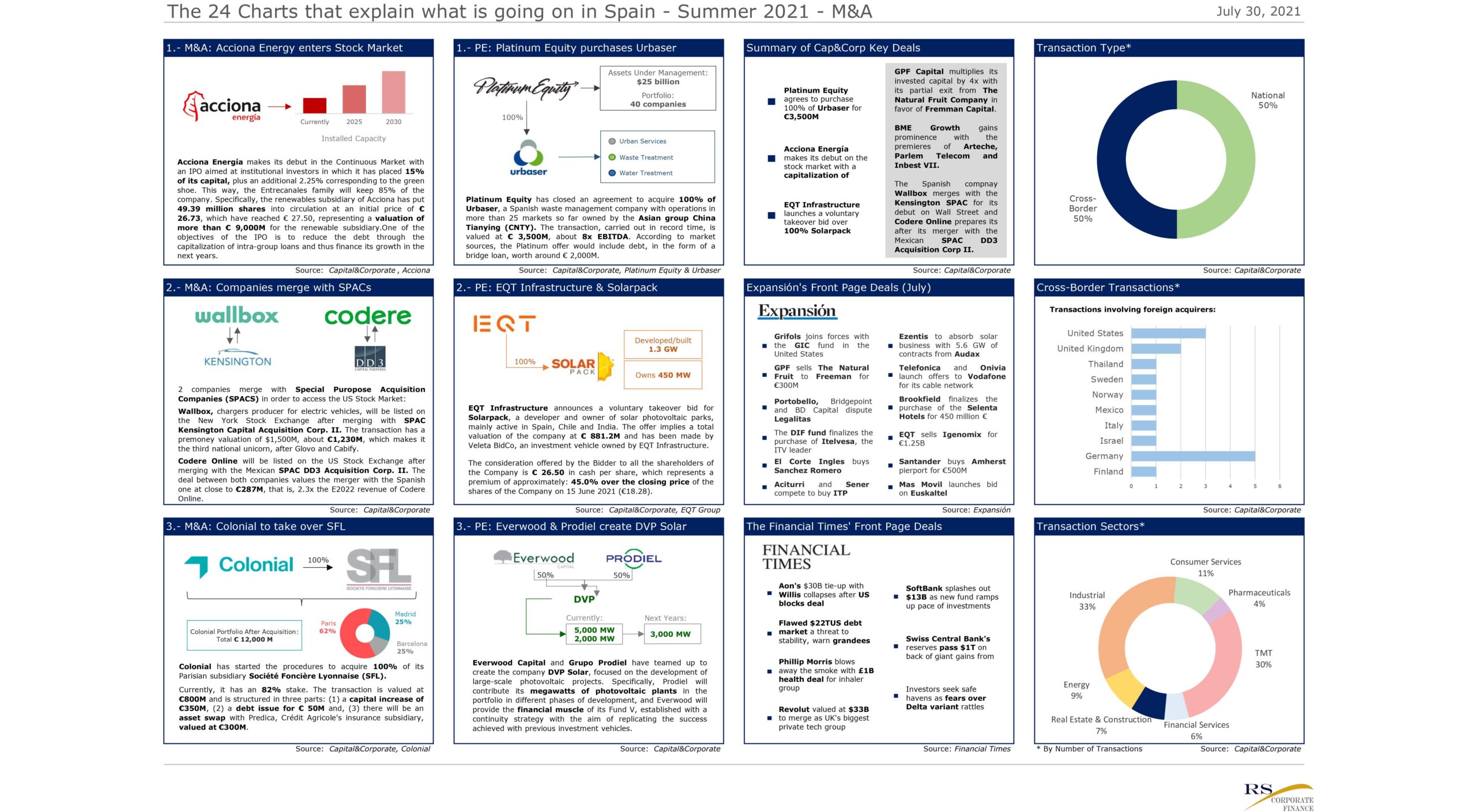

Some of the most relevant M&A transactions that took place in July included:

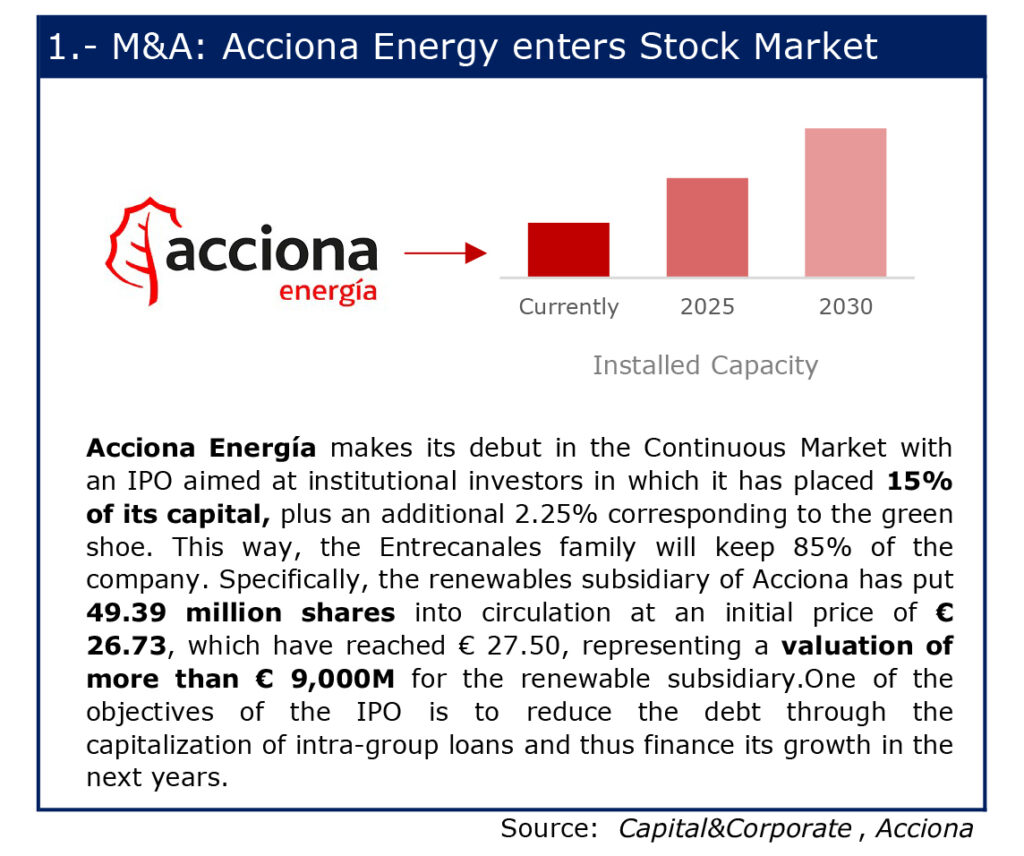

- Acciona Energía made its debut on the Continuous Market with an IPO aimed at institutional investors in which it has placed 15% of its capital, which represents a valuation of more than € 9,000 M for the company.

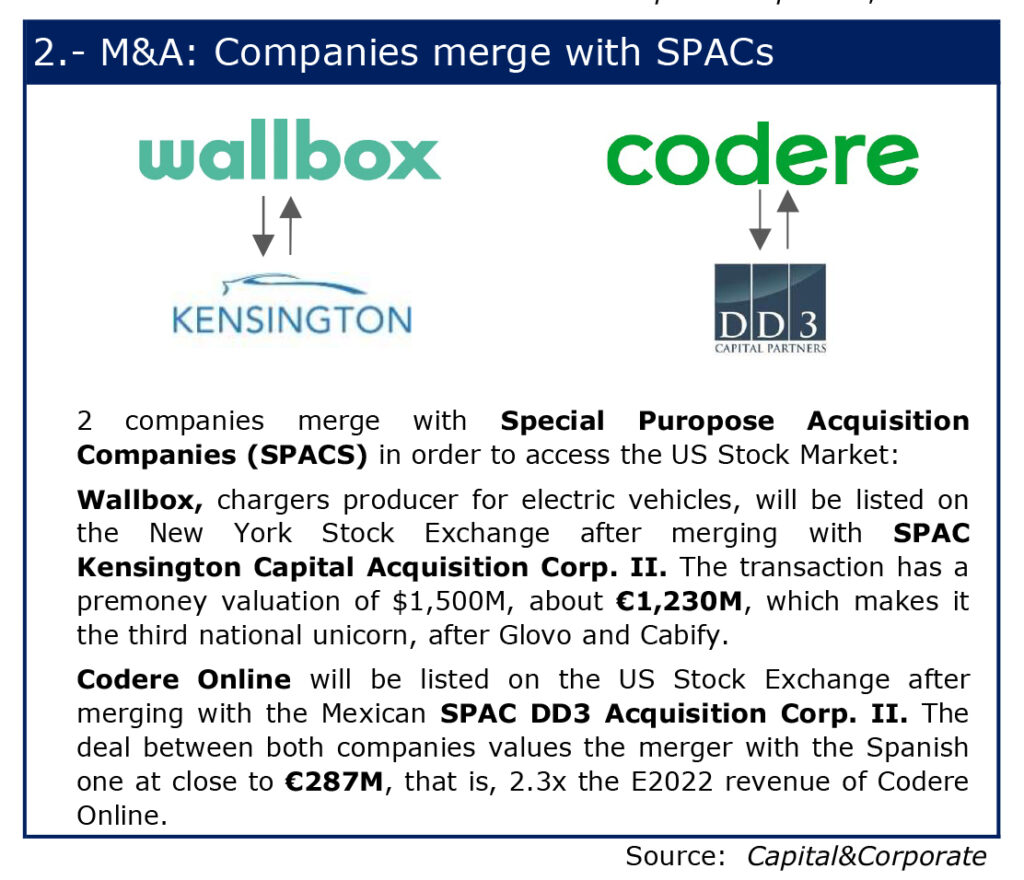

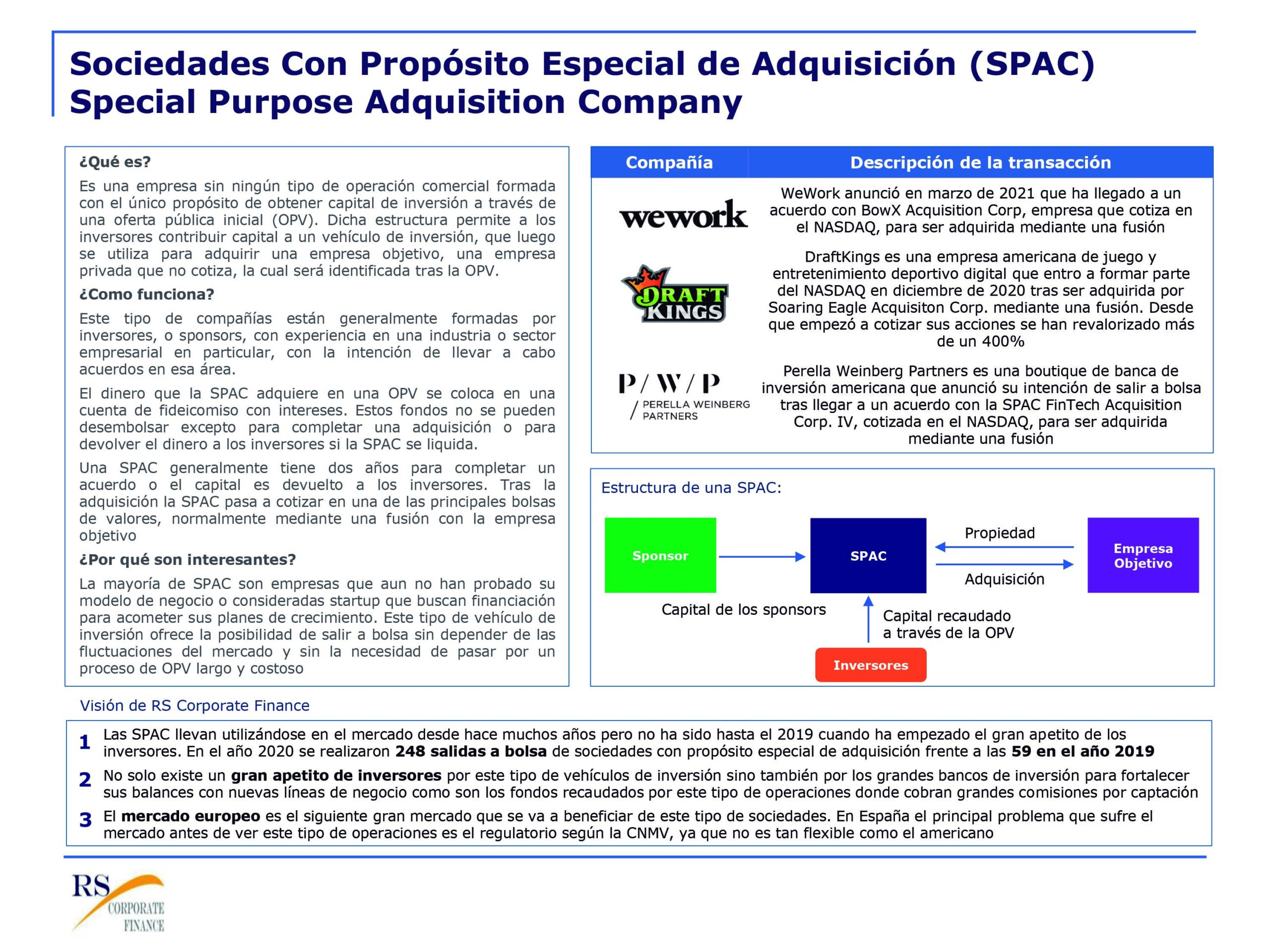

- 2 companies merged with SPACS or Special Purpose Acquisition Companies (to access the US Stock Exchange), Wallbox, a producer of chargers for electric vehicles, and Codere Online, an online betting house.

- Colonial has started the procedures to acquire 100% of its Parisian subsidiary SFL. The transaction is valued at € 800 million and Colonial's portfolio after the acquisition will total € 12,000 million.

On the other hand, Private Equities made significant transactions such as:

- Platinum Equity has closed an agreement to acquire 100 from Urbaser, a Spanish waste management company. The transaction is valued at € 3,500 M around 8 x EBITDA.

