24 Charts -What is going on in Spain in corporate finance September- October 2021

RS Corporate Finance analyses the Spanish financial market during the months of September and October, as well as the most relevant Private Equity and M&A transactions.

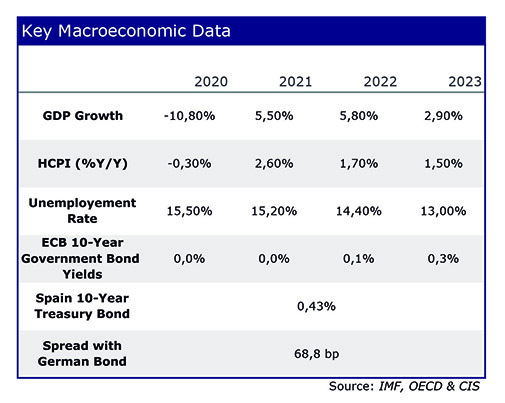

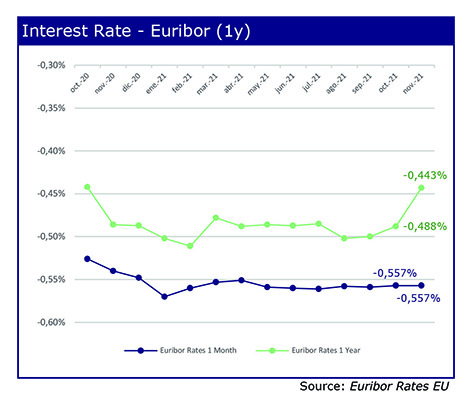

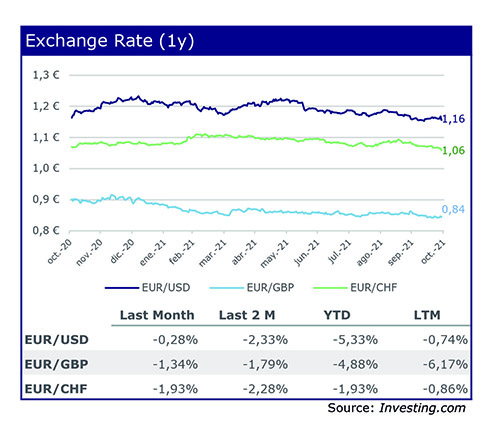

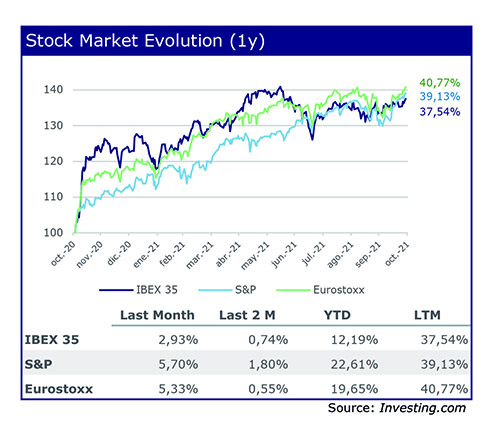

In the 24 Graphs we analyze what happened in Spain during the months of September and October both from a financial point of view and in terms of mergers and acquisitions. Throughout the first 12 graphs we can observe the evolution that the macroeconomic data have maintained, as well as the Euribor and the evolution of the stock market during the last year and a comparison is made with the months of September and October.

During the last two months, we have witnessed high volatility in the markets. During September, the world’s stock markets suffered a correction due to the collapse of the Chinese real estate company Evergrande and supply chain problems. During October, however, the stock market had a strong rebound.

