24 Charts that explain what is going on in Spain in corporate finance june 21

RS Corporate Finance offers the vision of the Spanish financial market during the last year where it analyzes with special interest what has happened in the last month.

This new new initiative from RS Corporate Finance, the 24 charts to understand what is happening in Spain from a financial point of view, from a point of view of M&A. This monthly report is divided into two blocks where the first contains 12 graphs of the financial market, where it is highlighted and analyzed from a sectorial and shareholder point of view which are the actions and sectors that have responded better or worse to the market. The second block with the following 12 graphs, analyzes different M&A operations that occurred worldwide and in Spain, in addition, 3 newspapers are compared on how they treat mergers and acquisitions operations and finally an analysis from the sector point of view where we will see What type of operations have been more frequent in the last month.

During this 2021, the Spanish economy has been recovering its activity after an atypical year 2020. The Spanish economy is expected to recover the pre-pandemic level in both economic growth and employment, with the continued support of the ECB through liquidity injections that are noticeable in decreases in the EURIBOR.

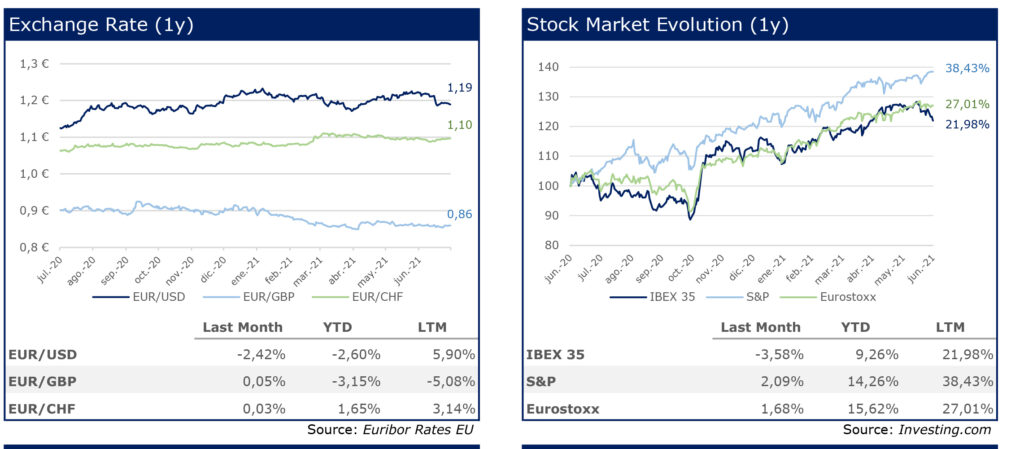

In the exchange market, it is worth noting the depreciation of the dollar and the Swiss franc against the euro during the last 12 months, which contrasts with the appreciation of the pound sterling against the euro.

Regarding the stock market, the IBEX 35 has grown by 22% in the last 12 months, a lower growth than that of the European and American benchmark indices due to the great weight of the tourism sector in our index and soon weight of the technology sector.