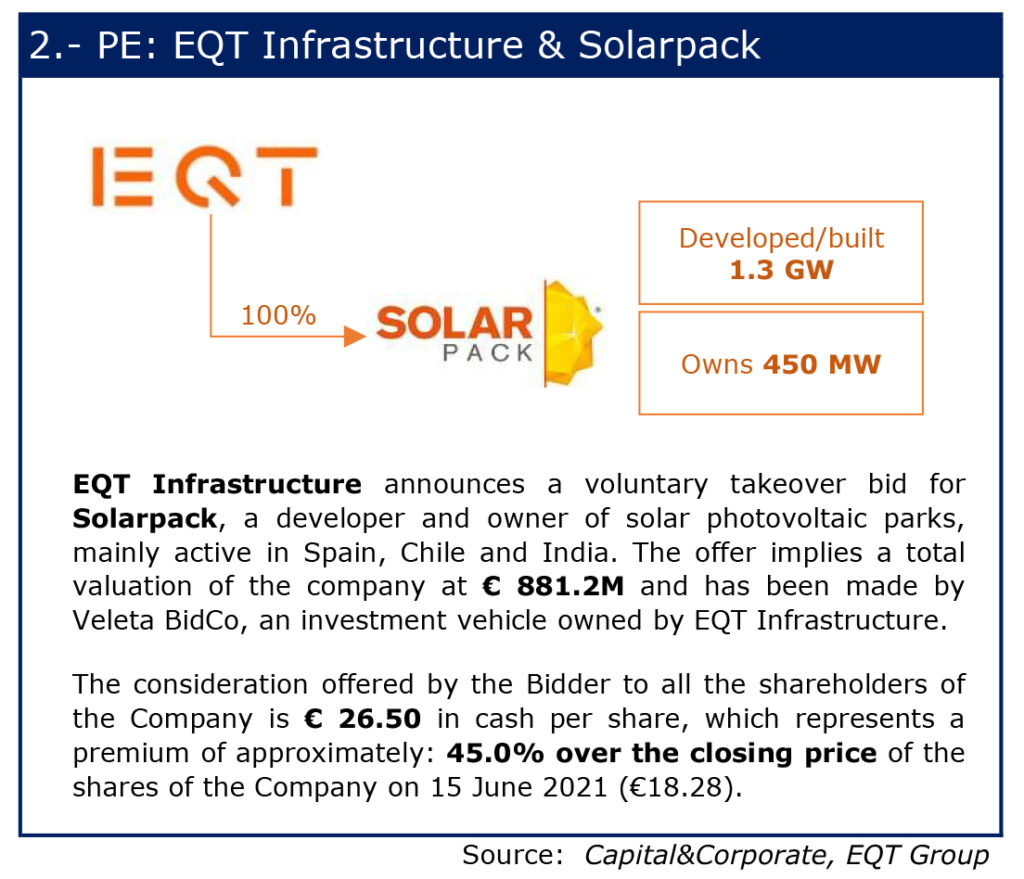

- EQT Infrastructure announced a voluntary takeover bid of Solarpack, the Spanish developer and owner of photovoltaic solar parks. The consideration offered to the Company's shareholders represents a premium of approximately 45% over the closing price.

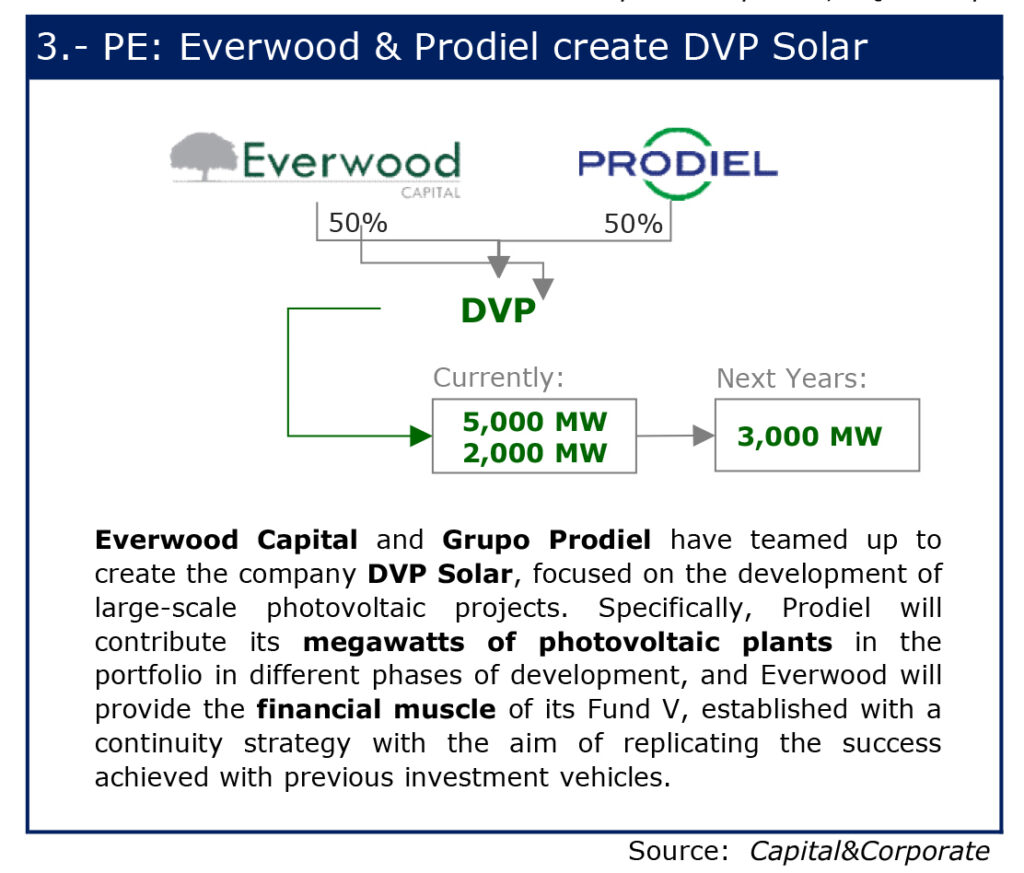

- Lastly, Everwood Capital and Grupo Prodiel have come together to create the DVP Solar company focused on the development of large-scale photovoltaic projects. Specifically, Prodiel will contribute its megawatts of portfolio photovoltaic plants in different phases of development, and Everwood will provide the financial muscle.

July 2021

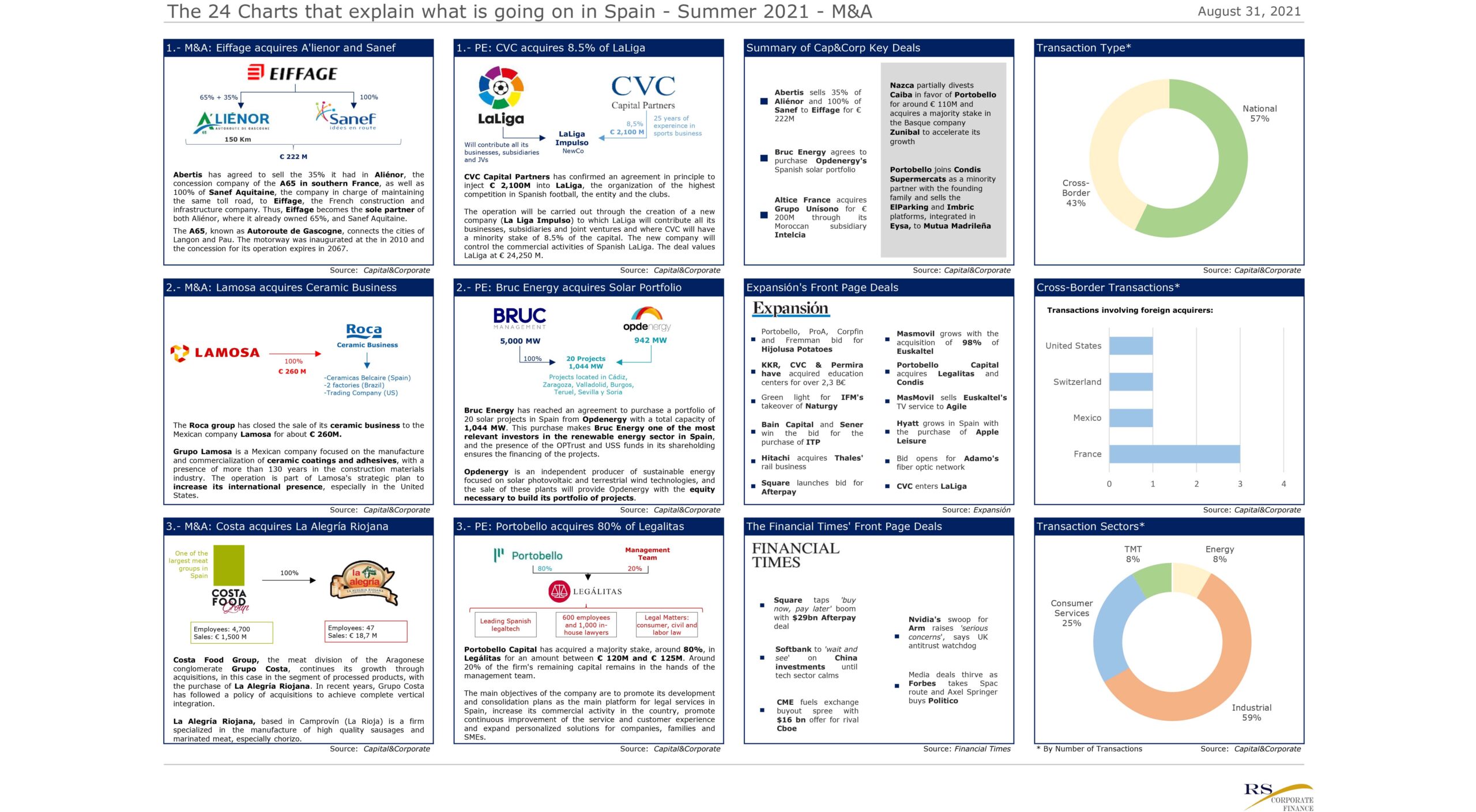

As the M&A and Private Equity markets continued to be very active in August, some of the most relevant transactions included:

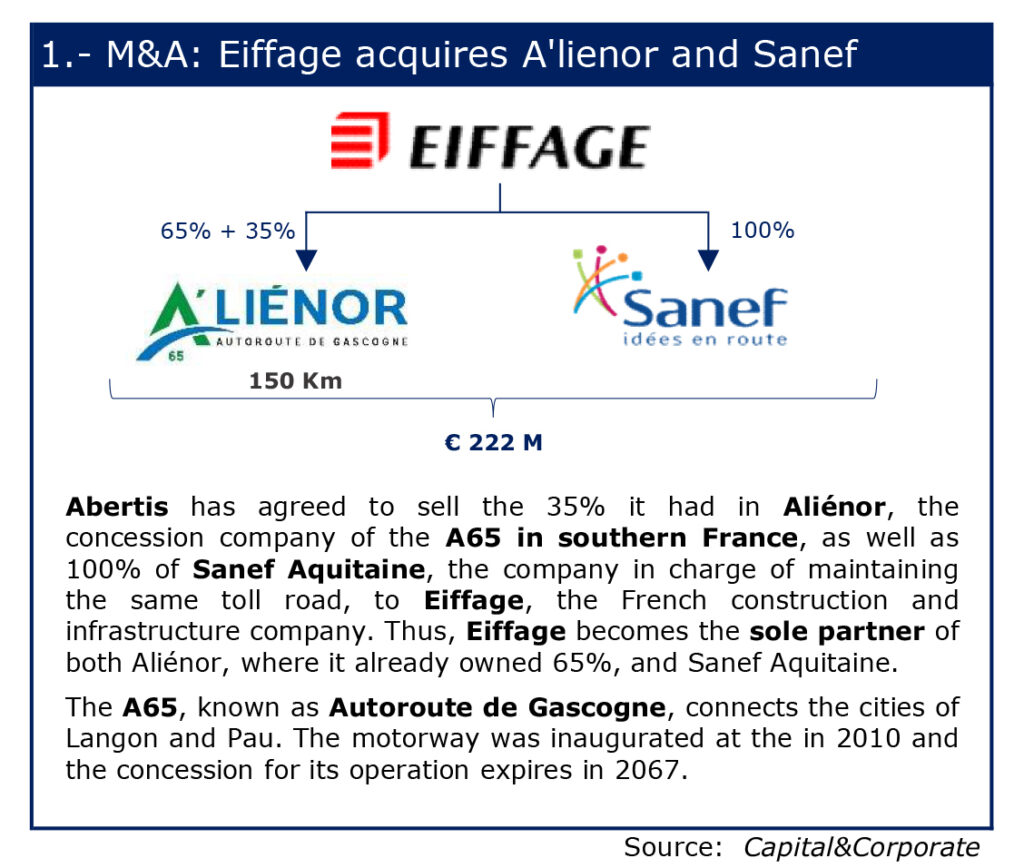

- Eiffage’s acquisition of A´lienor and Sanef.

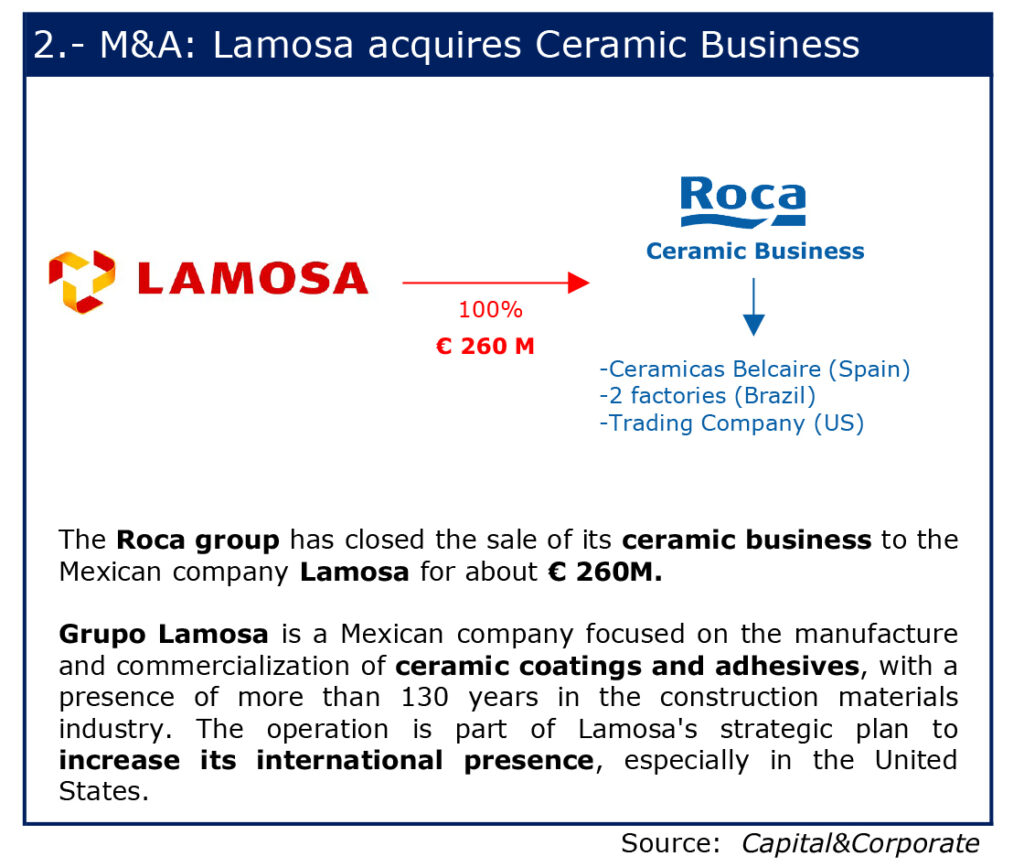

- The sale of Roca Group's ceramics business to Lamosa, a Mexican company focused on the manufacture and commercialization of ceramic coatings

