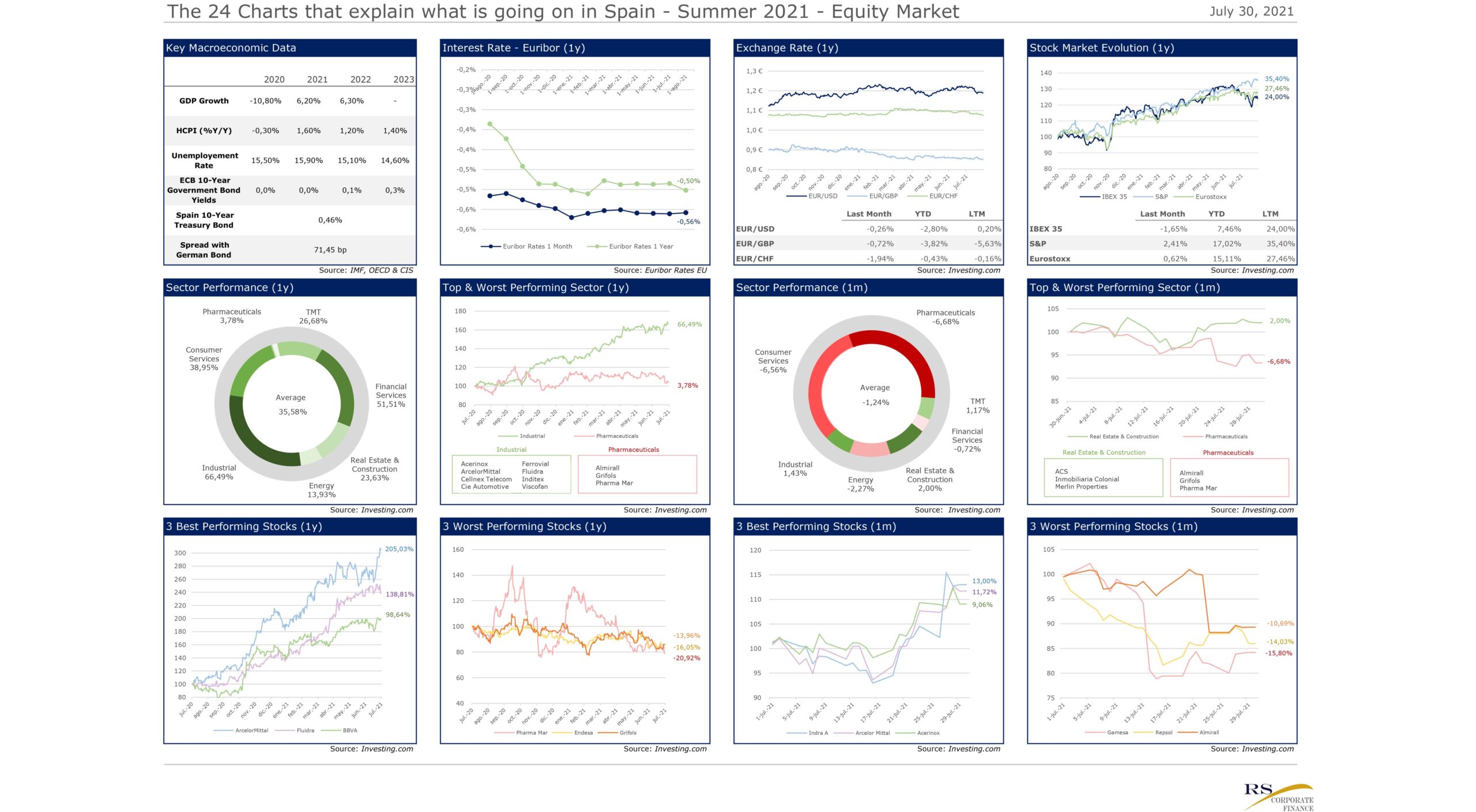

24 Charts -What is going on in Spain in corporate finance summer 2021

RS Corporate Finance analyzes the situation of the Spanish financial market during the summer, as well as the most relevant Private Equity and M&A transactions.

The 24 Graphs analyse what happened in Spain during the summer months both from a financial point of view and with respect to mergers and acquisitions.

On this occasion, the report is bimonthly, therefore, the first 24 graphs it contains are related to the financial markets, which highlight and analyse which stocks and sectors have performed better or worse from a shareholder’s point of view, and then, another 24 graphs which focus on several M&A transactions that occurred in Spain, compare 3 newspapers’ coverage on M&A transactions an analyse the transactions that ocurr3ed during the summer months.