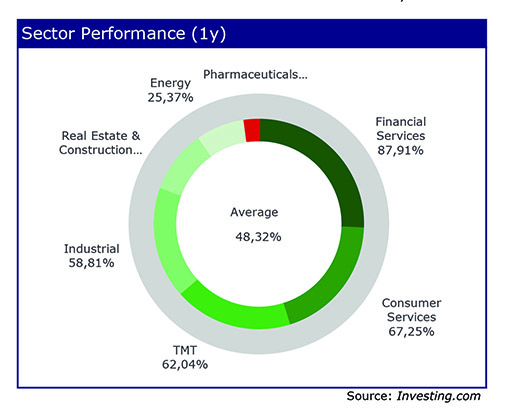

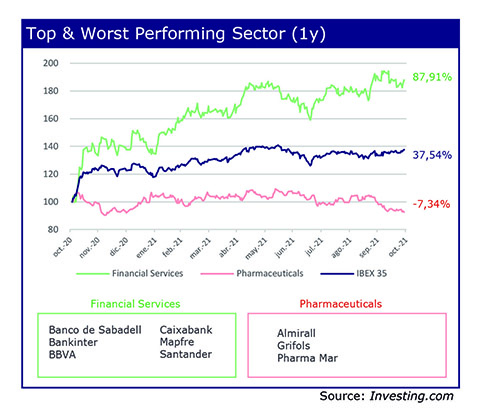

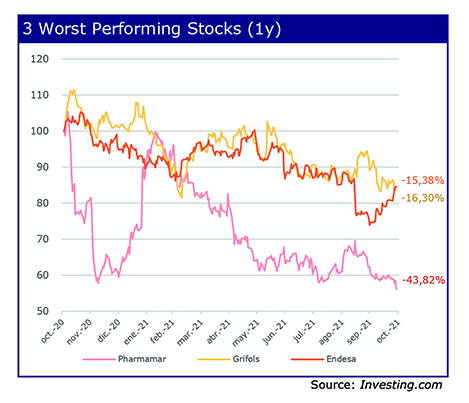

If we analyze the evolution by sector, we can see that the sector with the greatest strength during the last year is the financial services sector followed by the consumer sector. The sector that has performed the worst in the last 12 months has been the pharmaceutical sector, which had experienced a significant growth at the beginning of the pandemic which has gradually been fading.

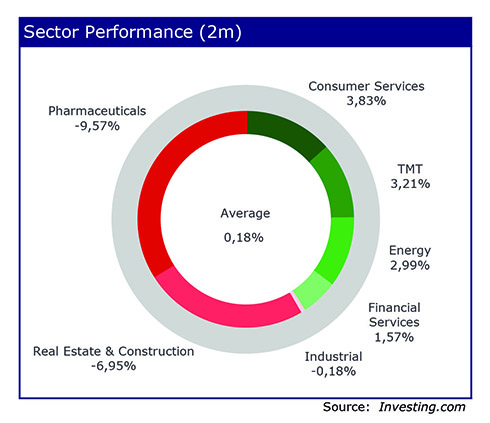

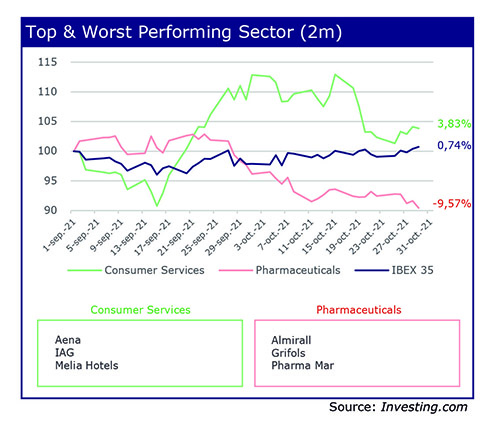

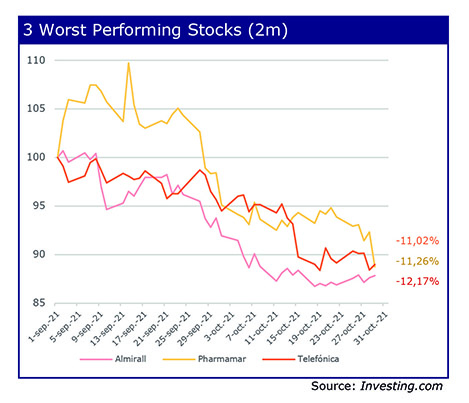

While analyzing the industry sectors within the IBEX during September and October, we can see that the one with the best performance is the services sector with a rise of 3.83%, followed by the technology and energy sectors, and finally the financial services sector, which rose 1.57%. The most burdened sectors have been the pharmaceutical and the construction sectors. The pharmaceutical sector’s downtrend persists.

Specifically, the companies with the best performance on the IBEX in the last two months have been Acciona, Repsol and Banco Sabadell. On the other hand, the companies that have suffered the greatest losses have been Almirall, Pharmamar and Telefónica.