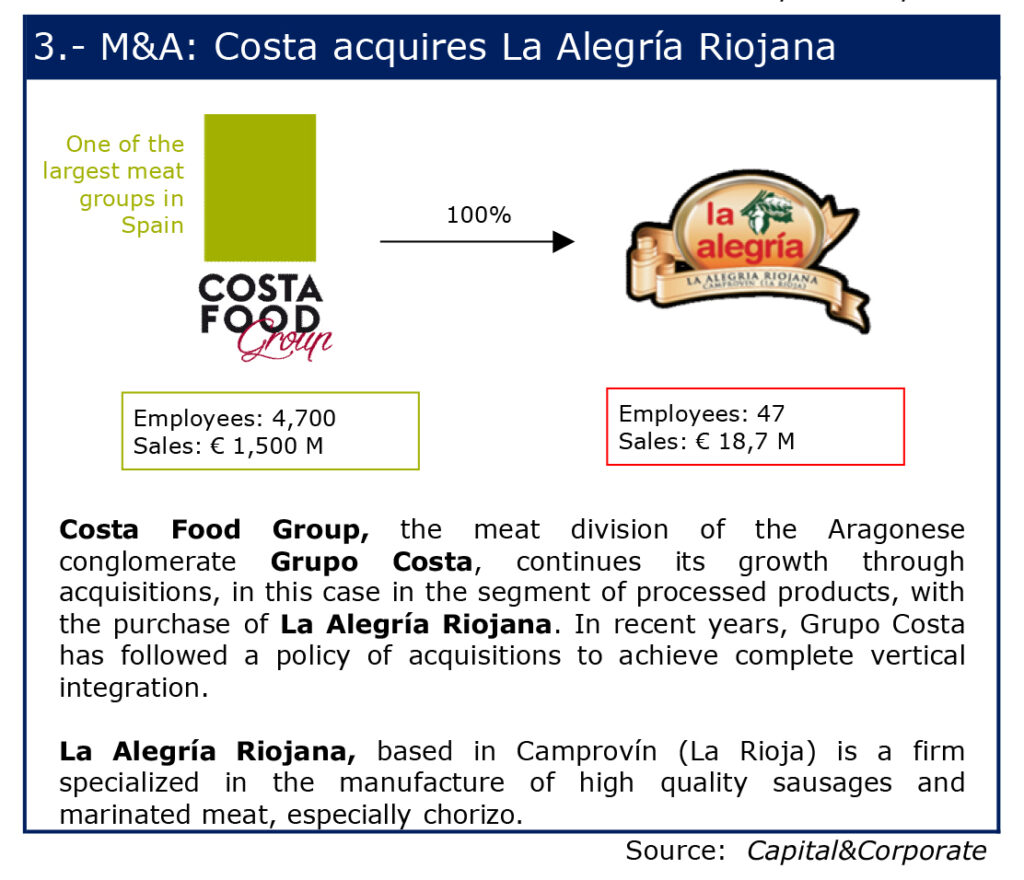

- Costa Food Group’s acquisition of 100% of La Alegria Riojana.

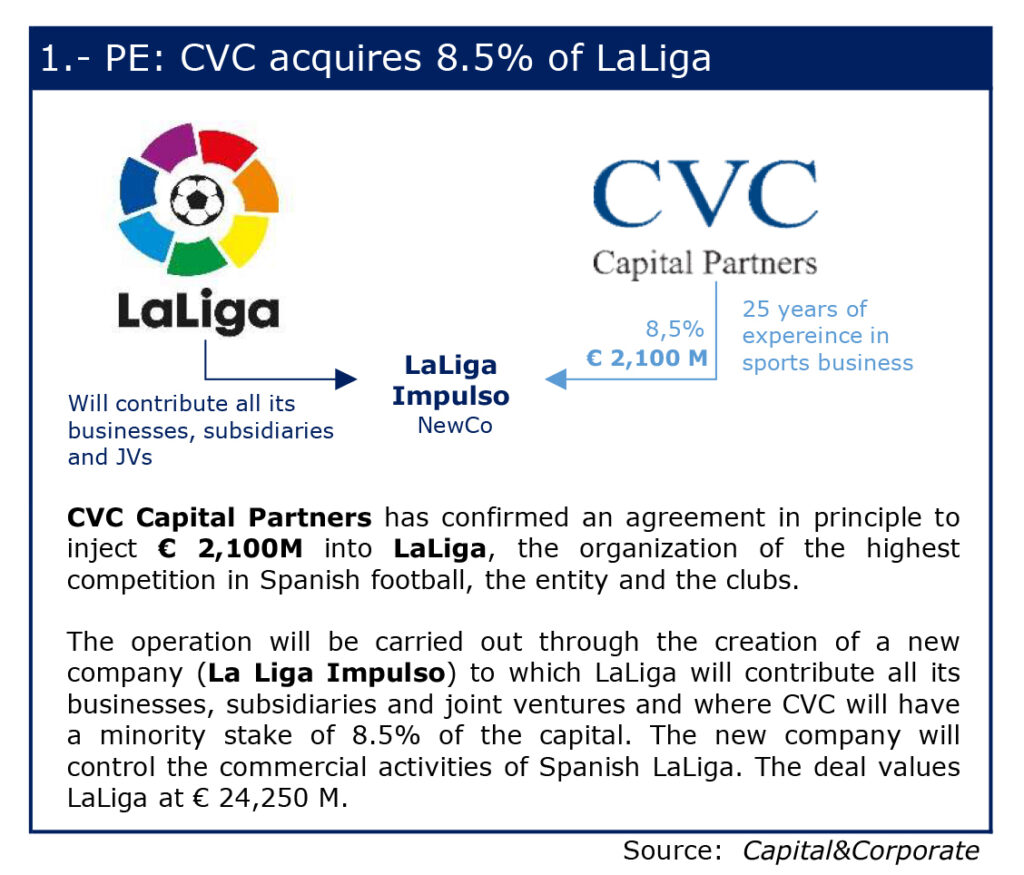

- CVC's agreement to inject 2.1 billion euros into La Liga in exchange for 8.5% of a NewCo, valuing La Liga at approximately 24,250 million euros

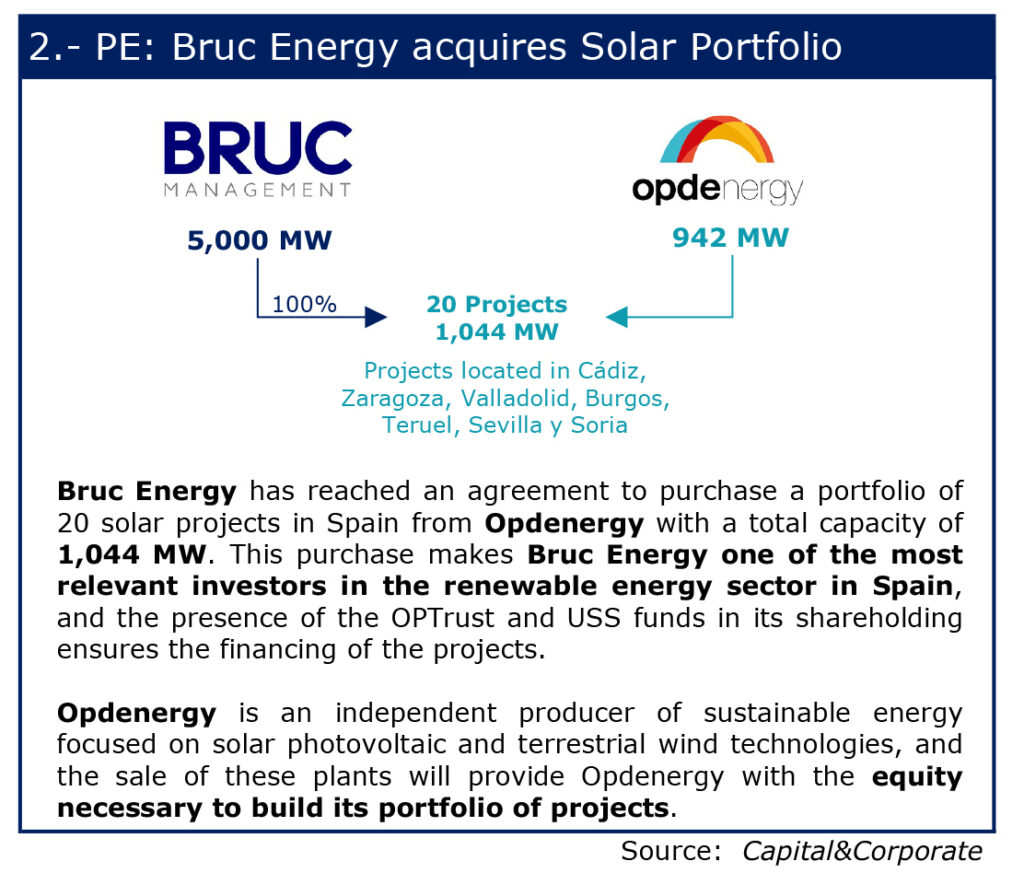

- Bruc Energy’s acquisition of the Opdenergy portfolio with a total capacity of 1,044MW

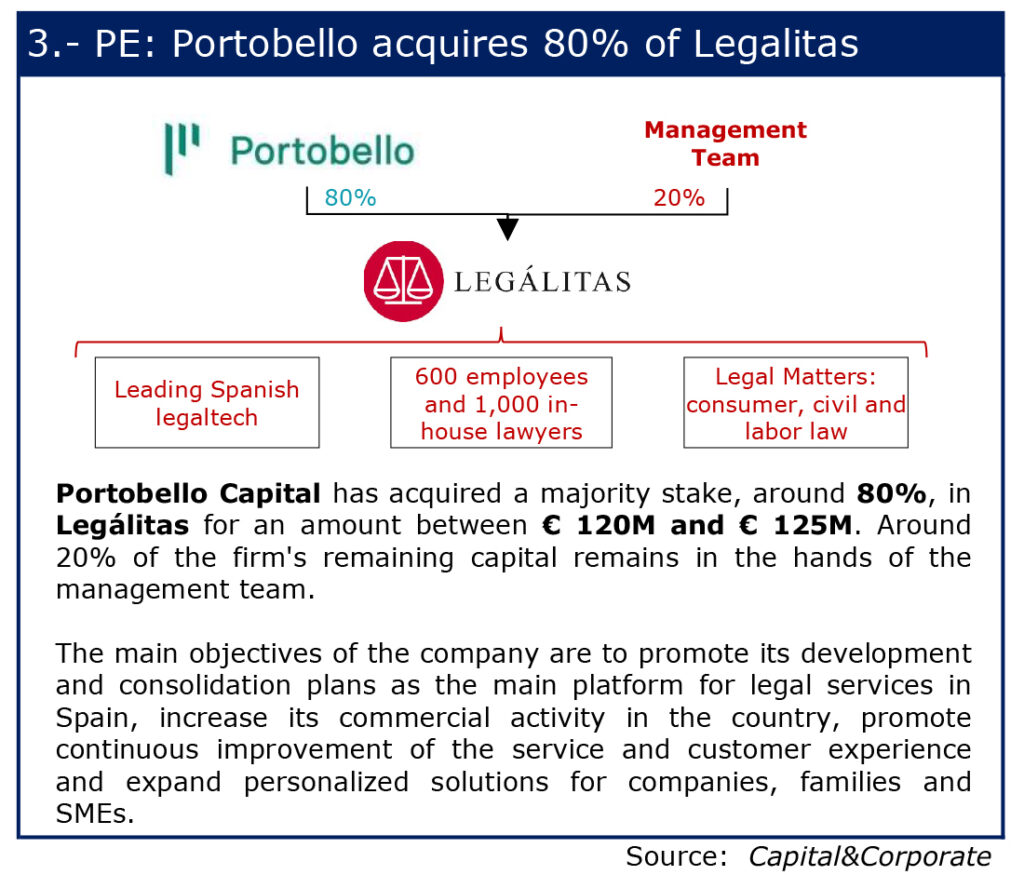

- And finally, Portobello Capital’s acquisition of a majority stake, around 80%, of Legalitas for an amount between € 120M and € 125M.

M&A August 2021

Private Equity August 2021

Three finance-focused media sources were analysed (Capital & Corporate, Expansión and The Financial Times) to observe which transactions were reported on. For July, these included:

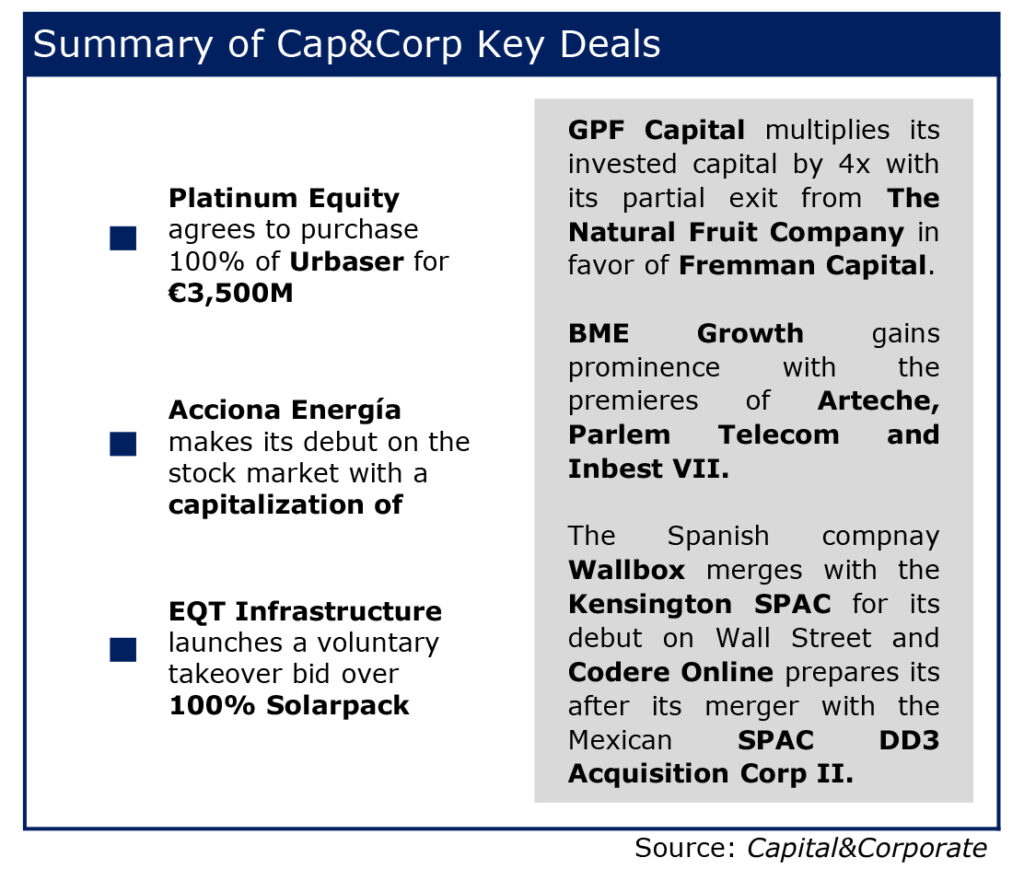

Capital & Corporate: The newscast highlights the previously mentioned operations of Platinum Equity, Acciona and Solarpack, among others.