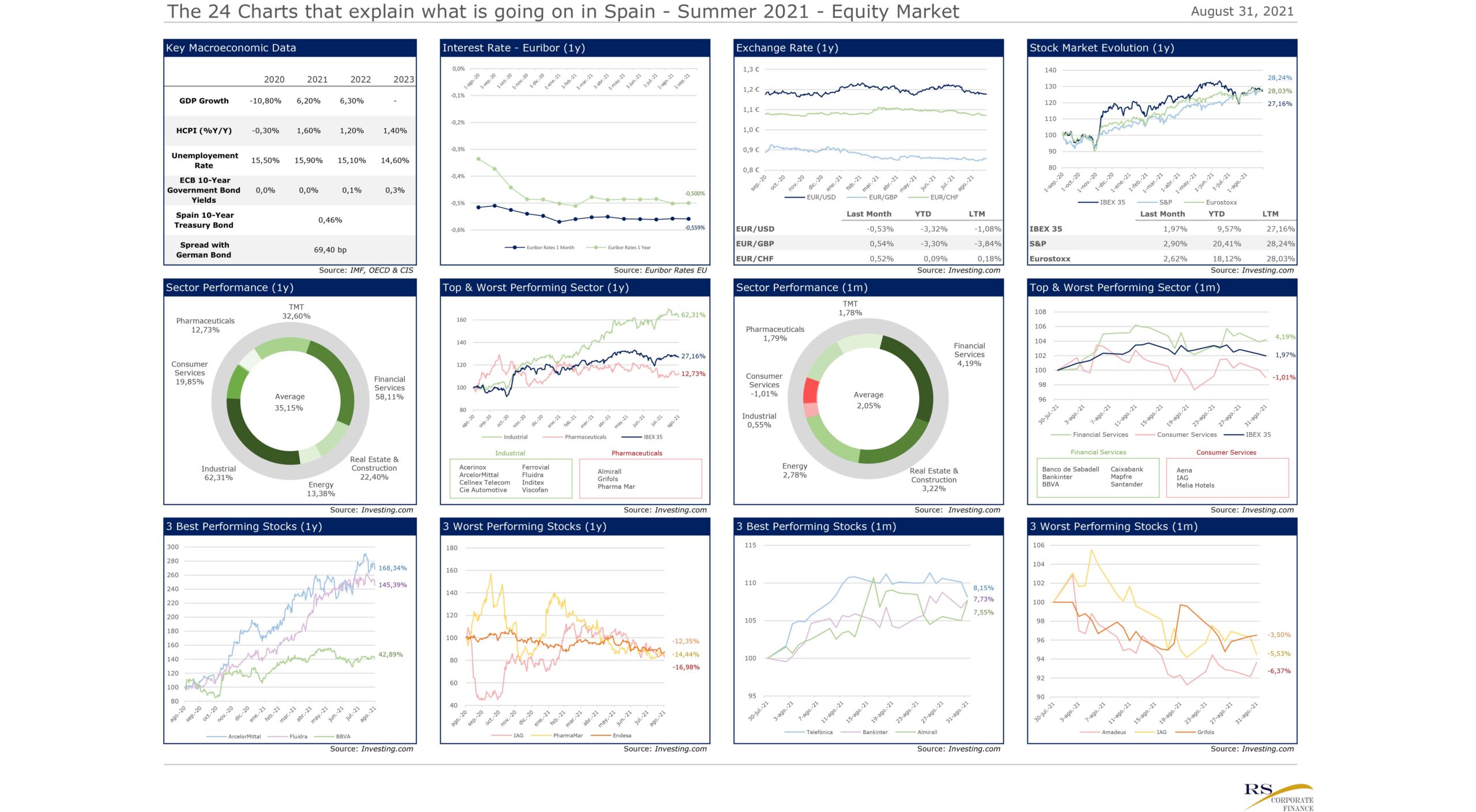

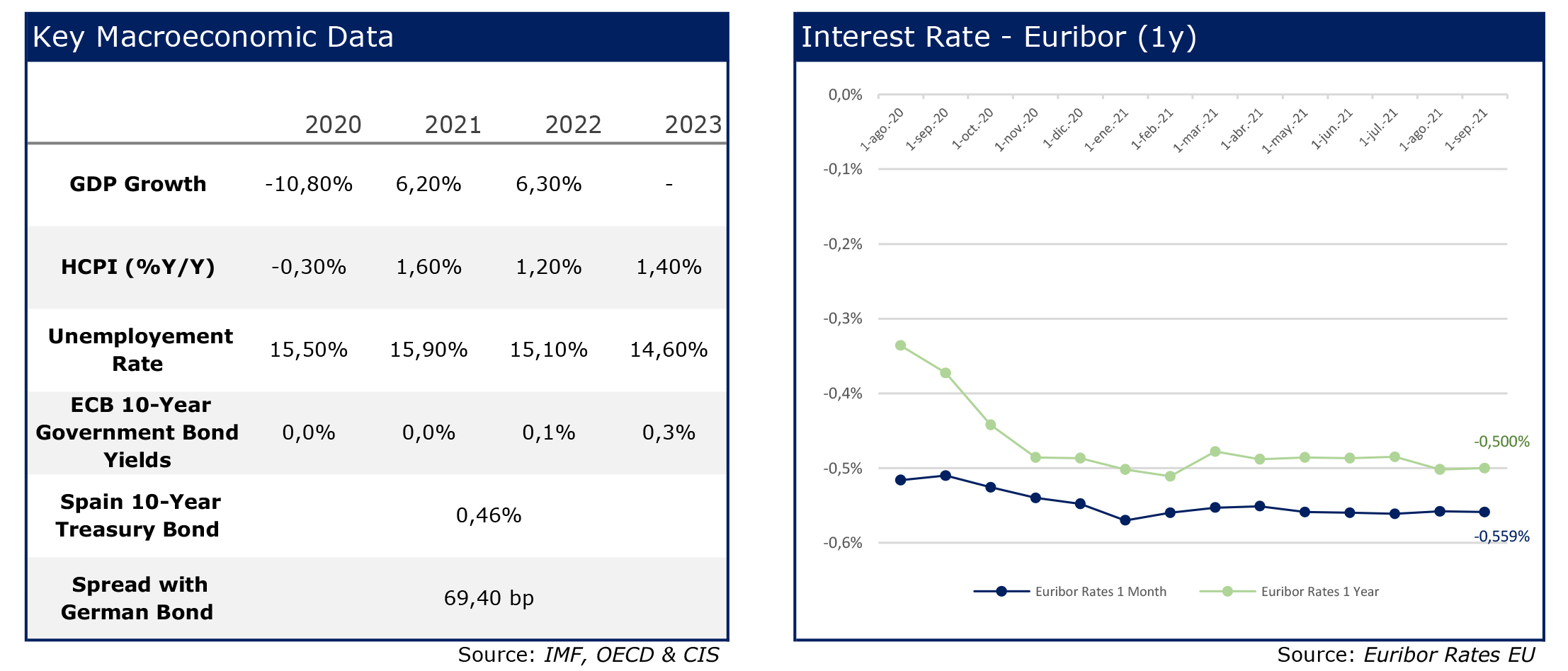

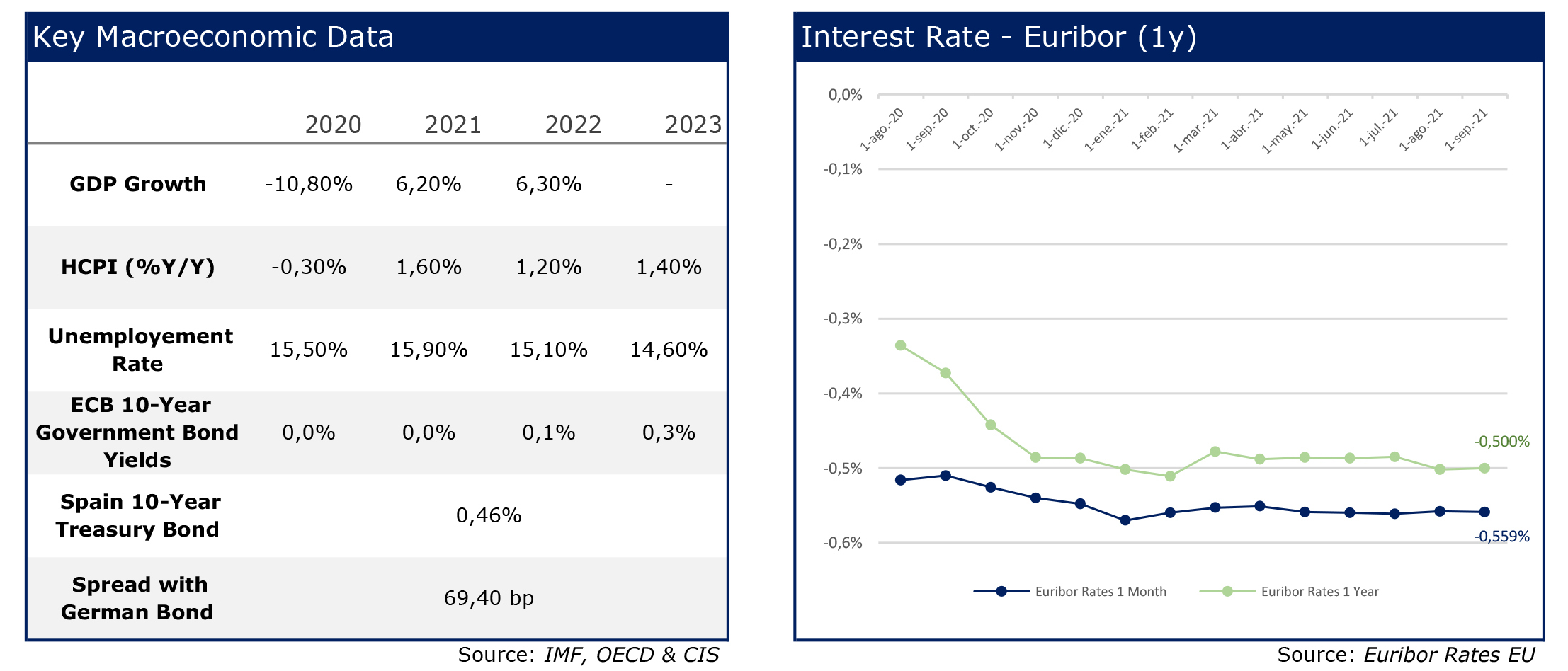

During the month of July, the macroeconomic indicators have remained constant except for the growth prospects of the Spanish economy, which have been revised upwards for 2022 and the EURIBOR continues the downward trend it has had in recent months. During the month of August, the indicators have remained constant, showing strong GDP growth and a progressive drop in the unemployment rate and for another month the EURIBOR continues its downward trend.