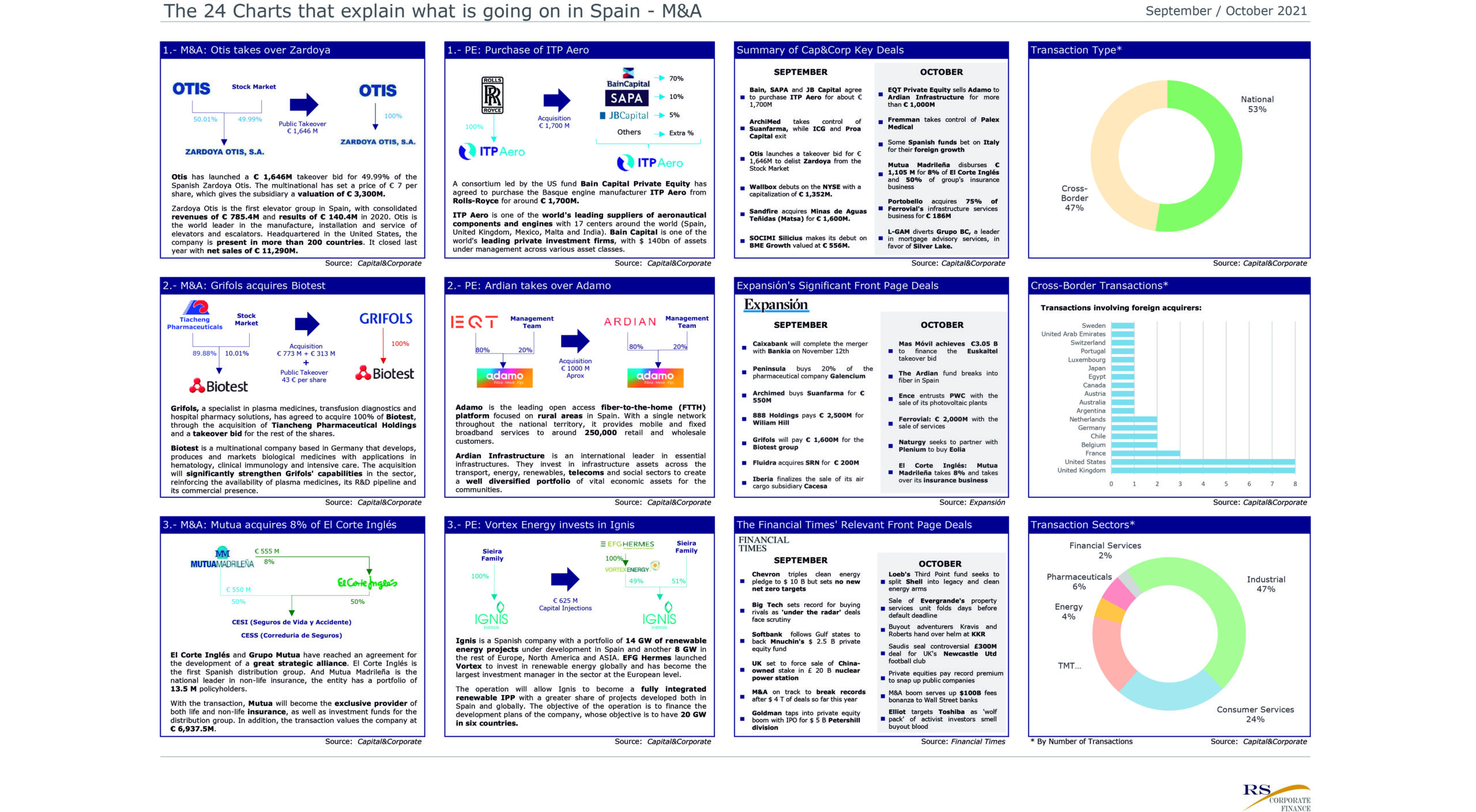

Within the M&A and Private Equity markets, 6 relevant transactions are analyzed after being announced during the past 2 months

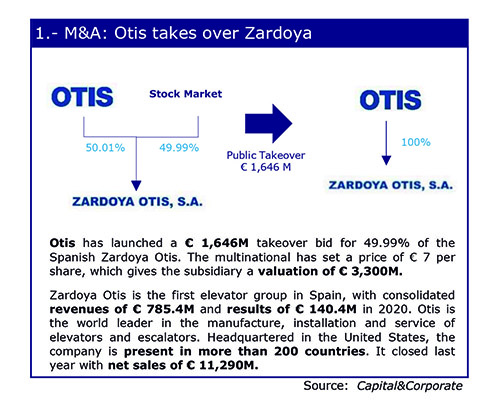

- In the first place, we have Otis’ takeover of Zardoya Otis of the 49.99% that it did not own with the aim of delisting the company from the stock market.

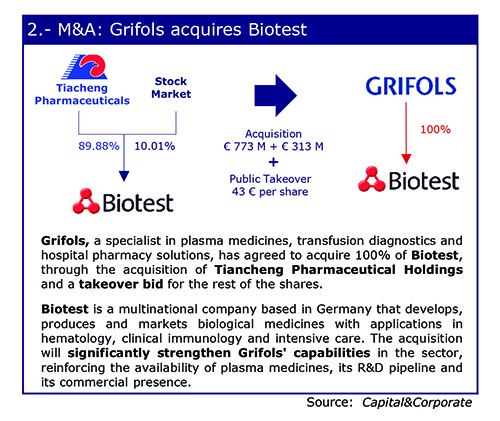

- In the pharmaceutical sector, Grifols has agreed to acquire 100% of Biotest, 89% through the acquisition of a holding company and the rest through a takeover bid.