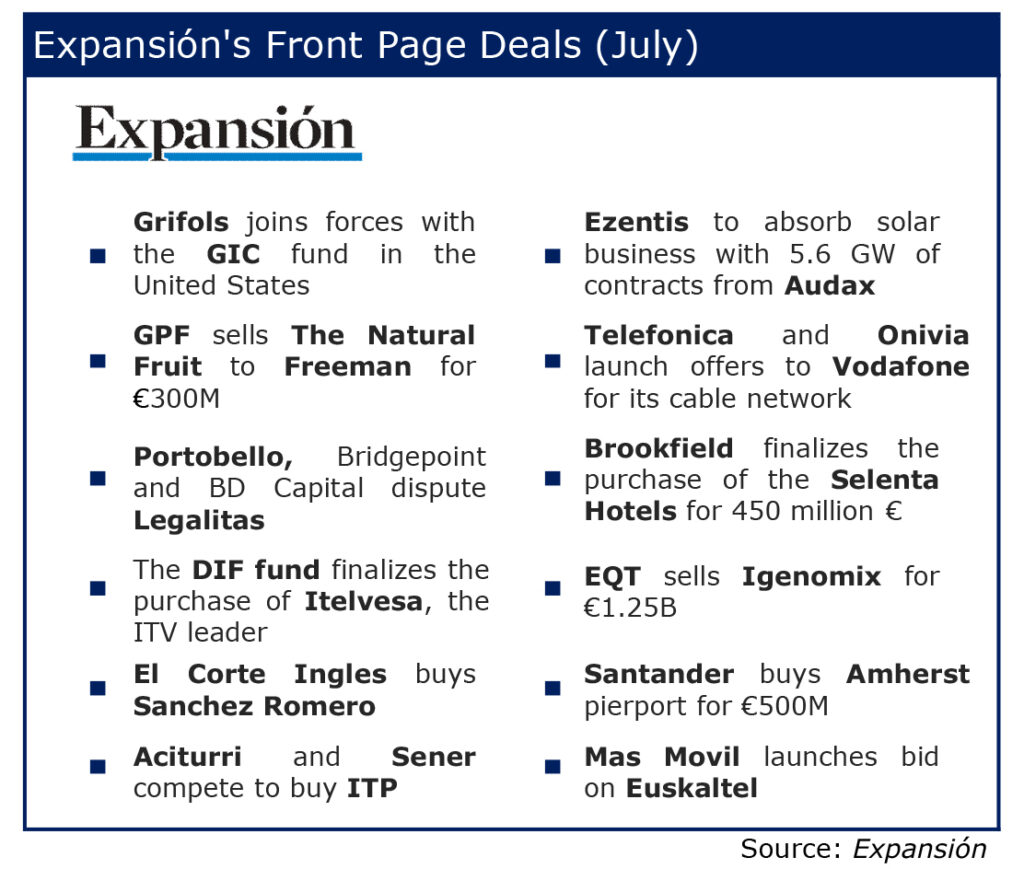

Expansion features the following headlines:

- Grifols joins forces with the GIC fund in the United States

- El Corte Inglés buys Sánchez Romero

- Brookfield completes the purchase of Selenta Hotels for 450 million.

Regarding the global market, The Financial Times highlights the following news on the front page:

- Aon's $ 30 billion deal with Willis collapses after being blocked by the US.

- Phillip Morris makes £ 1bn bid for inhaler group.

- SoftBank Invests $ 13 Billion as New Fund Accelerates Pace of Investments.

July 2021

For August, these included:

Capital & Corporate, features the transactions of Bruc Energy, Eiffage and Portobello, among others.

Expansión highlights the agreement carried out by La Liga and the CVC fund, among others.

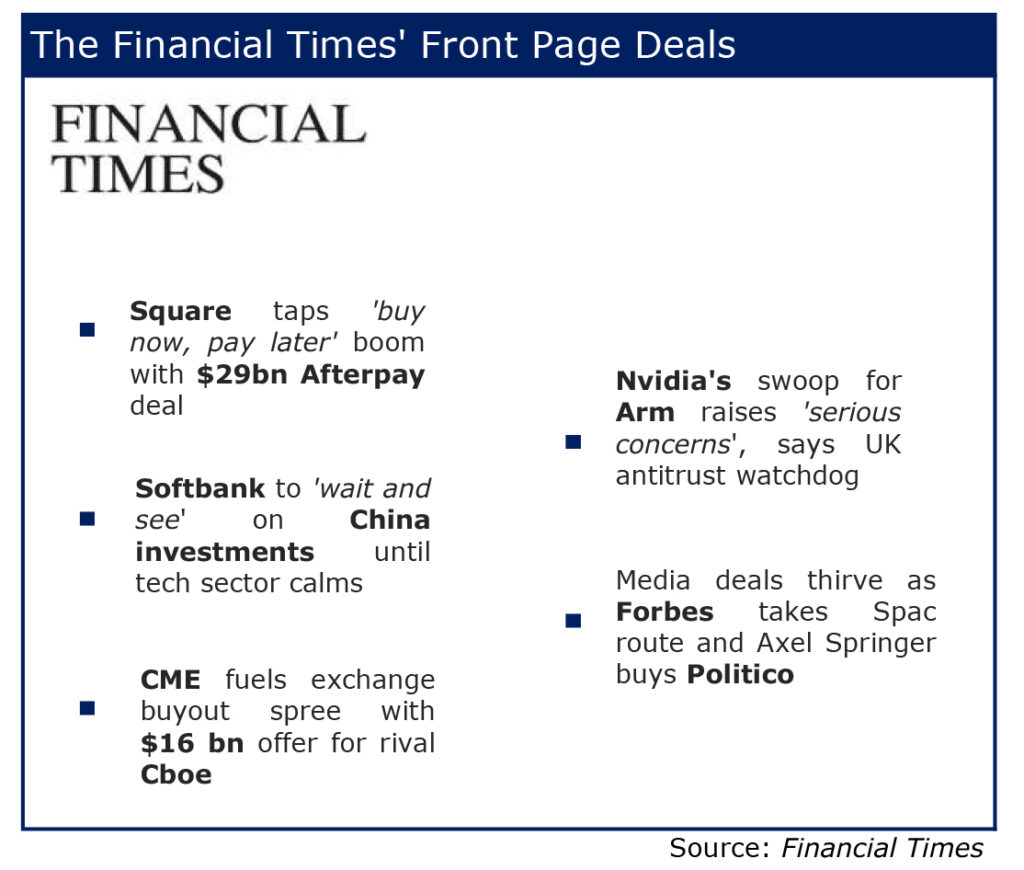

And the Financial Times highlights the agreement reached by Square and Afterpay for $ 16bn and the IPO of Forbes magazine via Spac.