July 2021

August 2021

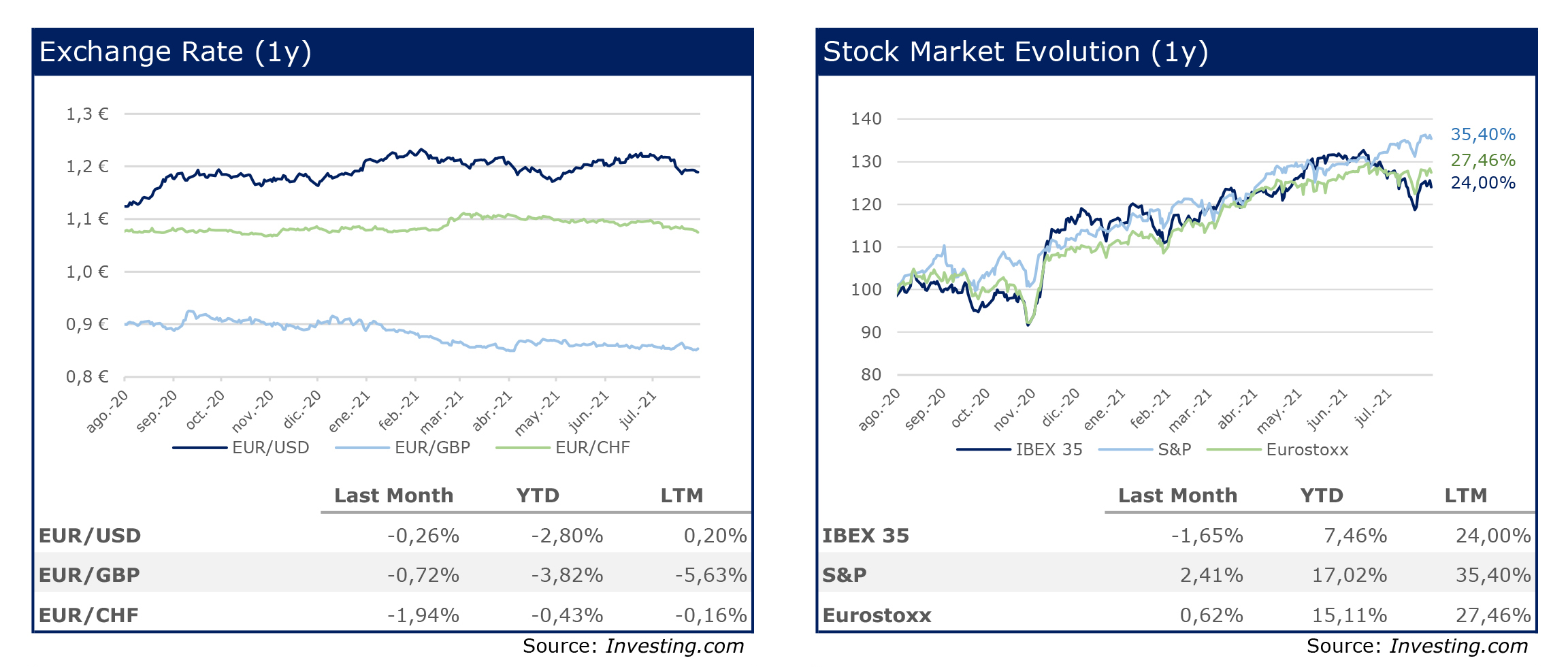

During the month of July, the Euro slightly depreciated against the main currencies and during the month of August although it continued to depreciate against the US dollar, it recovered against the British Pound and the Swiss Franc.

Regarding the stock markets, both the American and European markets have appreciated, as indicated by the S&P500 and Euro Stoxx indexes, while the Spanish index depreciated during the month of July. The month of August was a month of appreciations in world stock markets with the US at the forefront, which continues to reach maximum levels week by week. The Ibex, for its part, barely appreciated a few tenths during the summer.