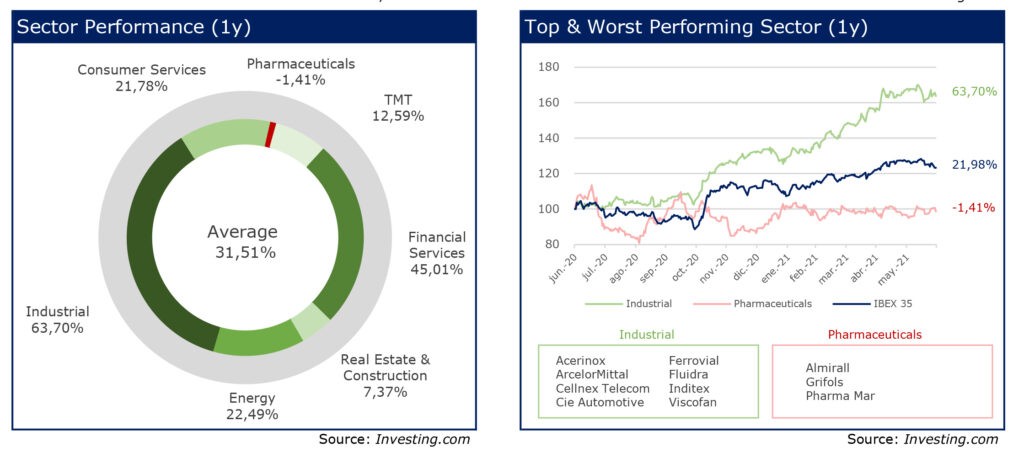

If we analyze theevolution by sector, we see that during the last year the sector with the greatest strength has been the industrial sector, which was the most affected by the pandemic. The sector that has performed the worst in the last 12 monthshas been the pharmaceutical sector, which has already experienced great growth just at the beginning of the pandemic that has been gradually fading away.

Analyzing only the month of June, practically all the sectors have fallen except pharmaceutical and technology, while the services and real estate sectors have suffered falls of up to 10%.

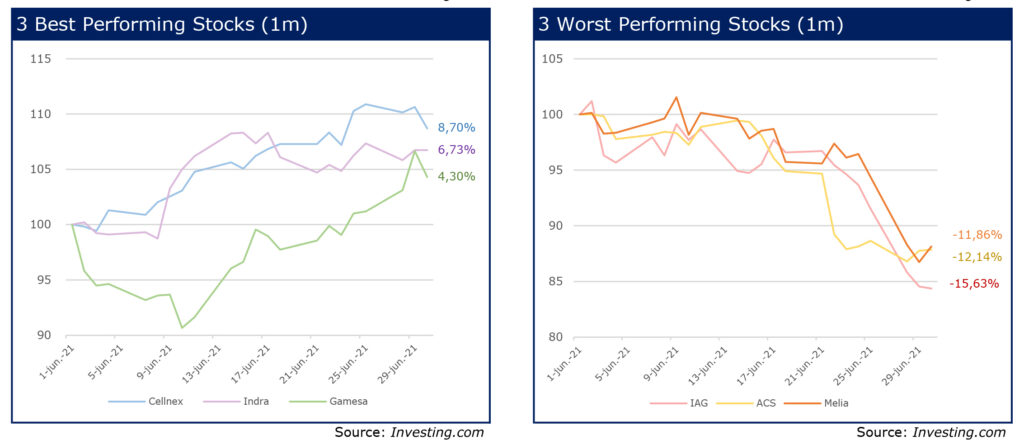

This growth in the industrial sector has been driven mainly by the companies Fluidra and ArcelorMittal. On the other hand, the most burdened companies have been the pharmaceutical companies Pharma Mar and Grifols, together with the airline IAG. Taking into account only the month of June, Cellnex, Indra and Gamesa are the companies with the highest increases while IAG, Meliá and ACS are the companies with the highest decreases, which have been weighed down by the spread of the new Indian variant that puts reopening plans in Europe in jeopardy

Now, we will talk a bit about some of the most relevant M&A and PE transactions that were reported this month:

- First, we have Repsol’s acquisition of 40% of Hecate Energy, a US based PV solar and battery storage project developer.