August 2021

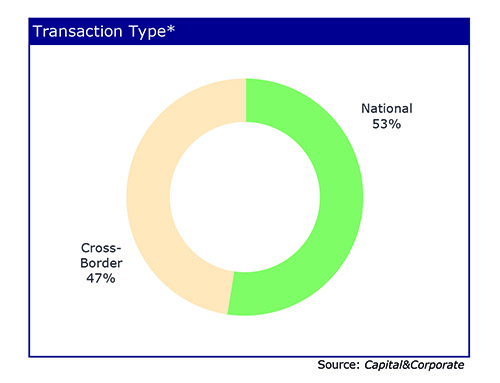

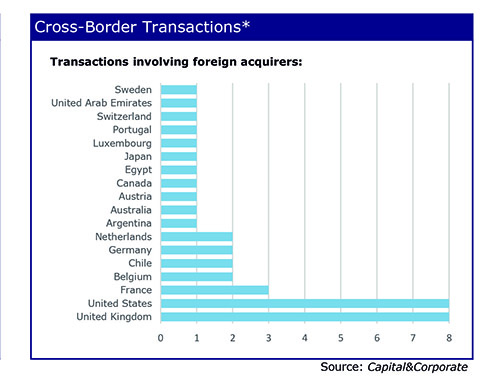

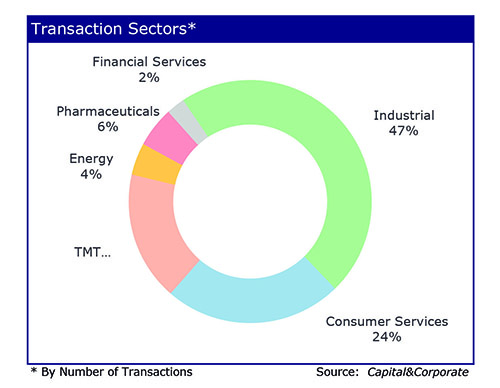

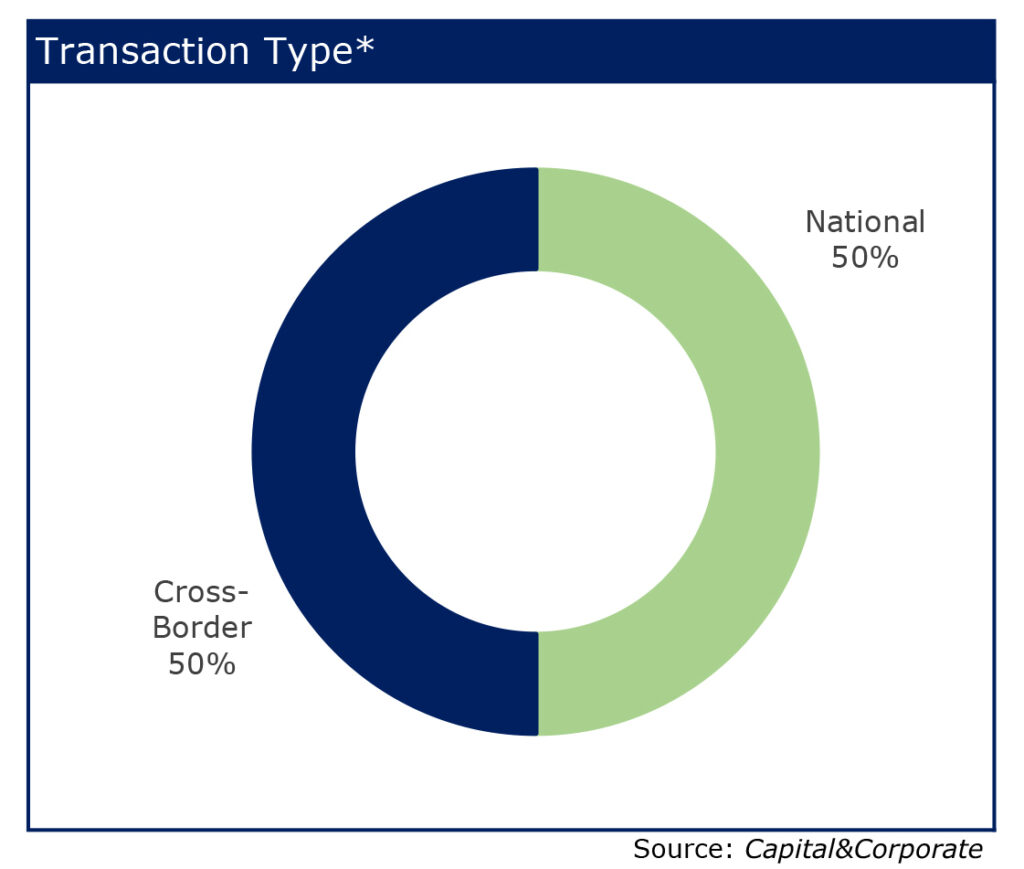

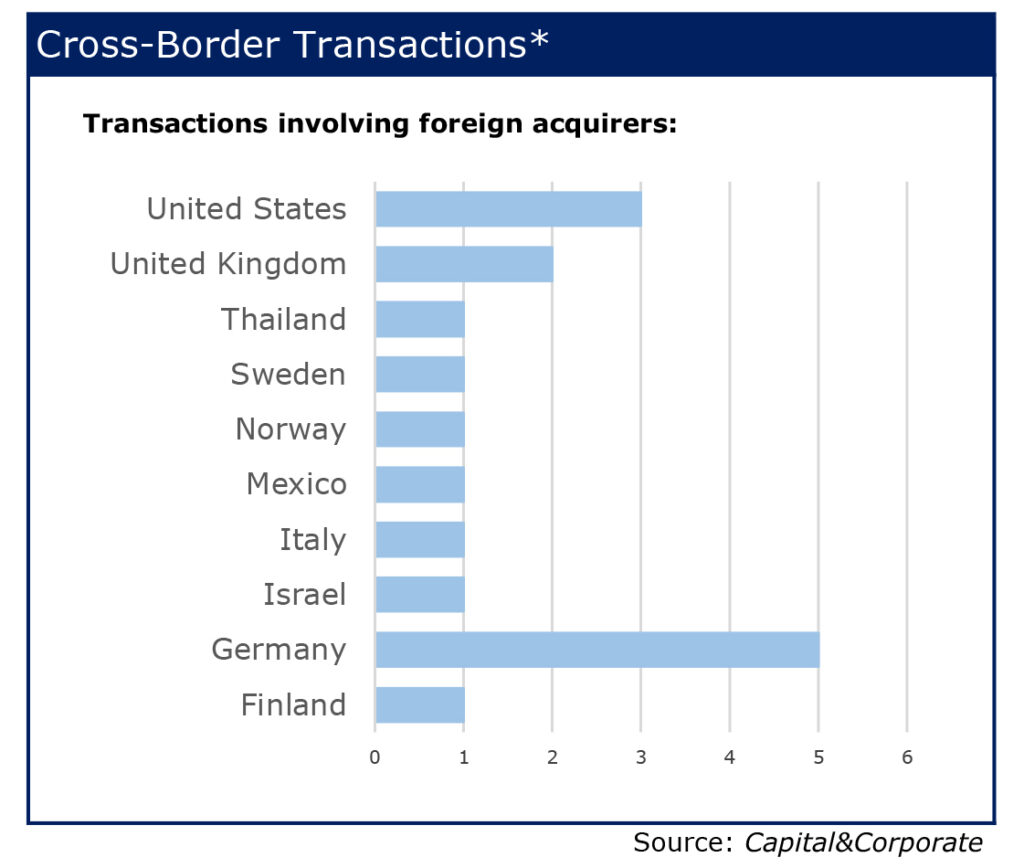

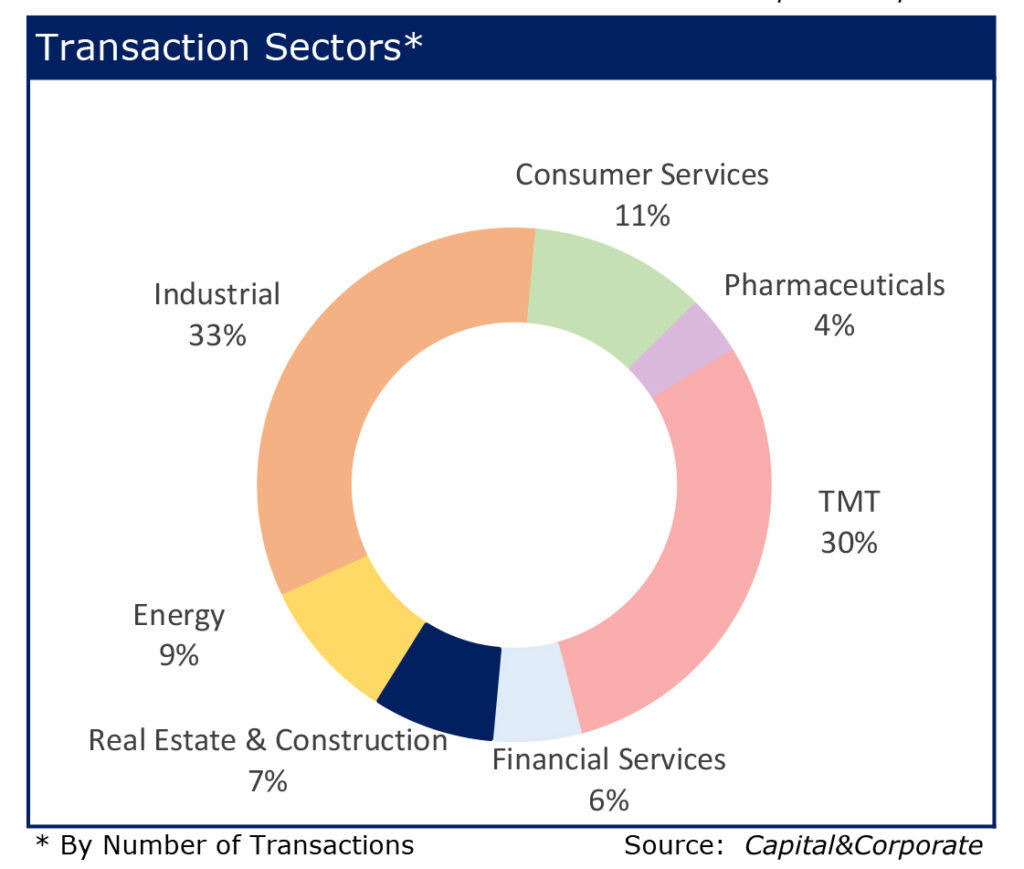

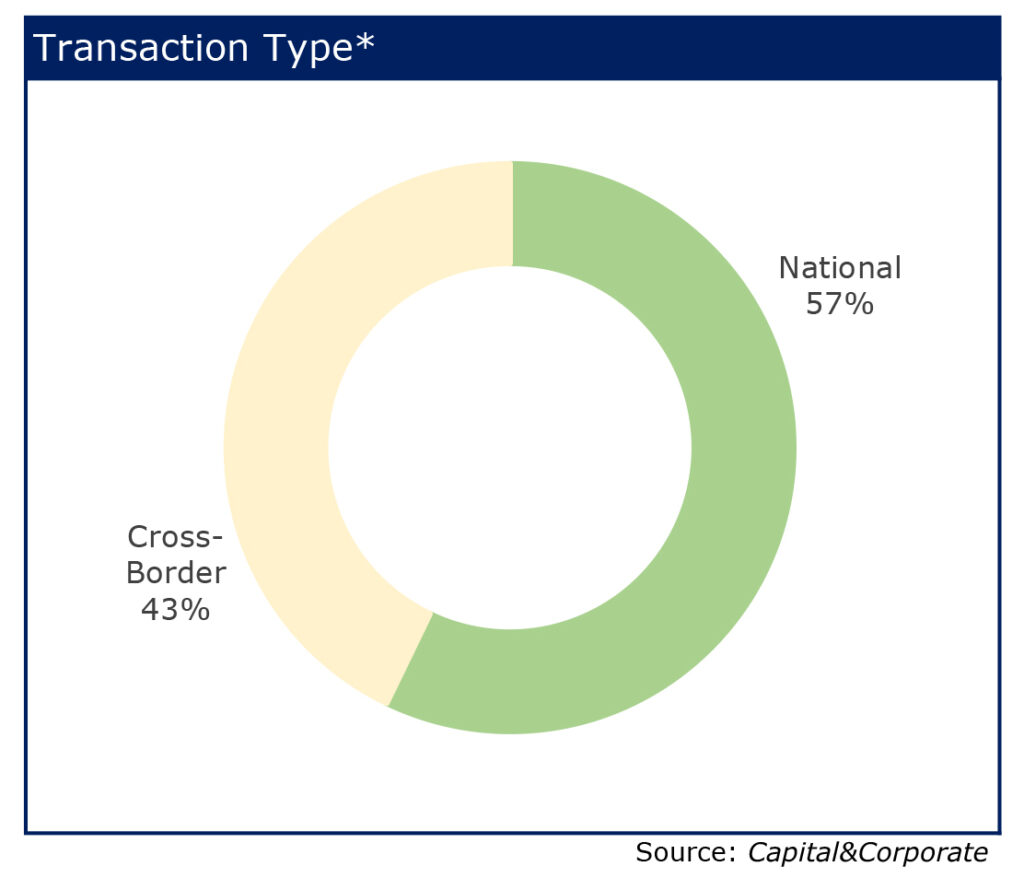

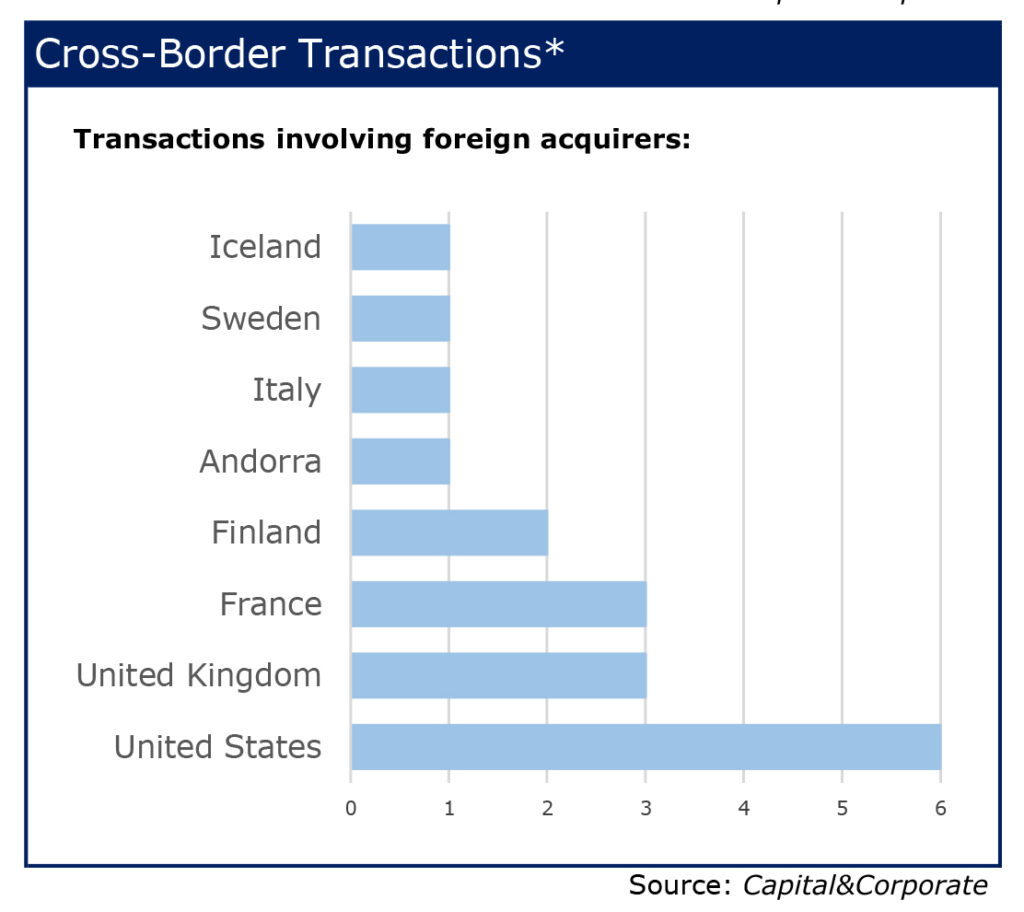

There were 54 transactions that took place in the Spanish market during the month of July according to Capital & Corporate, and from RS Corporate Finance, we can observe that 50% of these transactions involved a foreign part and the other 50% were domestic transactions. Of those that involved a foreign acquirer, the country that invested the most in Spain was Germany, followed by the United States and the United Kingdom. The sectors that have seen the highest number of transactions have been the Industrial and TMT sectors, representing 63% of the sample.

July 2021

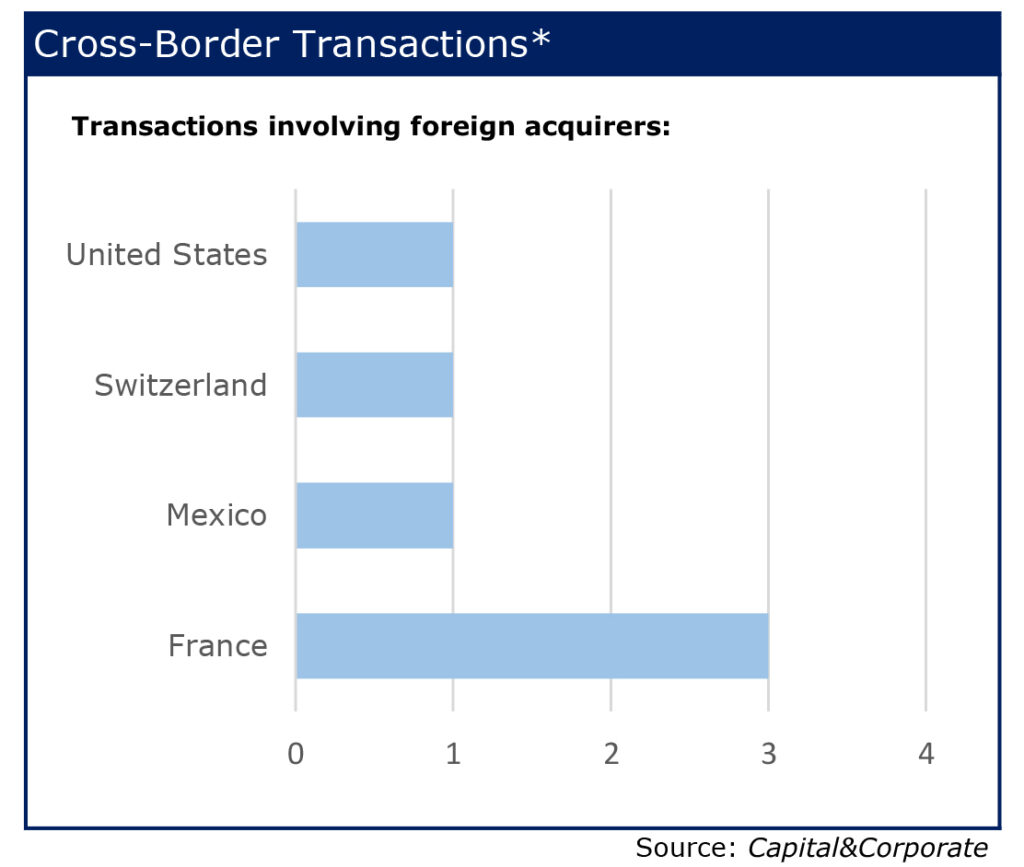

During the month of August, there was a 7% increase in domestic transactions compared to July. Of the foreign transactions, the country that most invested in Spain was France. The industrial sector is enforced for the second consecutive month as a sector of activity, accounting for 59% of operations in August.

24 Charts that explain what is going on in Spain in corporate finance june 21

RS Corporate Finance offers the vision of the Spanish financial market during the last year where it analyzes with special interest what has happened in the last month.

This new new initiative from RS Corporate Finance, the 24 charts to understand what is happening in Spain from a financial point of view, from a point of view of M&A. This monthly report is divided into two blocks where the first contains 12 graphs of the financial market, where it is highlighted and analyzed from a sectorial and shareholder point of view which are the actions and sectors that have responded better or worse to the market. The second block with the following 12 graphs, analyzes different M&A operations that occurred worldwide and in Spain, in addition, 3 newspapers are compared on how they treat mergers and acquisitions operations and finally an analysis from the sector point of view where we will see What type of operations have been more frequent in the last month.

During this 2021, the Spanish economy has been recovering its activity after an atypical year 2020. The Spanish economy is expected to recover the pre-pandemic level in both economic growth and employment, with the continued support of the ECB through liquidity injections that are noticeable in decreases in the EURIBOR.

In the exchange market, it is worth noting the depreciation of the dollar and the Swiss franc against the euro during the last 12 months, which contrasts with the appreciation of the pound sterling against the euro.

Regarding the stock market, the IBEX 35 has grown by 22% in the last 12 months, a lower growth than that of the European and American benchmark indices due to the great weight of the tourism sector in our index and soon weight of the technology sector.

If we analyze theevolution by sector, we see that during the last year the sector with the greatest strength has been the industrial sector, which was the most affected by the pandemic. The sector that has performed the worst in the last 12 monthshas been the pharmaceutical sector, which has already experienced great growth just at the beginning of the pandemic that has been gradually fading away.

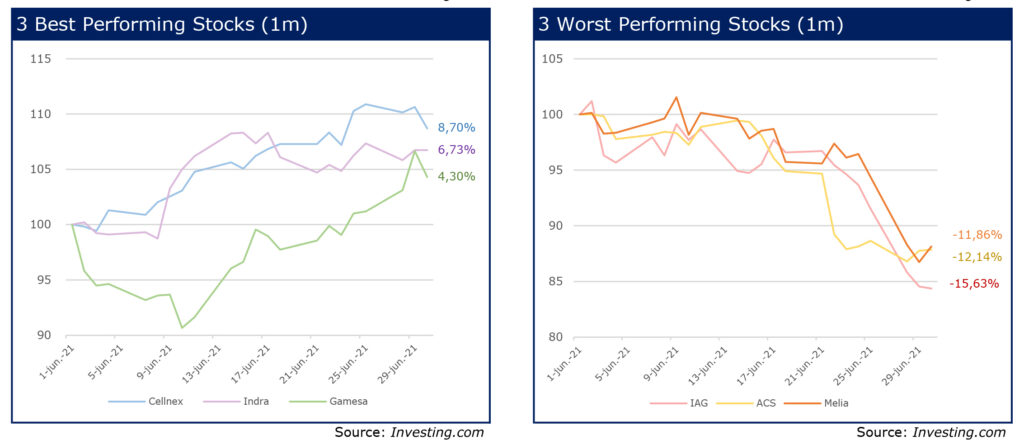

Analyzing only the month of June, practically all the sectors have fallen except pharmaceutical and technology, while the services and real estate sectors have suffered falls of up to 10%.

This growth in the industrial sector has been driven mainly by the companies Fluidra and ArcelorMittal. On the other hand, the most burdened companies have been the pharmaceutical companies Pharma Mar and Grifols, together with the airline IAG. Taking into account only the month of June, Cellnex, Indra and Gamesa are the companies with the highest increases while IAG, Meliá and ACS are the companies with the highest decreases, which have been weighed down by the spread of the new Indian variant that puts reopening plans in Europe in jeopardy

Now, we will talk a bit about some of the most relevant M&A and PE transactions that were reported this month:

- First, we have Repsol’s acquisition of 40% of Hecate Energy, a US based PV solar and battery storage project developer.