July 2021

August 2021

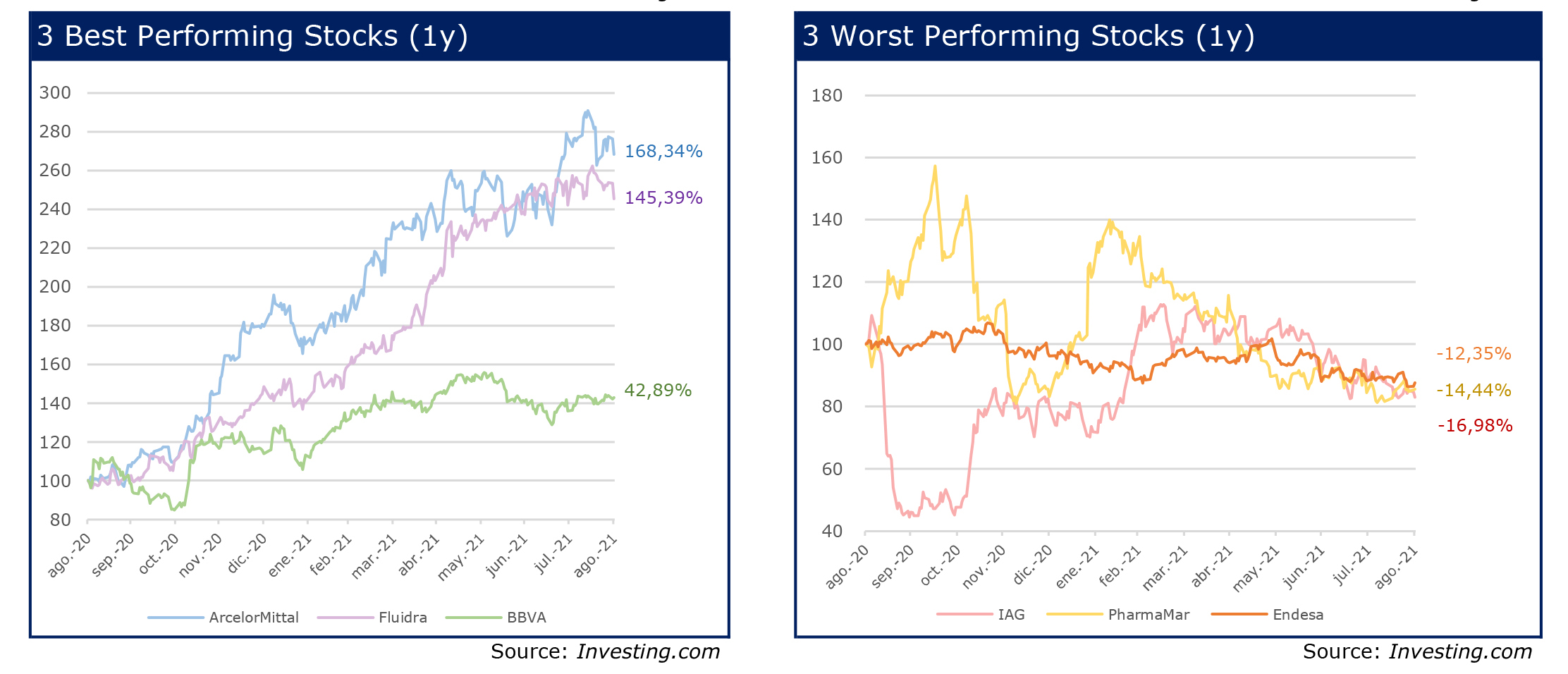

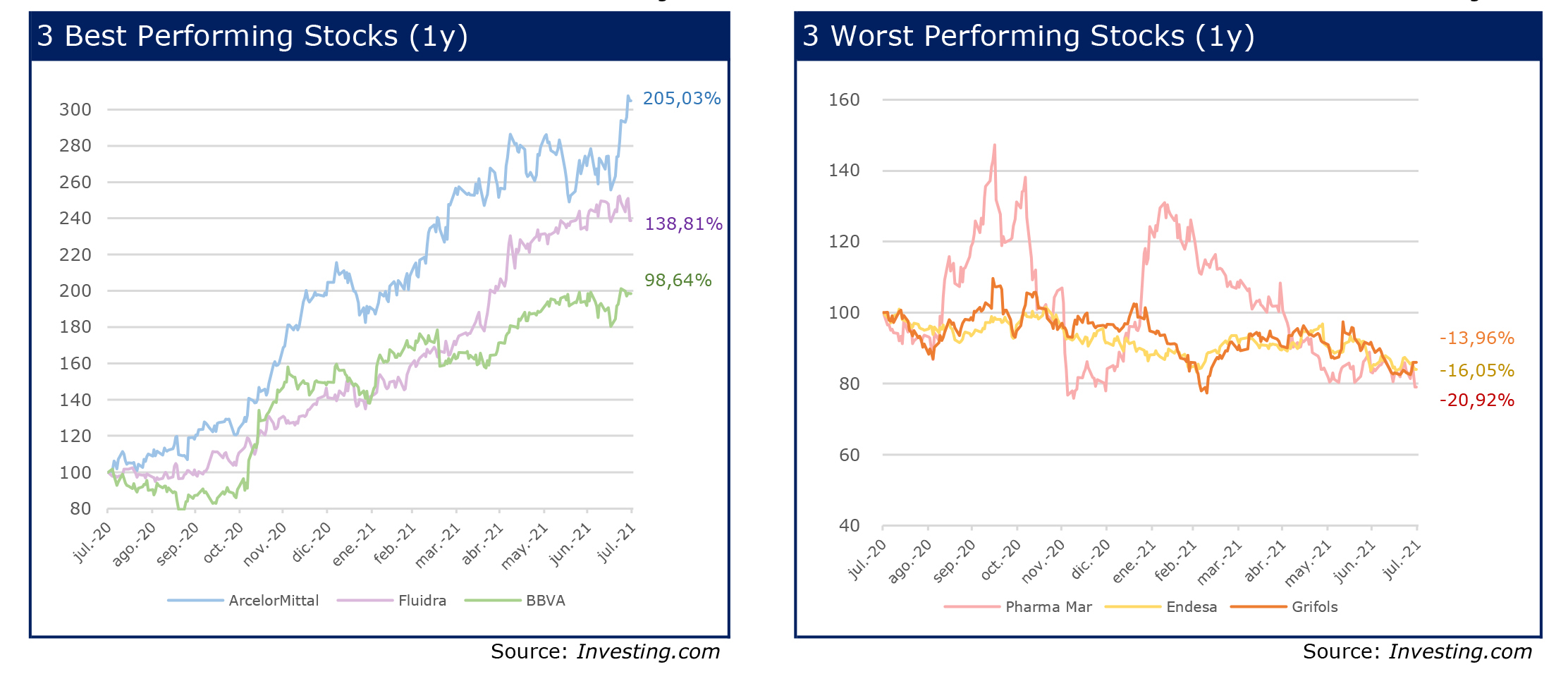

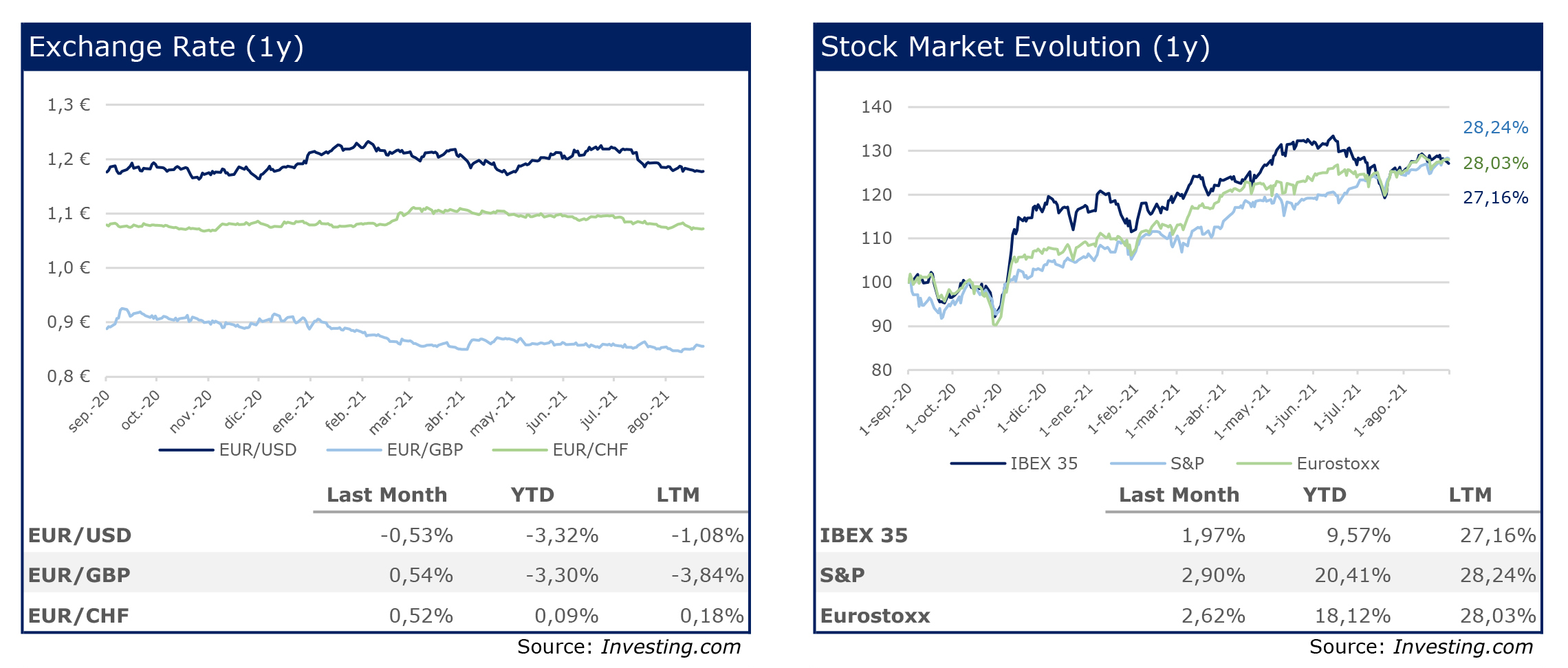

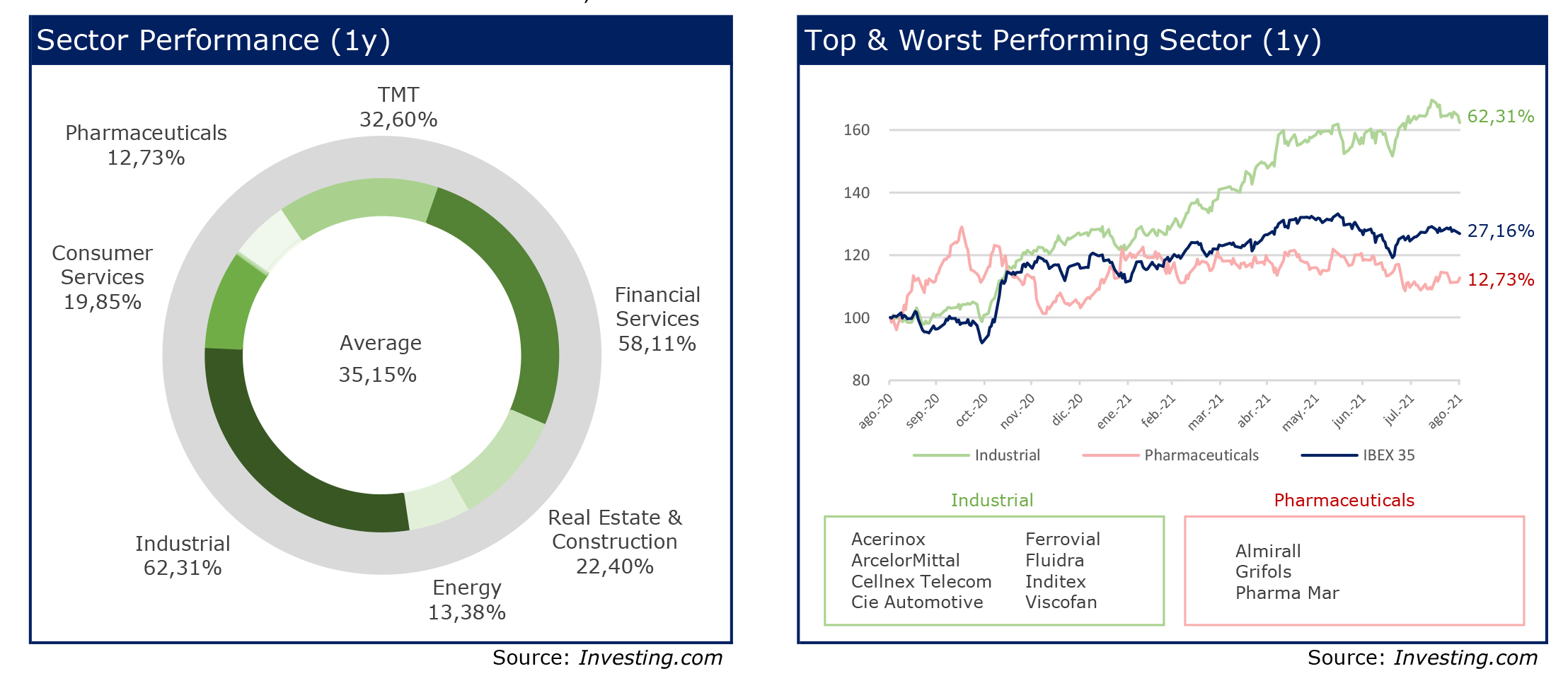

When analysing the differentsectors’ evolution in the Spanish stock market during the last 12 months, the industrial sector has been the strongest sector with the most growth while the pharmaceutical sector has had the worst performance.