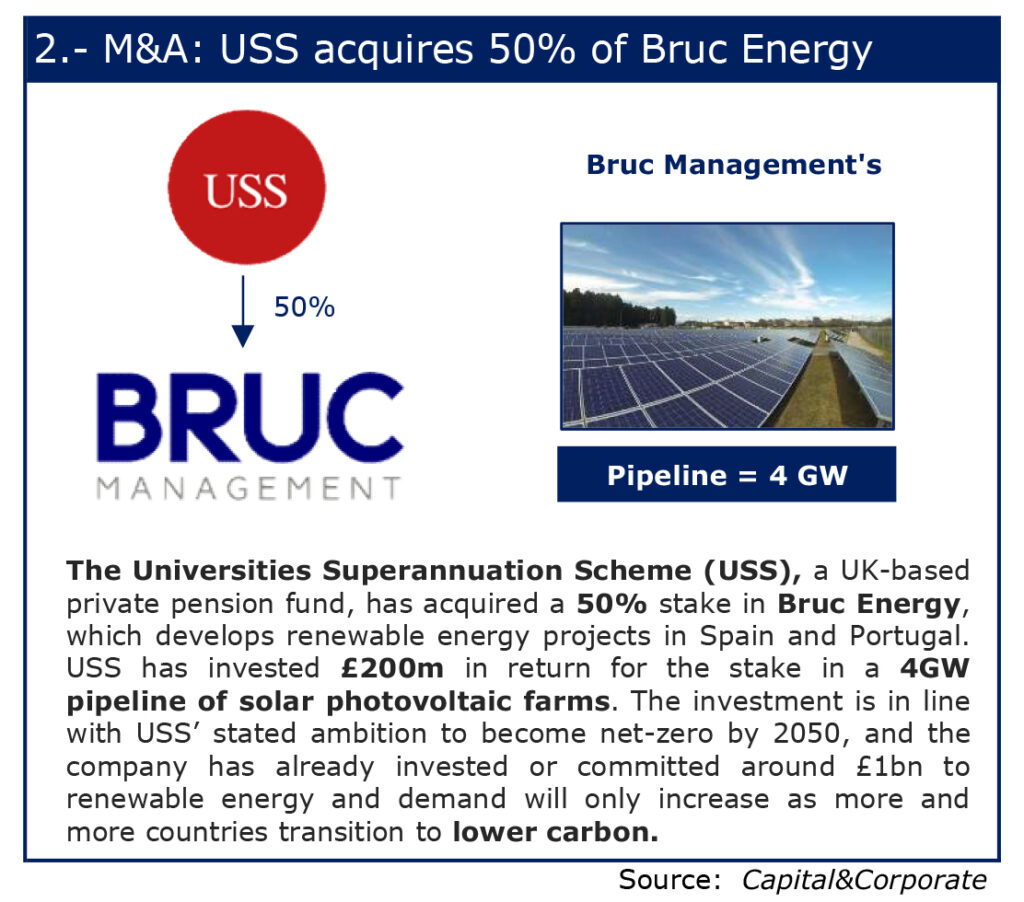

- • We also have Universities Superannuation Scheme or USS, a UK-based private pension fund’s acquisition of a 50% stake in Bruc Energy a developer of renewable energy projects in Spain and Portugal. Both transactions point to the growth of the renewable energy market as demand will only increase as more and more countries transition to low carbon emissions.

- Third we have the acquisition of 3 Delivery Hero companies by Glovo, both delivery platforms, with the aim of gaining access to markets in Central and Eastern Europe.

On the other hand, we also evaluated several PE transactions including:

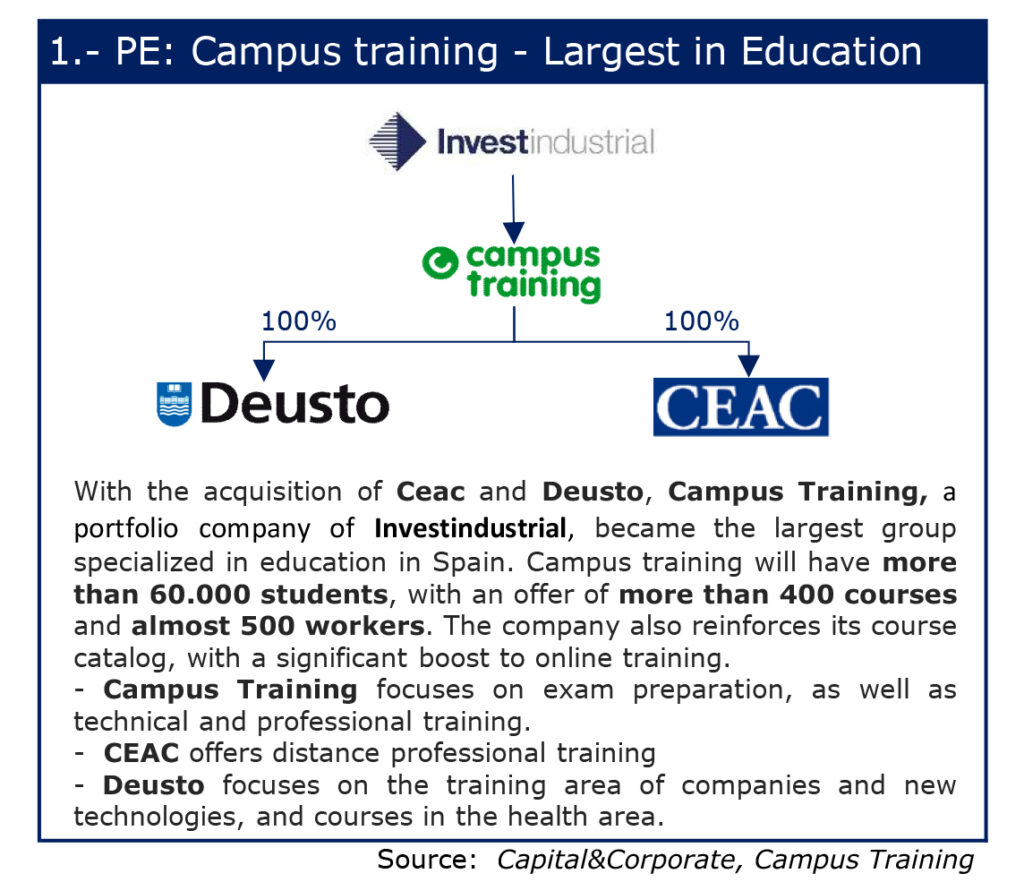

- First, Campus Training’s acquisition of Deusto and CEAC which allowed it to become the largest group specialized in education in Spain and indicates the current trends as it has a heavy focus on online education.

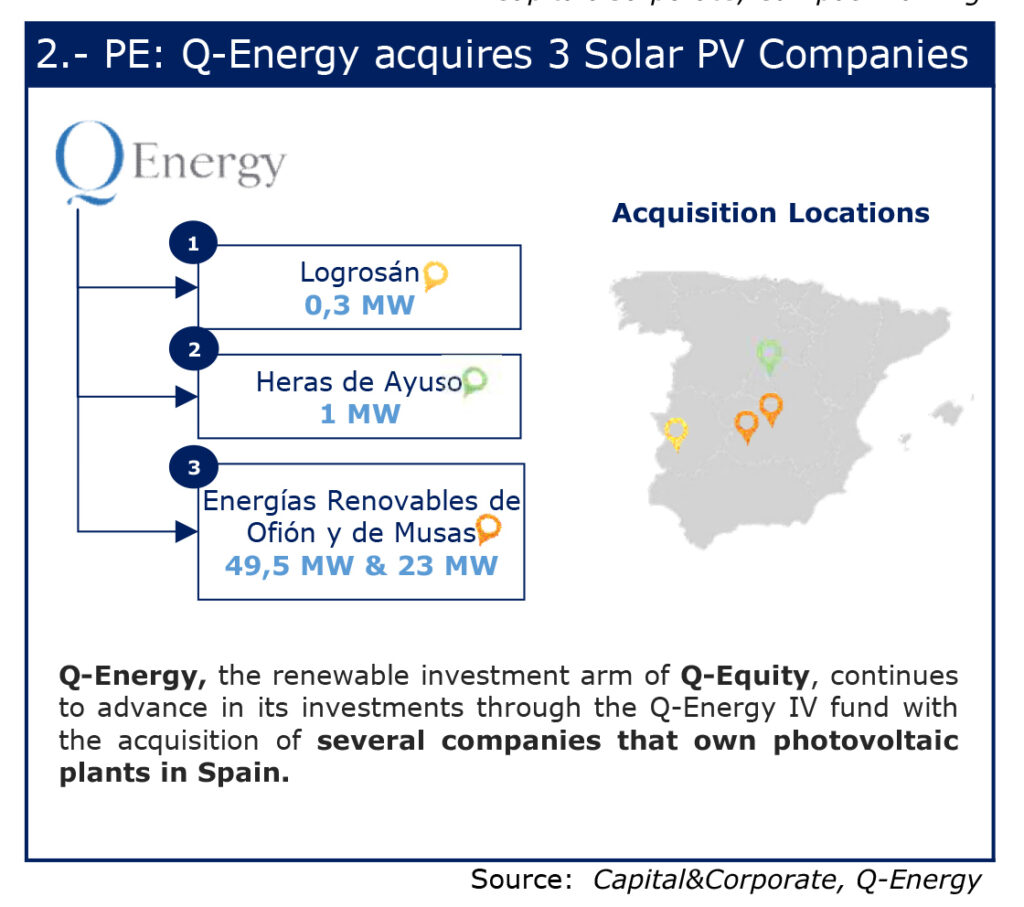

- Secondly, we have more acquisitions in the renewable energy sector with Q-energy’s acquisition of 3 solar projects equivalent to over 70 MW in Spain.