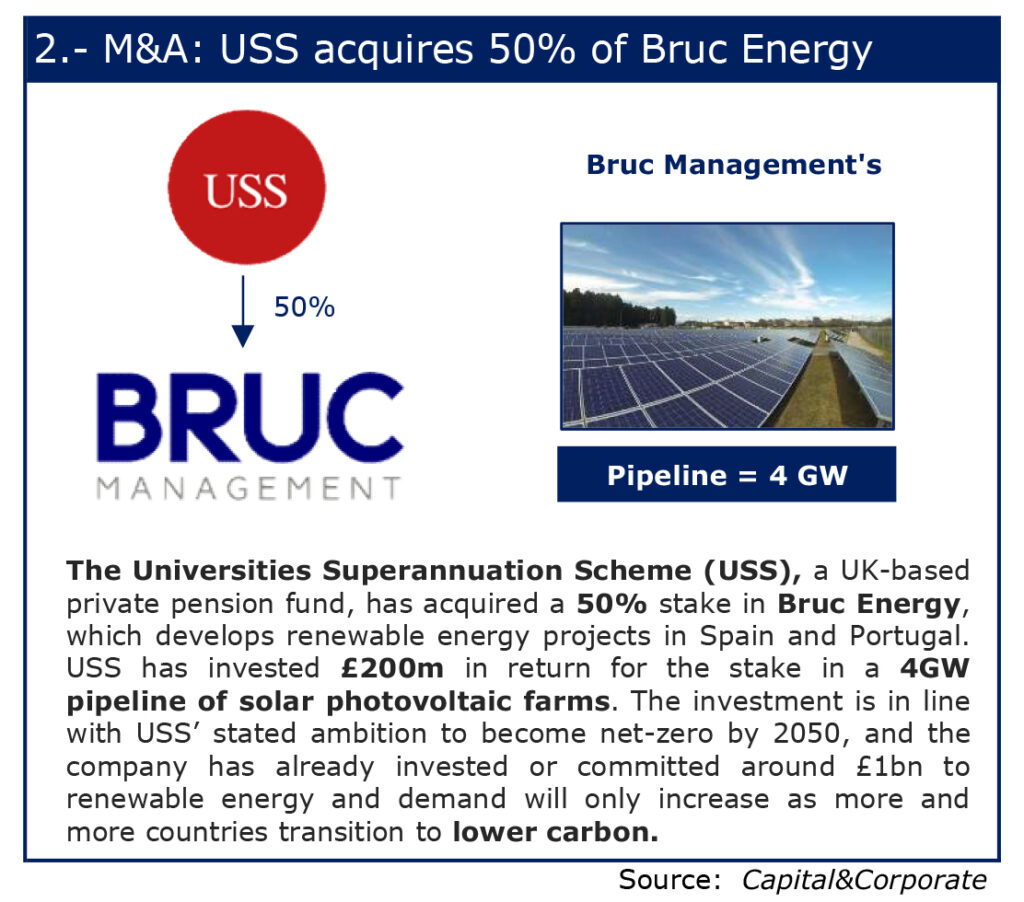

- • We also have Universities Superannuation Scheme or USS, a UK-based private pension fund’s acquisition of a 50% stake in Bruc Energy a developer of renewable energy projects in Spain and Portugal. Both transactions point to the growth of the renewable energy market as demand will only increase as more and more countries transition to low carbon emissions.

- Third we have the acquisition of 3 Delivery Hero companies by Glovo, both delivery platforms, with the aim of gaining access to markets in Central and Eastern Europe.

On the other hand, we also evaluated several PE transactions including:

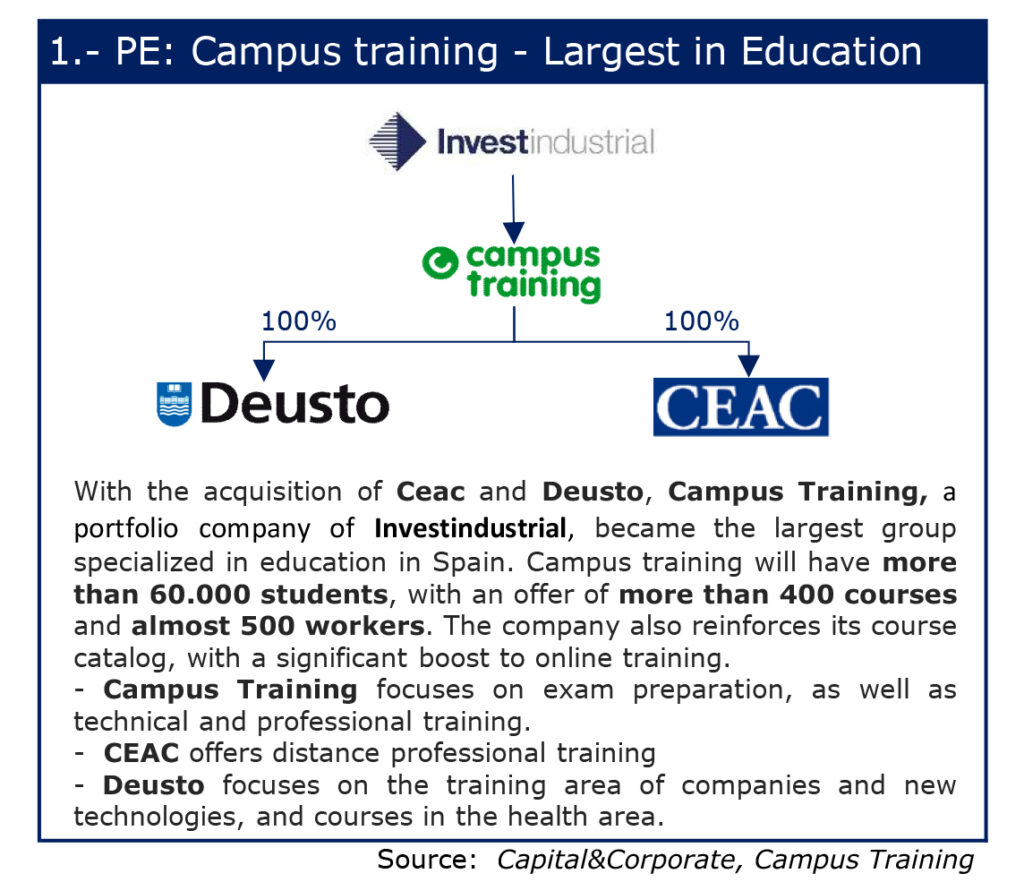

- First, Campus Training’s acquisition of Deusto and CEAC which allowed it to become the largest group specialized in education in Spain and indicates the current trends as it has a heavy focus on online education.

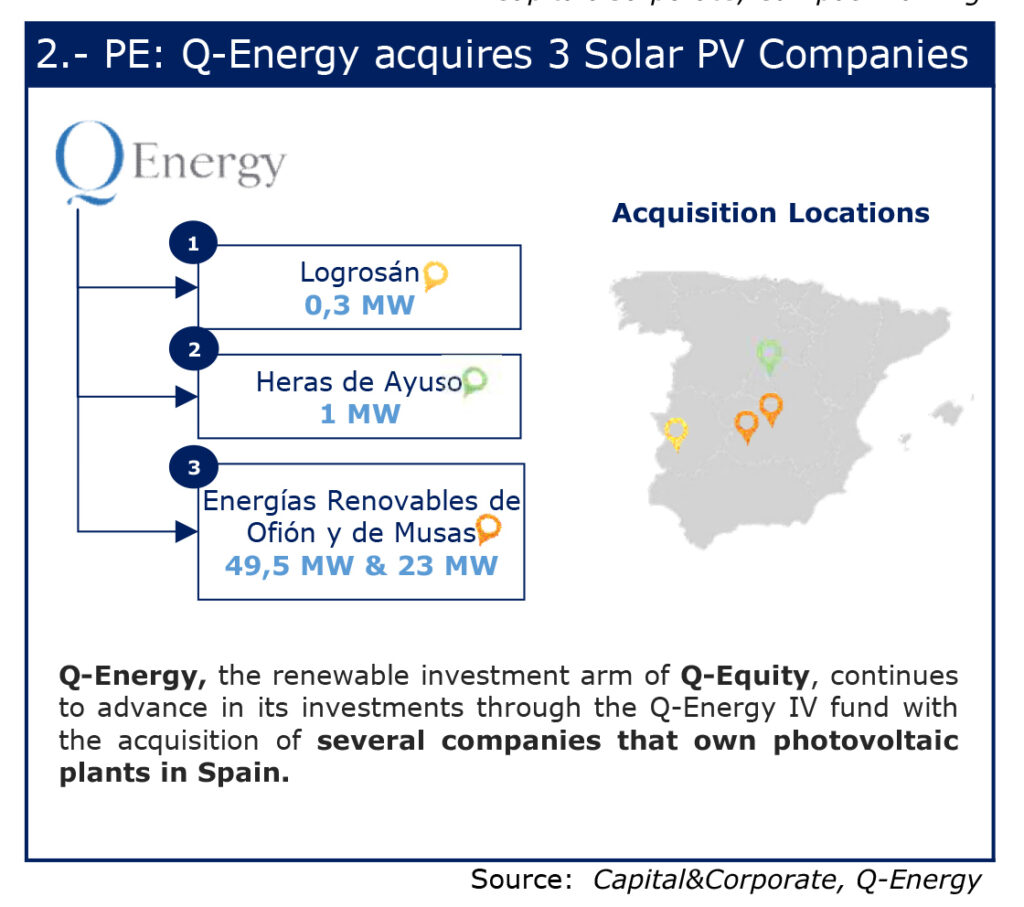

- Secondly, we have more acquisitions in the renewable energy sector with Q-energy’s acquisition of 3 solar projects equivalent to over 70 MW in Spain.

- • And third we have a deal between Asterion and Telefonica for a 20% stake in Nabiax in exchange for 4 Data Centers with attractive growth potential and that confirm Telefonica’s bet on infrastructure assets.

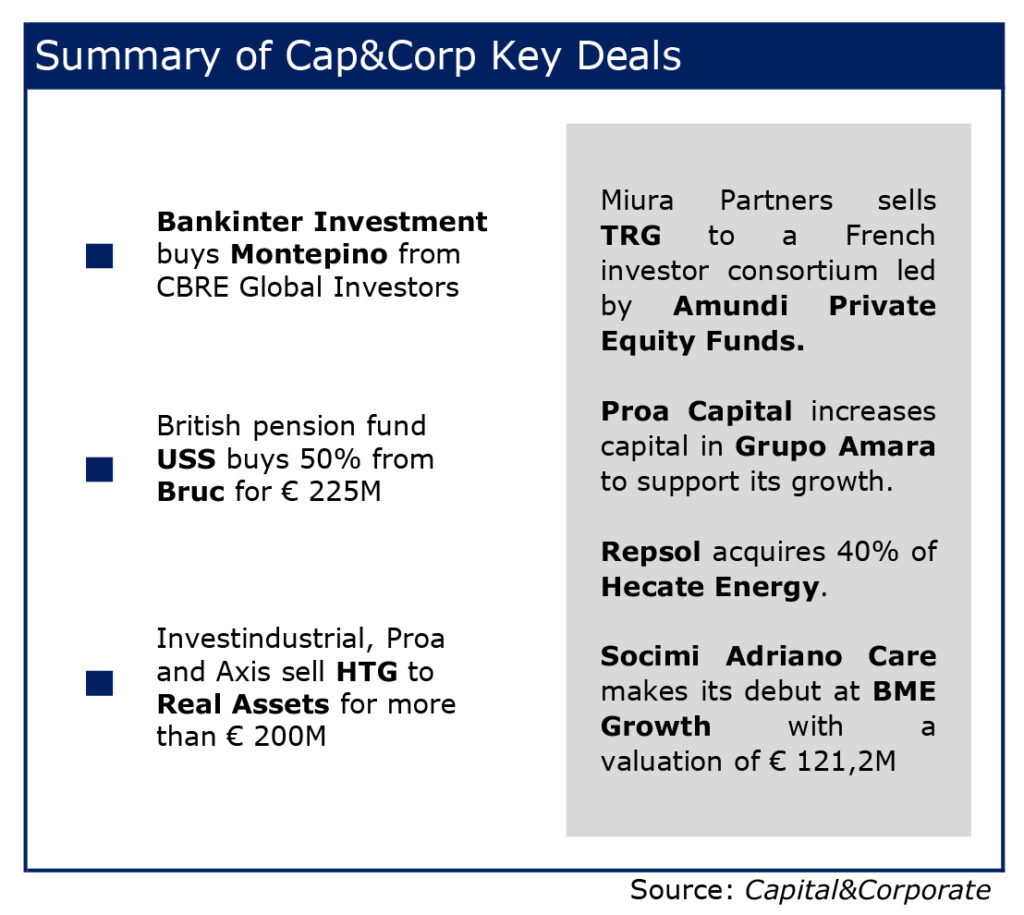

After analyzing the three media with a financial focus, Capital & Corporate, Expansión and The Financial Times, on what happened in the Spanish and global market during the last month, we highlight the following operations:

Spanish Market

- Capital & Corporate: The newscast highlights the purchase of Montepino from CBRE by Bankinter Investment, the acquisition of 50% of the Bruc renewables business by the British pension fund USS and the sale by Investindustrial, Proa and Axis of HTG to Real Assets

- Expansion: The media distinguishes the union between the Godia family and the Everwood fund to create a photovoltaic giant, the takeover of the Swedish fund EQT on the listed Spanish Solarpack.. Also noteworthy is the advancement in the renewables race and zero CO2 emission by BP to the oil companies Repsol and Total with the purchase of a package of renewable energy projects, the announcement by Portobello Capital about its negotiation in the entry into the Condis supermarkets and finally the Suez council gives the green light for the takeover launched by Veolia

Global Market

- The Financial Times: The international media underlines the announcement of the purchase of the DEOPOP application by Etsy, the acquisition of the JD catalog by Warner and finally highlights the words of the bearish investor who predicted the ENRON scandal and his new warning about the business the SPAC.

And analyzing the 44 operations that took place in the Spanish market during the last month in Capital & Corporate and taking an analytical approach from RS Corporate Finance, we see that 48% of the operations are foreign, the majority being the acquirer from the United States, while 52 The remaining% are national operations. The sectors that have seen the highest number of operations have been the TMT and the Industrial sector, representing 55% of the sample.

Case Study: SPAC- Special Purpose Adquisition Company

What is a SPAC and why do people keep talking about it?

These purely instrumental companies, also known as "blank checks companies", are essentially created for the sole purpose of raising money to later buy or merge with a target company.

SPACs have been around for decades but the stock market rally after the outbreak of the pandemic, together with the low profitability offered by fixed-income investments and the dazzling of the market with new options to earn money is the perfect breeding ground for SPACs to grow exponentially. So far in 2021 more money has been raised than in 2020.