July 2021

August 2021

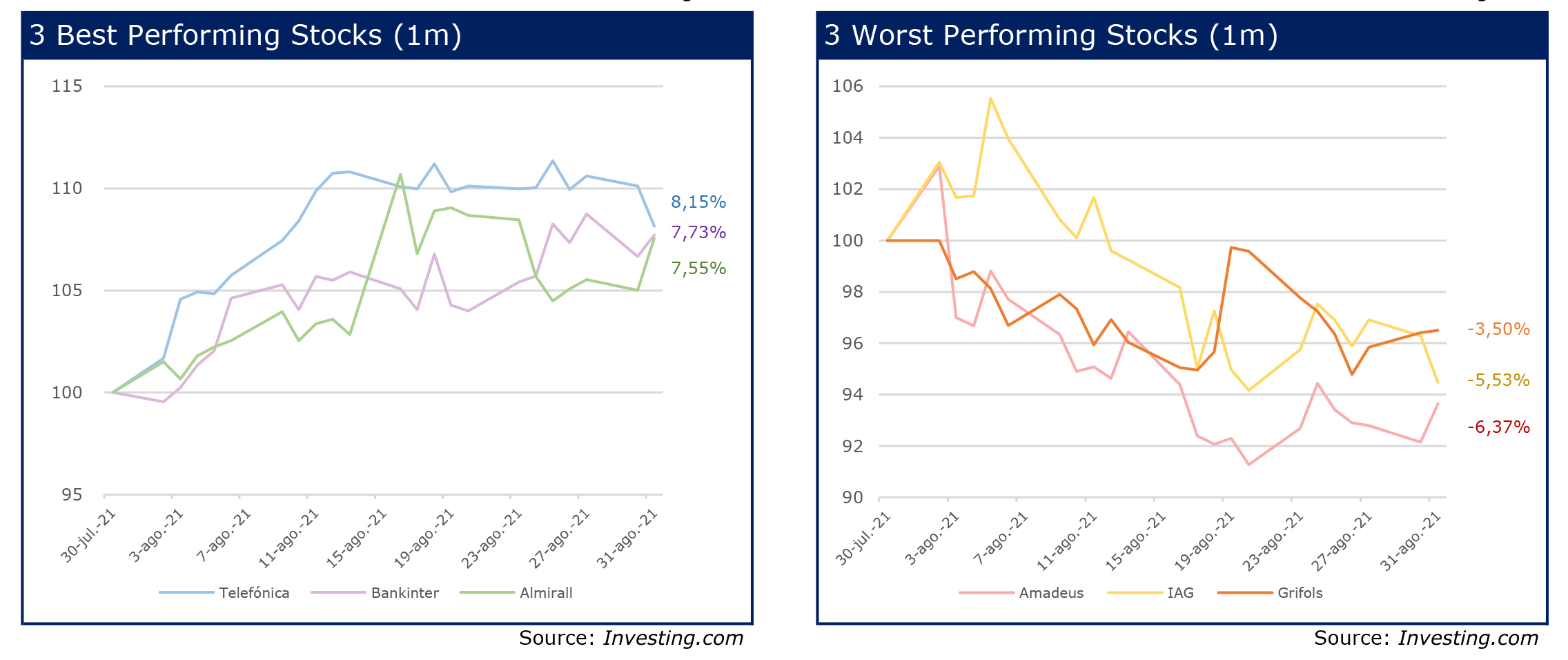

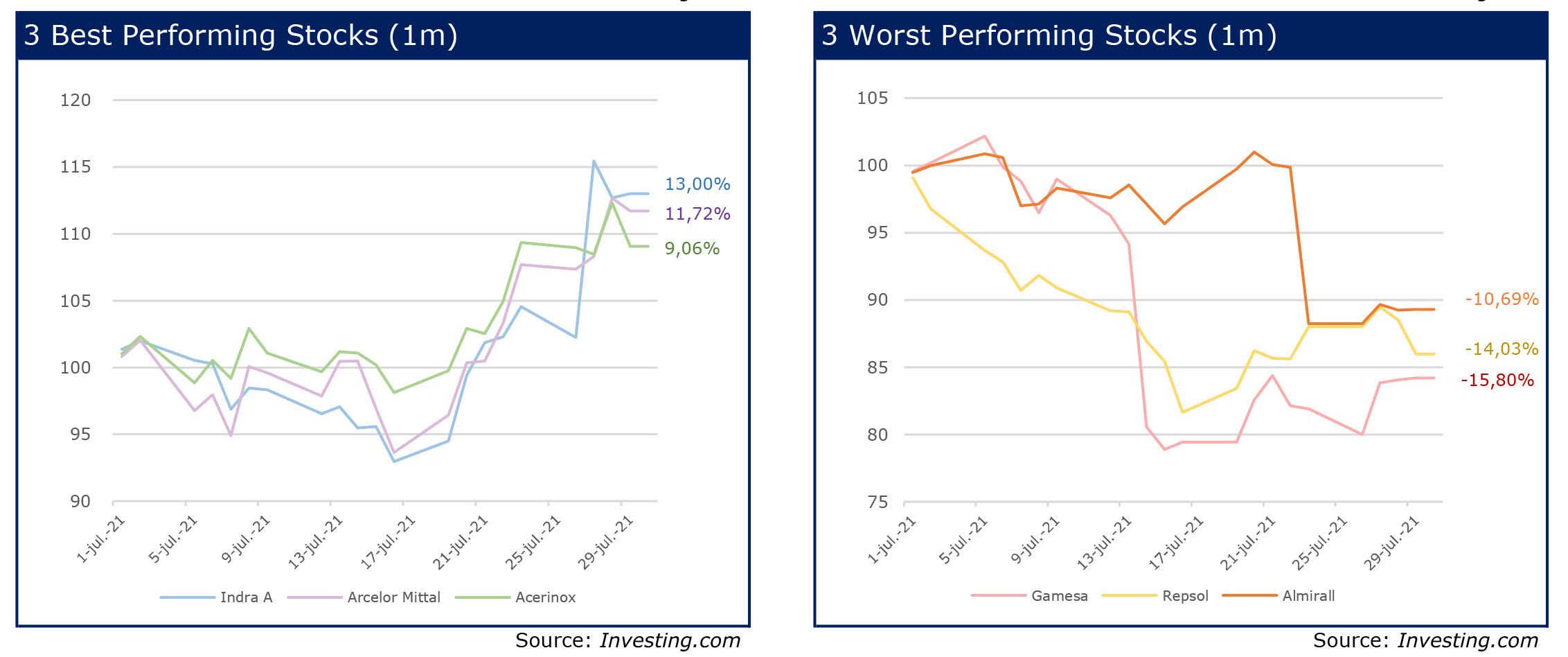

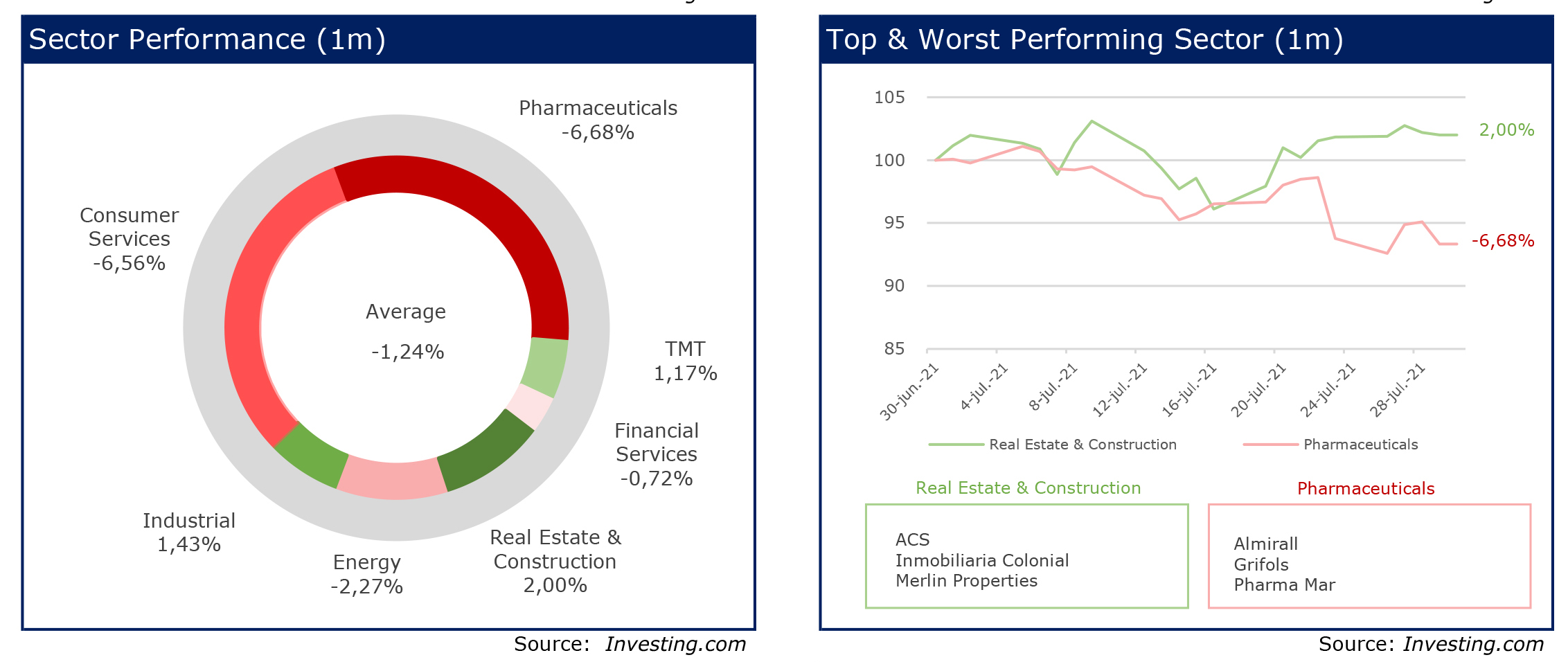

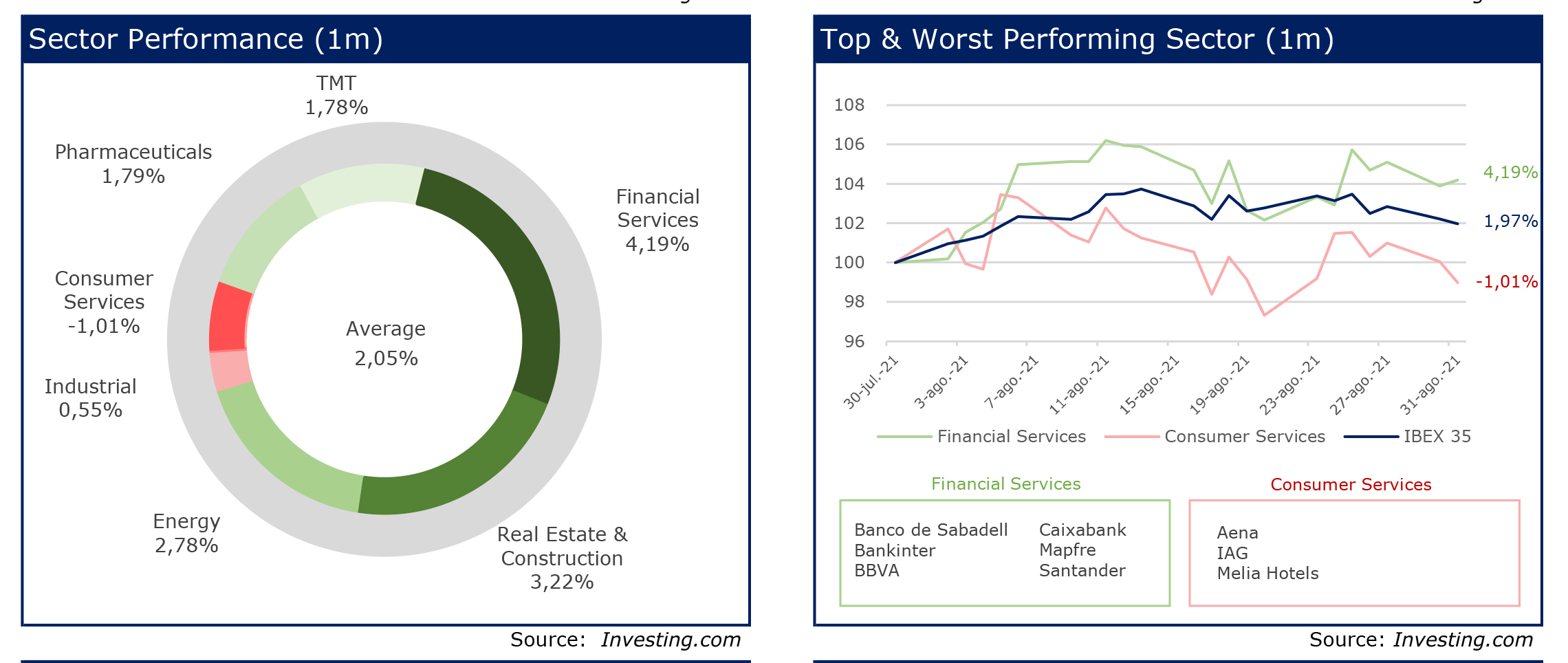

The Spanish stock market experienced a generalized decrease during July, especially in the pharmaceutical and consumer sectors. The technological, industrial and construction sectors were spared from this decrease and in fact had a slight increase. However, during the month of

The IBEX sectors that have grown the most have been the construction, technology and financial sectors, while the most affected sectors have been the pharmaceutical and consumer sectors.

July 2021

August 2021

During the last 12 months, the remarkable growth of the industrial sector is mainly due to Fluidra and ArcelorMittal. BBVA’s performance can also be highlighted as it was the best in its sector. On the other hand, the most troubled companies have been the pharmaceutical companies Pharma Mar, the electricity company Endesa; Grifols and IAG shared one position in July and another in August.

TDuring the month of July, Indra, Arcelor and Acerinox were the companies with the greatest increases while Gamesa, Repsol and Almirall were the companies with the most significant decreases. On the other hand, during the month of