- • And third we have a deal between Asterion and Telefonica for a 20% stake in Nabiax in exchange for 4 Data Centers with attractive growth potential and that confirm Telefonica’s bet on infrastructure assets.

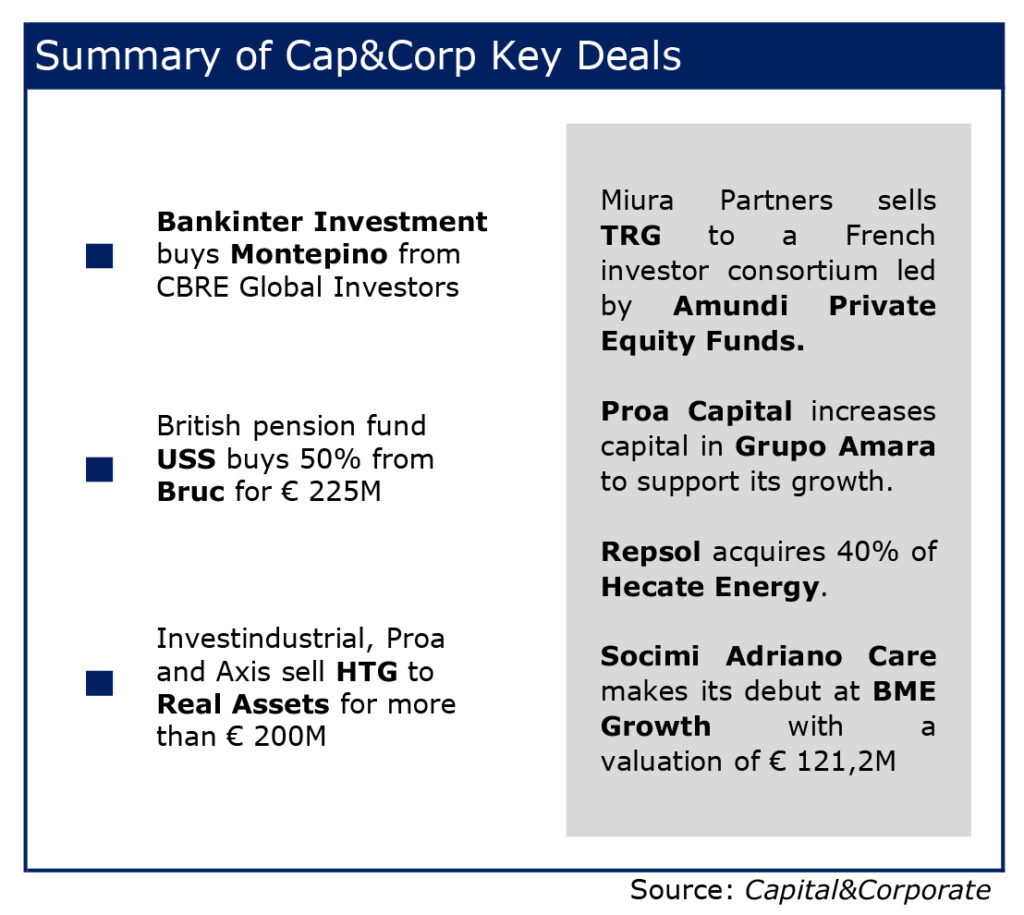

After analyzing the three media with a financial focus, Capital & Corporate, Expansión and The Financial Times, on what happened in the Spanish and global market during the last month, we highlight the following operations:

Spanish Market

- Capital & Corporate: The newscast highlights the purchase of Montepino from CBRE by Bankinter Investment, the acquisition of 50% of the Bruc renewables business by the British pension fund USS and the sale by Investindustrial, Proa and Axis of HTG to Real Assets