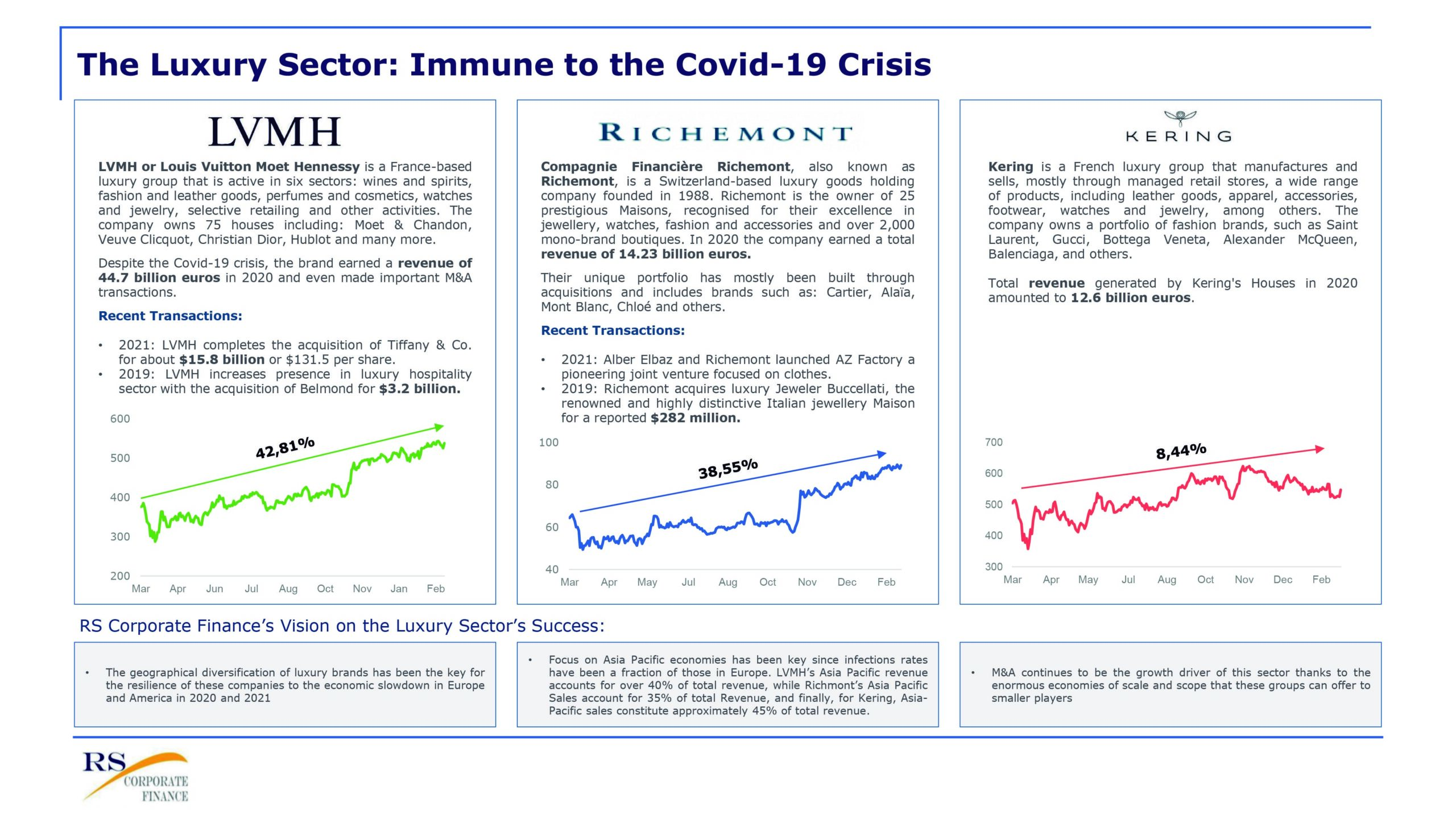

Case Study: The Luxury Sector

If something characterizes Covid-19, it is that it affects us all, it does not distinguish between social or economic sectors. However, it does not affect all in the same way. Luxury brands have not been spared, economic uncertainty coupled with enforced lockdowns, stores closing, and no tourism caused the industry to face a 25-30% decline at the start of the pandemic.

Now, one year after the fall, we can see how the luxury industry has not only recovered but even has a positive balance in its accounts and its shares have appreciated.

From RS Corporate Finance, we compare 3 of the main luxury companies and we share our vision on the sector's behavior.

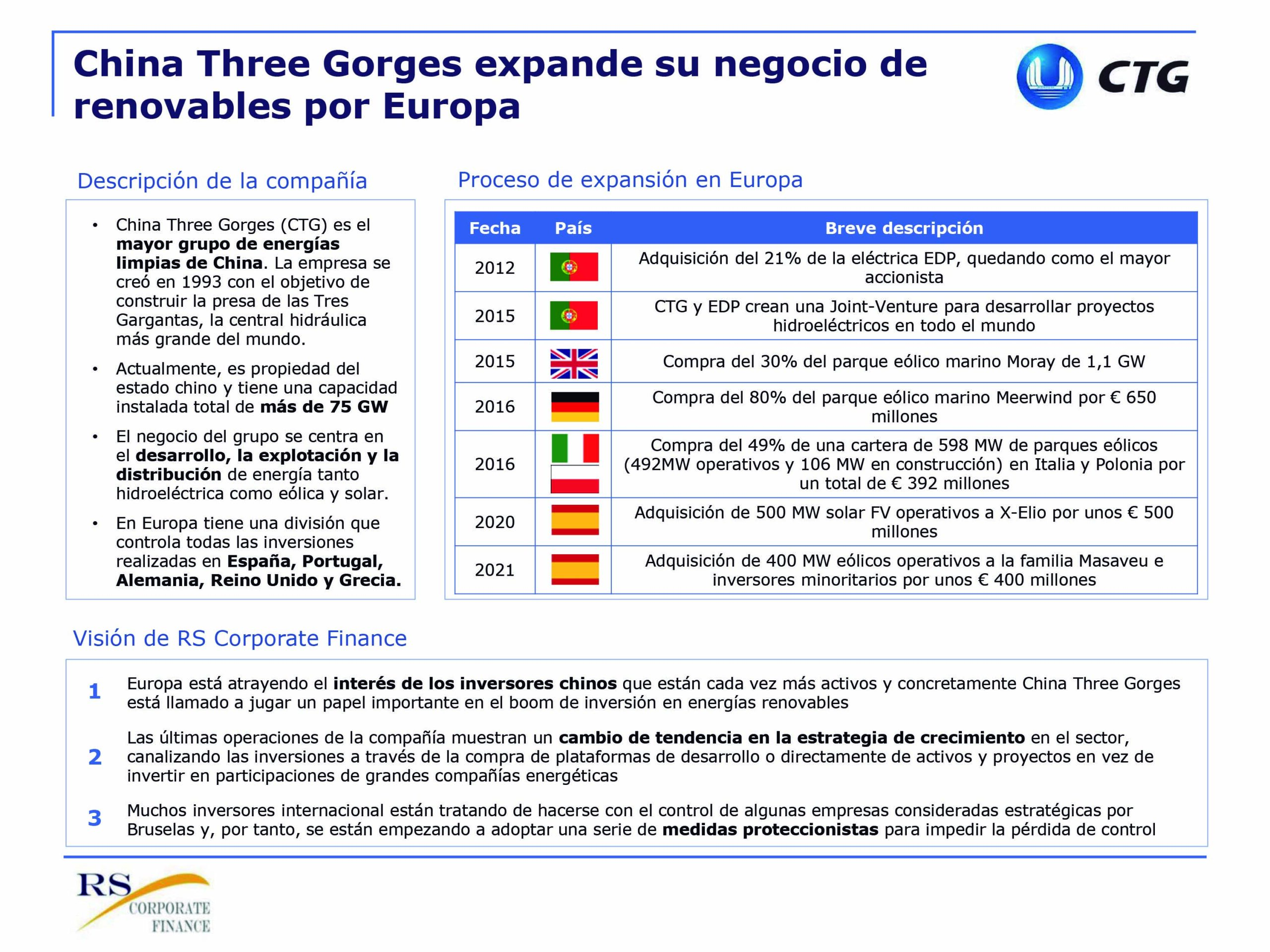

Case Study: Three Gorges Corporation expands renewable energy business across Europe

In recent years, the Chinese group, Three Gorges Corporation has invested heavily in renewable energy generation platforms in Europe and in the last year has entered Spain through two large asset acquisitions.

From RS Corporate Finance we analyze the expansion of the group in recent years, since its growth strategy has evolved since its inception as a constructor of the famous Three Gorges Dam, the largest hydraulic power plant in the world, to a business model that it focuses mainly on the development, exploitation and distribution of energy.

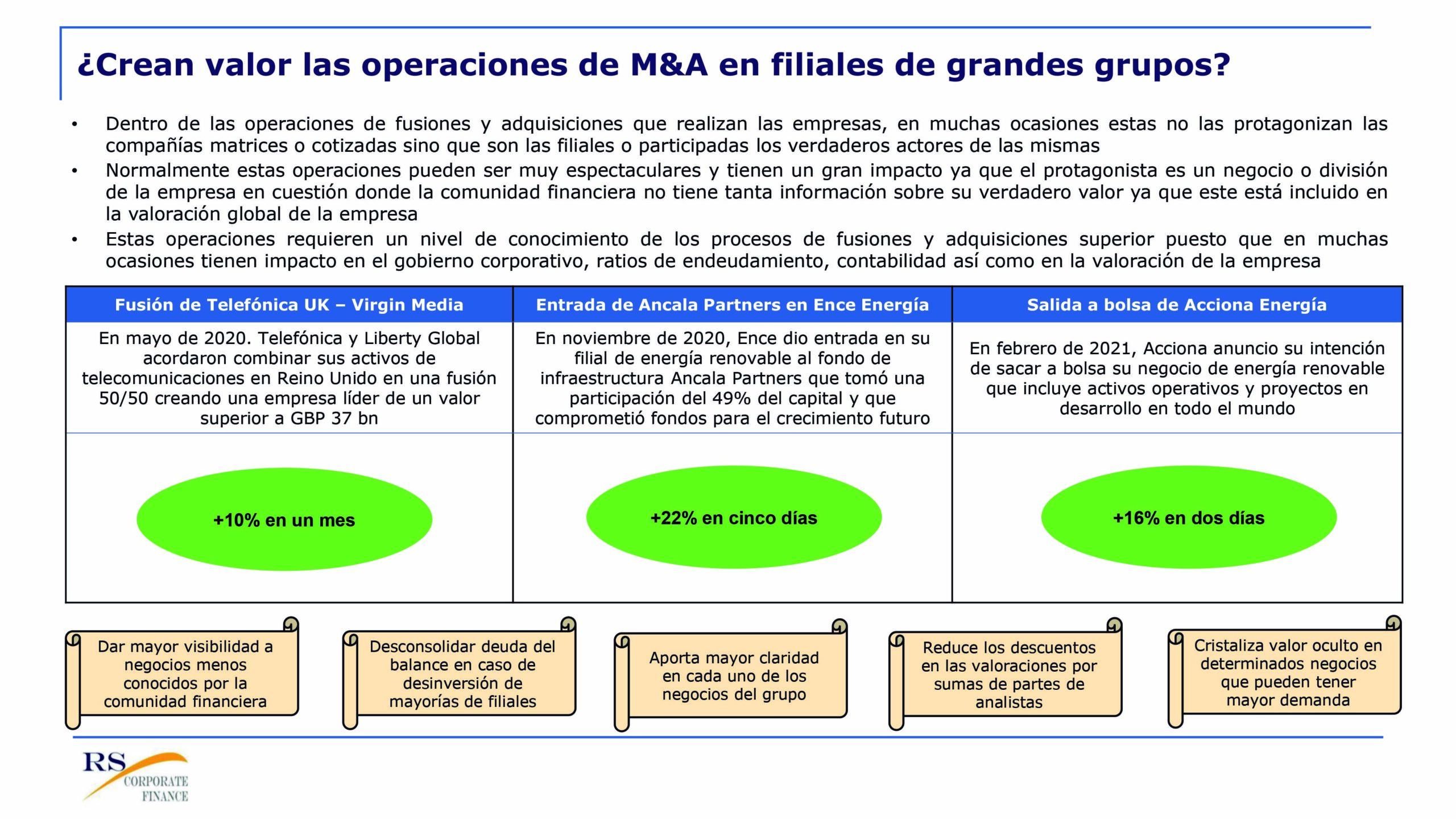

Case Study: Unlocking Value

Do M&A transactions in subsidiaries of large groups create value?

Jesus Reglero, partner of RS Corporate Finance, analyzes the creation of value for shareholders in M&A transactions, when they are not carried out by the listed company but by its subsidiaries and gives his opinion on the most relevant aspects of the analyzed transactions.

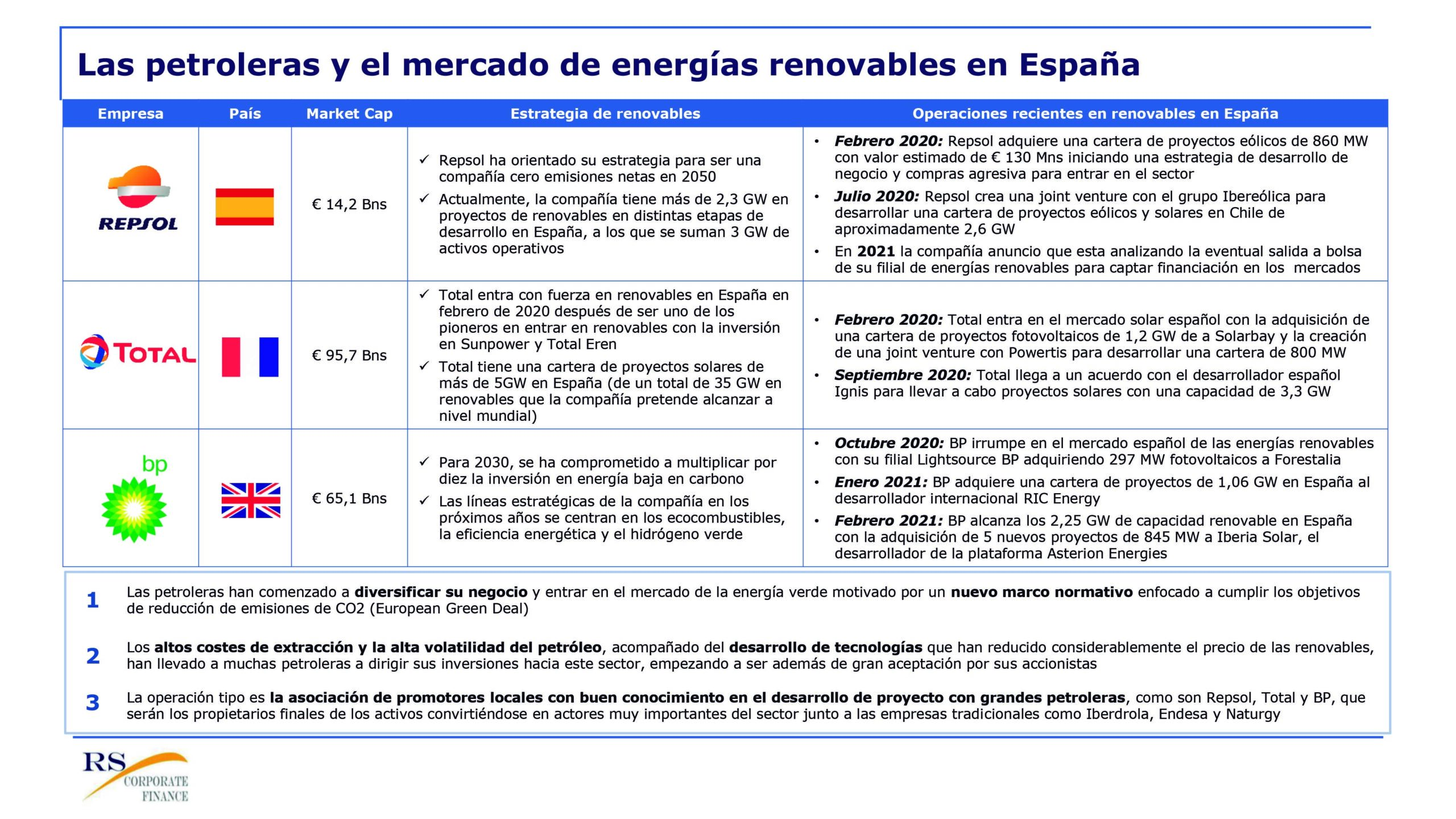

Case Study: Spanish renewable energy market - Big oil companies

RS Corporate Finance analyzes the Spanish renewable energy market, which has become one of the greatest bets for the world's big oil companies, which have been steering their business model towards this sector for some time to lead the process of decarbonization and energy transition.