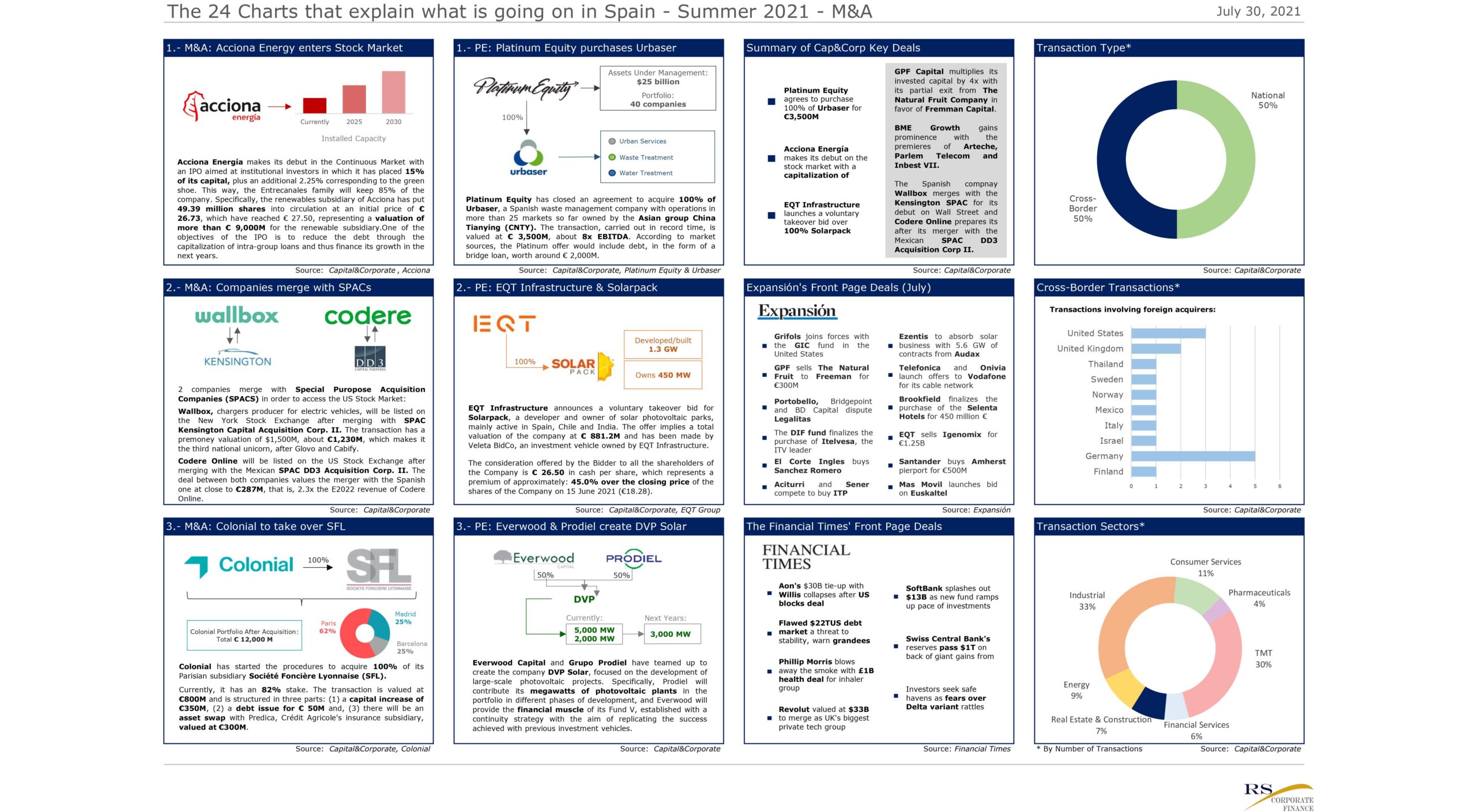

Some of the most relevant M&A transactions that took place in July included:

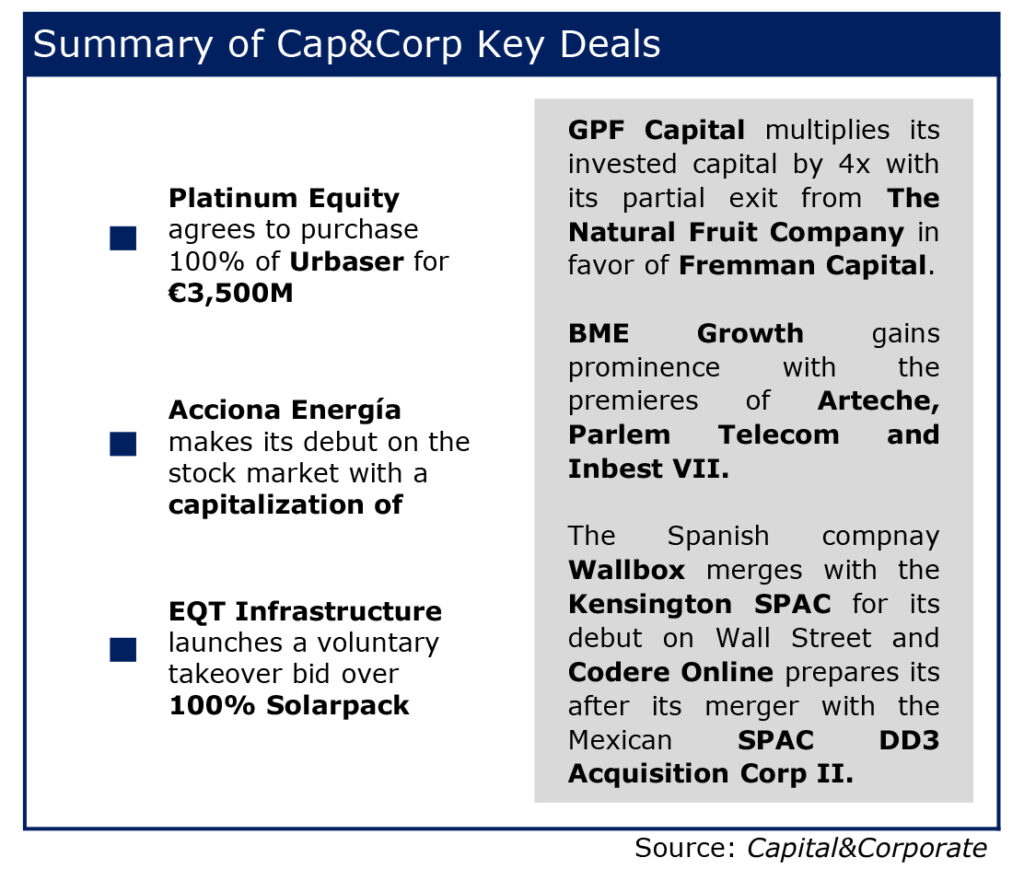

- Acciona Energía made its debut on the Continuous Market with an IPO aimed at institutional investors in which it has placed 15% of its capital, which represents a valuation of more than € 9,000 M for the company.

- 2 companies merged with SPACS or Special Purpose Acquisition Companies (to access the US Stock Exchange), Wallbox, a producer of chargers for electric vehicles, and Codere Online, an online betting house.

- Colonial has started the procedures to acquire 100% of its Parisian subsidiary SFL. The transaction is valued at € 800 million and Colonial’s portfolio after the acquisition will total € 12,000 million.

On the other hand, Private Equities made significant transactions such as:

- Platinum Equity has closed an agreement to acquire 100 from Urbaser, a Spanish waste management company. The transaction is valued at € 3,500 M around 8 x EBITDA.

- EQT Infrastructure announced a voluntary takeover bid of Solarpack, the Spanish developer and owner of photovoltaic solar parks. The consideration offered to the Company’s shareholders represents a premium of approximately 45% over the closing price.