- And finally, in the M&A market, Mutua Madrileña’s acquisition of 8% of El Corte Inglés valuing the company at 6,937 Million Euros.

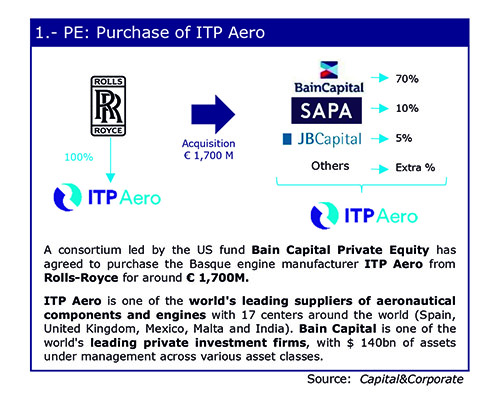

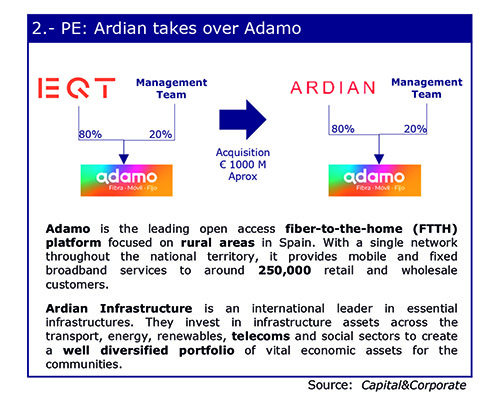

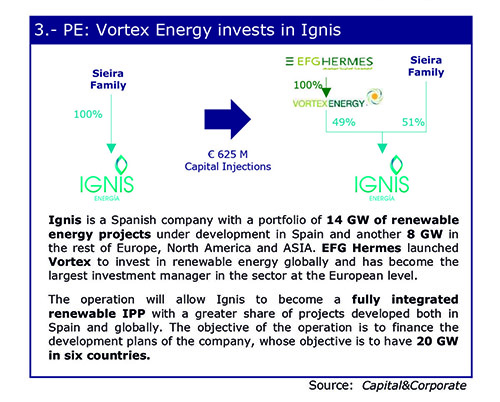

On the other hand, Private Equities made significant transactions such as:

In the Private Equity market we can highlight the continued ambition for the renewable energy market, an example of which is Vortex Energy’s purchase of 49% of Ignis.

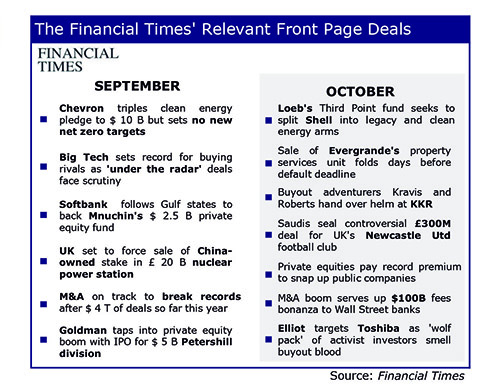

Next, after analyzing three medias with a financial focus: Capital & Corporate, Expansión and The Financial Times, on what happened in the Spanish and global market during the last two months, the following operations should be highlighted:

Capital & Corporate:

- Wallbox’s debut on the NYSE stands out with a capitalization of € 1,325M in the month of September.

- And in October, Mutua Madrileña’s acquisition of 8% of El Corte Inglés and 50% of its insurance business.

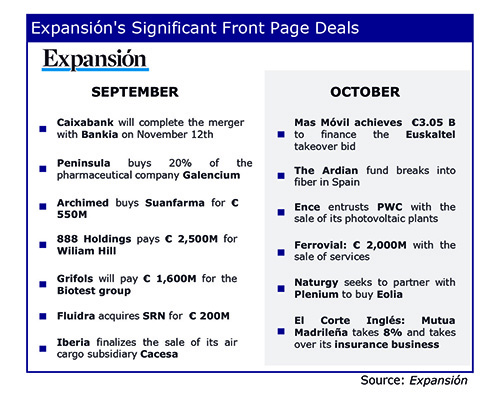

In Expansión, the following transactions can be highlighted:

- In September the aforementioned acquisition of Biotest Group by Grifols for € 1,600 million. And the acquisition of SRN by Fluidra for € 200m.

- And in October the news of Naturgy and Plenium partnering up for the acquisition of Eolia.

Regarding the global market, The Financial Timeshighlights the following news on the front page: in September the news about mergers and acquisitions, which beats records, reaching agreements worth 4 trillion so far this year. Additionally, in October we highlight the failure of Evergrande in the sale of its real estate services unit.