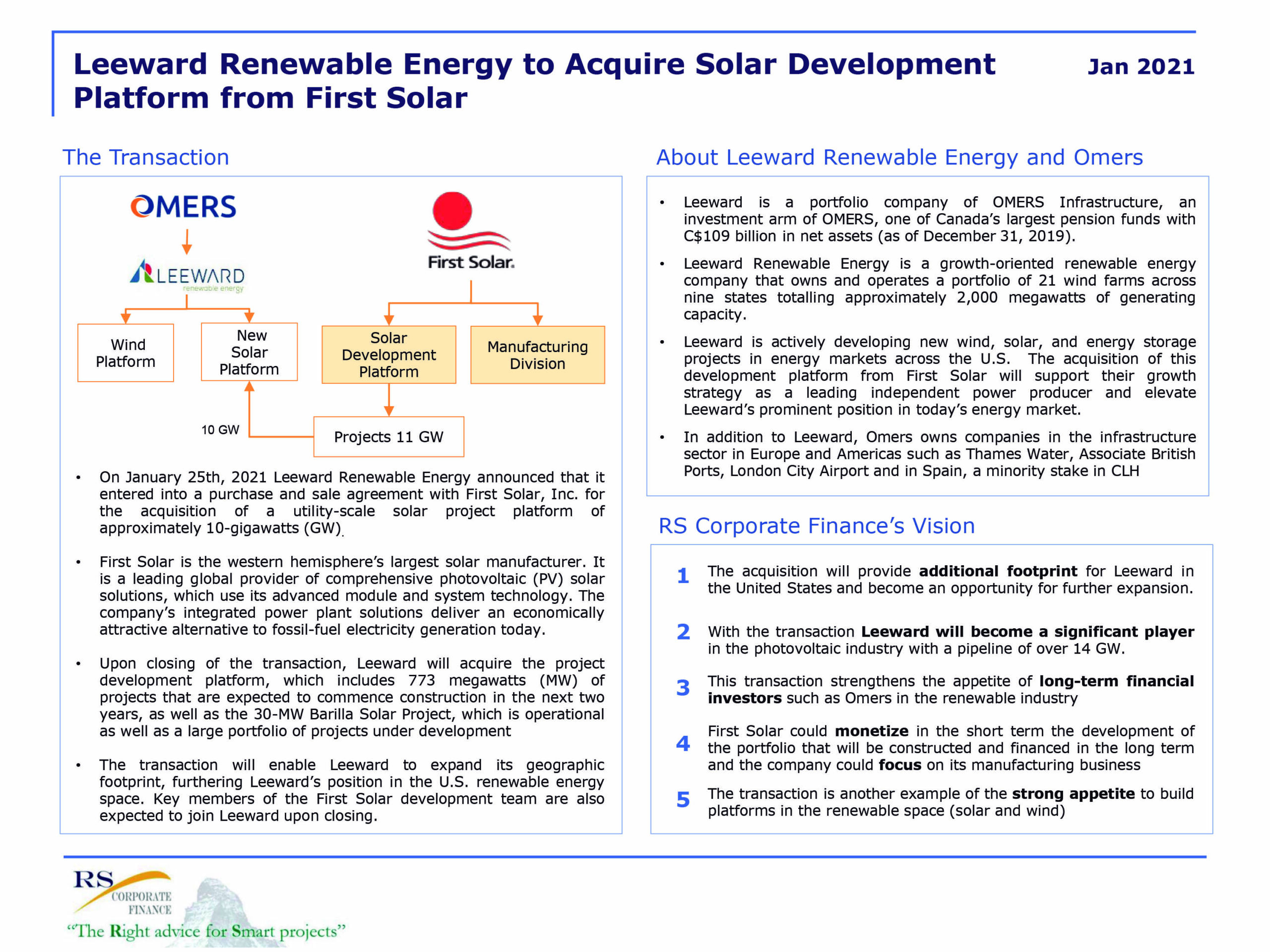

Case Study: Transaction Leeward Renewable Energy - First Solar

From RS Corporate Finance we want to share our vision of the agreement, through which Leeward acquires form First Solar a utility-scale solar project platform of approximately 10-gigawatts and the most interesting aspects to review.

IFM launches a partial takeover bid for Naturgy for € 5,060M

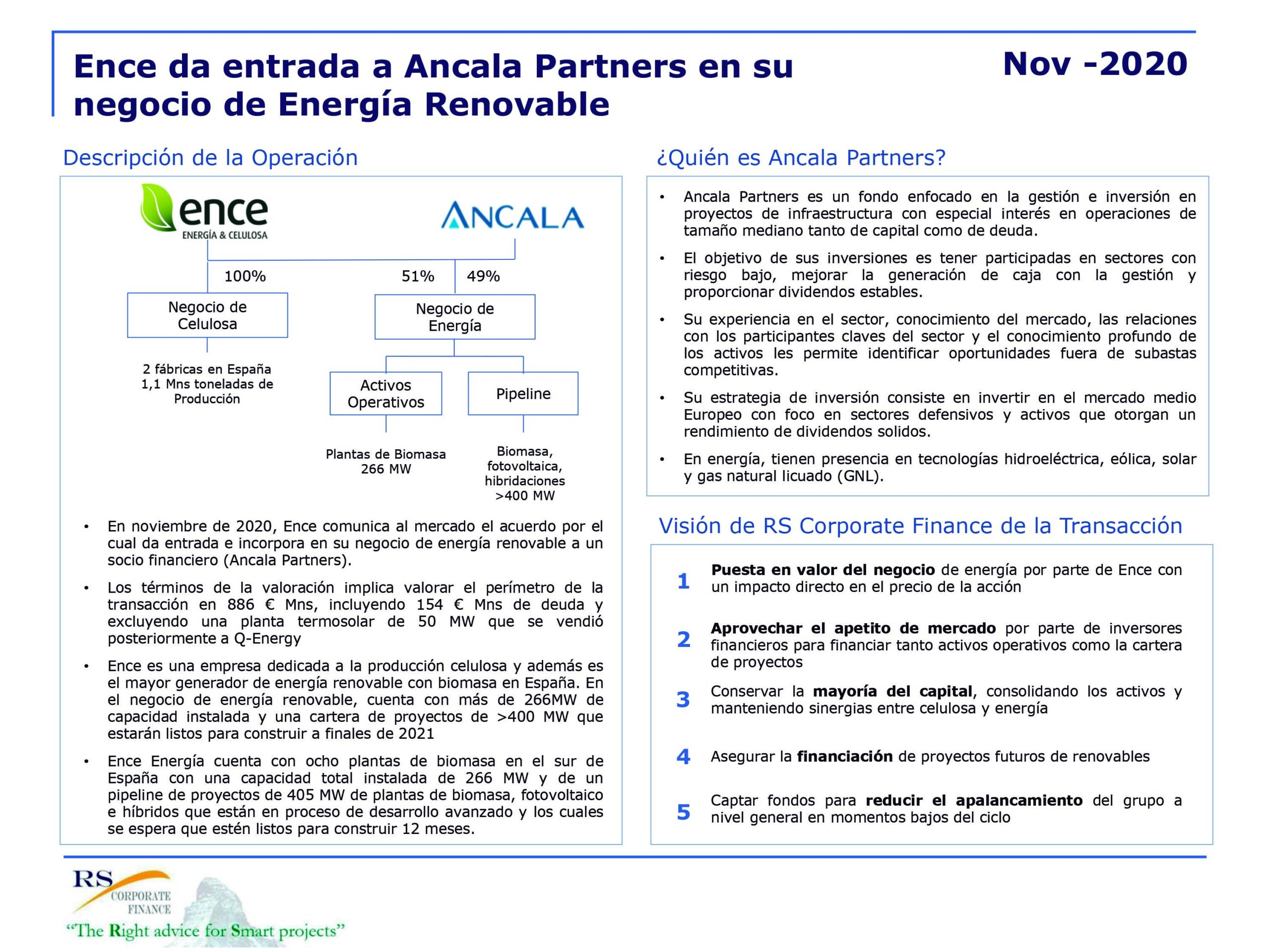

Case Study: Transaction Ence Energia - Ancala Partners

Ancala Partners agrees to acquire 49% of Ence Energia.

From RS Corporate Finance we want to share our vision of Ancala Partners' entry into Ence's Renewable Energy business and its most attractive aspects

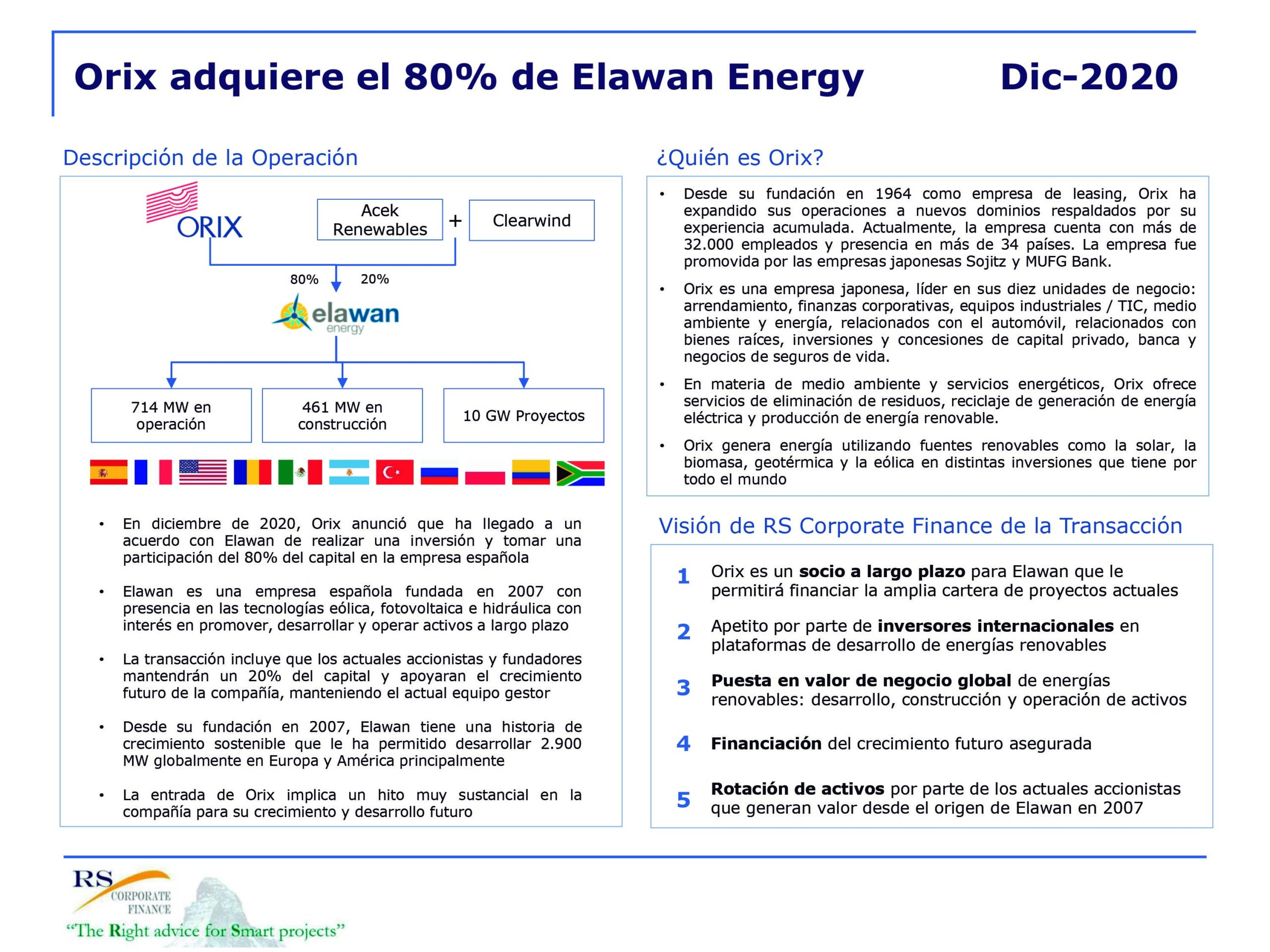

Case Study: Transaction Elawan-Orix

Orix Corporation reached an agreement to acquire an 80% stake in Elawan Energy

From RS Corporate Finance we carried out the Case Study of the Elawan-Orix transaction. Where we share our vision of the transaction and the most interesting aspects to review

Media interventions

Europe in recession (while Spain is spared)

The Crisis Around Credit Suisse

Silicon Valley Bank bankruptcy

Ferrovial case

The use of Next Generation funds: good but…

The finances

Global economic growth slows

Asesores financieros EFPA

Public debt is unacceptable

Global Vision 20h

Interview with Jesus Reglero

To Do List for 2022

Private Area

RS Corporate FinanceIn this section we put at your disposal the expert knowledge of our professionals, we invite you to get in:

Acces Private Area- Reports of RS Corporate Finance

- Case Studies of Mergers and Acquisitions

- Financial information

RS EducationIn this section, we offer you materials about corporate finance that are commonly used we invite you to get in:

Access- Sell side

- Cash vs Shares

- Advance valuation methodologies

RS FintechIn this section, we offer you tools that could be helpful for your transactions

Access Private Area- Energy trading comparable

- List of financial investors

- The 25 charts of the energy sector in Spain

Access Private Area

Access

In this section we put at your disposal the expert knowledge of our professionals, we invite you to get in:

In this section, we offer you tools that could be helpful for your transactions

In this section, we offer you materials about corporate finance that are commonly used we invite you to get in:

.