- Expansion: The media distinguishes the union between the Godia family and the Everwood fund to create a photovoltaic giant, the takeover of the Swedish fund EQT on the listed Spanish Solarpack.. Also noteworthy is the advancement in the renewables race and zero CO2 emission by BP to the oil companies Repsol and Total with the purchase of a package of renewable energy projects, the announcement by Portobello Capital about its negotiation in the entry into the Condis supermarkets and finally the Suez council gives the green light for the takeover launched by Veolia

Global Market

- The Financial Times: The international media underlines the announcement of the purchase of the DEOPOP application by Etsy, the acquisition of the JD catalog by Warner and finally highlights the words of the bearish investor who predicted the ENRON scandal and his new warning about the business the SPAC.

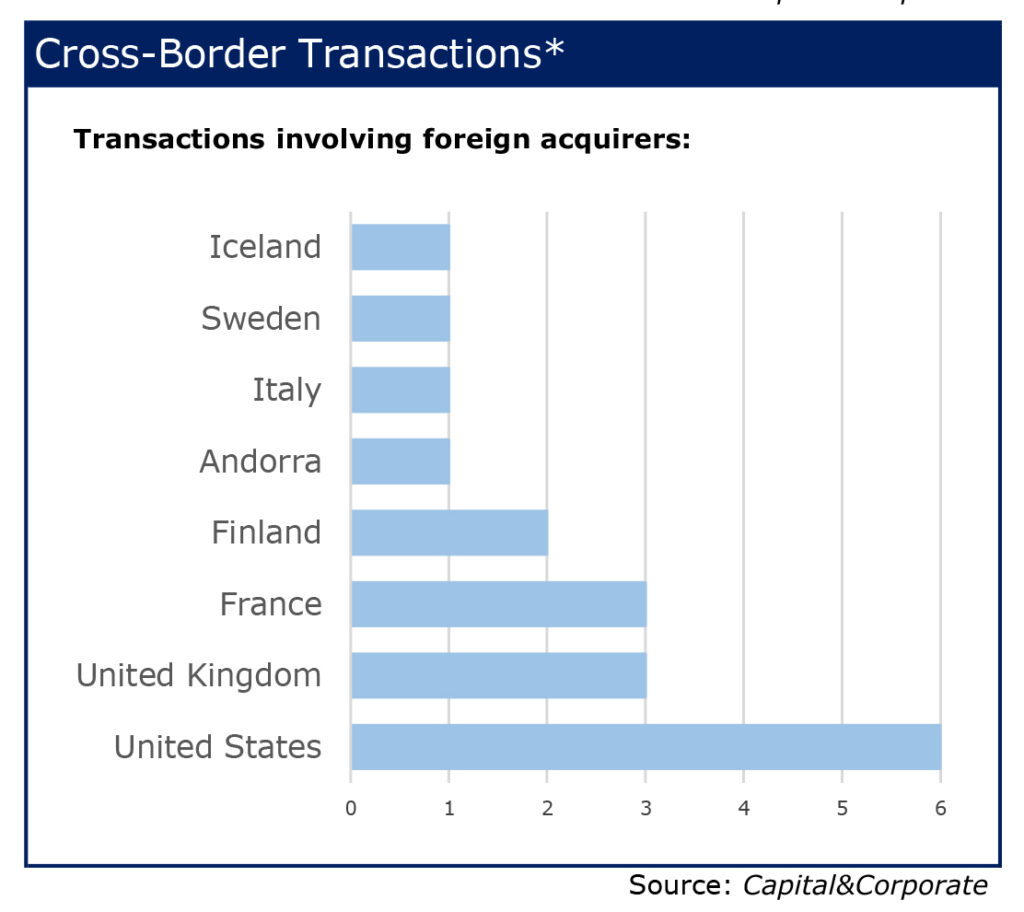

And analyzing the 44 operations that took place in the Spanish market during the last month in Capital & Corporate and taking an analytical approach from RS Corporate Finance, we see that 48% of the operations are foreign, the majority being the acquirer from the United States, while 52 The remaining% are national operations. The sectors that have seen the highest number of operations have been the TMT and the Industrial sector, representing 55% of the sample.