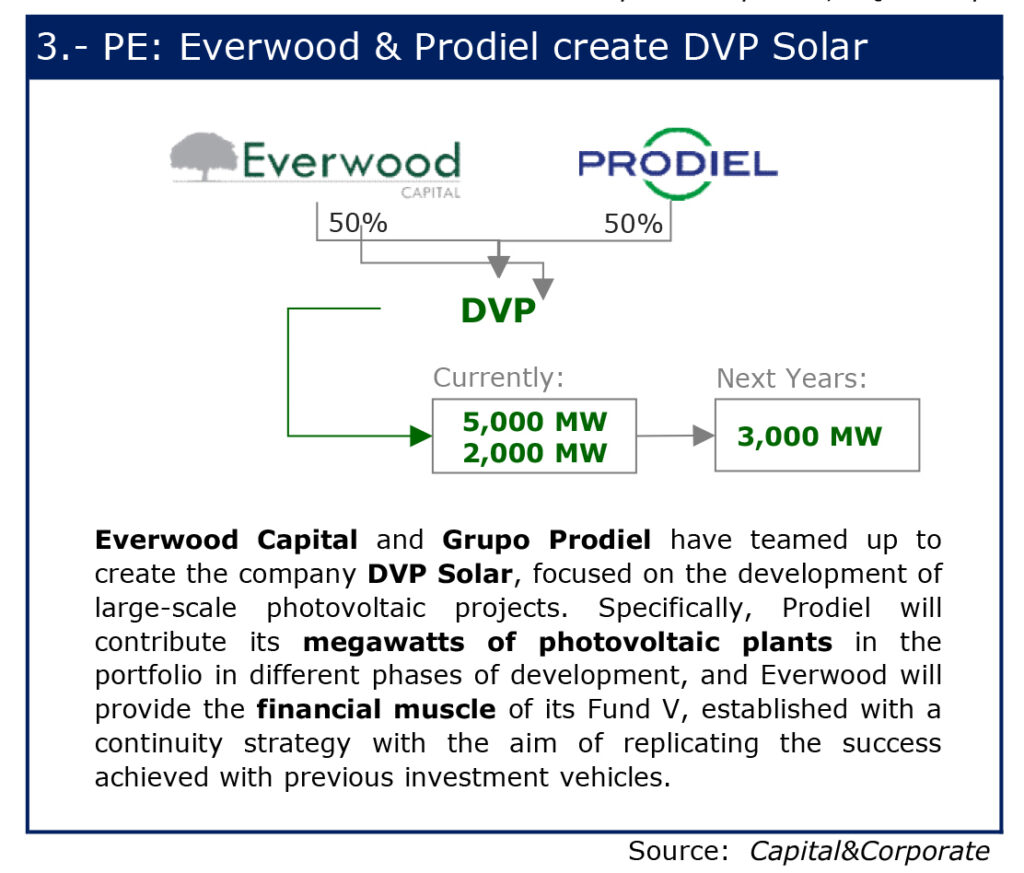

- Lastly, Everwood Capital and Grupo Prodiel have come together to create the DVP Solar company focused on the development of large-scale photovoltaic projects. Specifically, Prodiel will contribute its megawatts of portfolio photovoltaic plants in different phases of development, and Everwood will provide the financial muscle.

July 2021

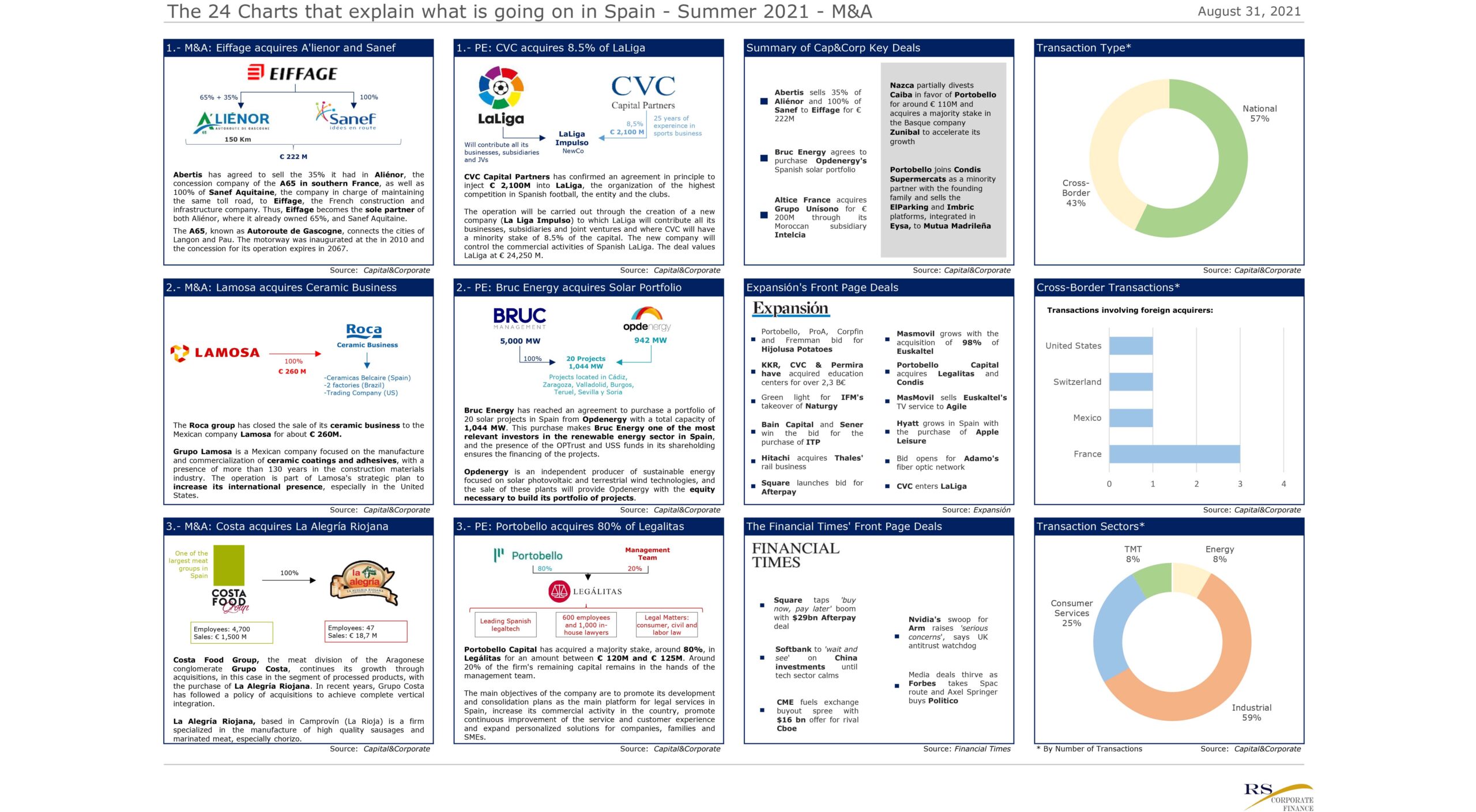

As the M&A and Private Equity markets continued to be very active in August, some of the most relevant transactions included:

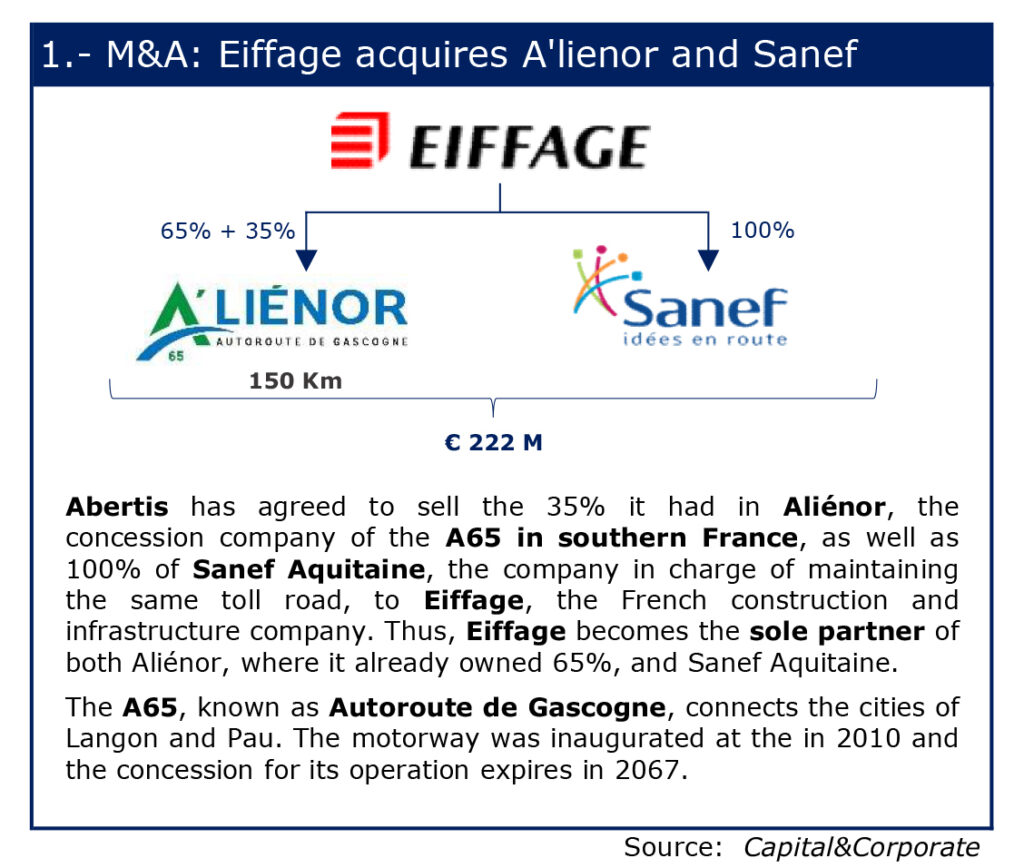

- Eiffage’s acquisition of A´lienor and Sanef.

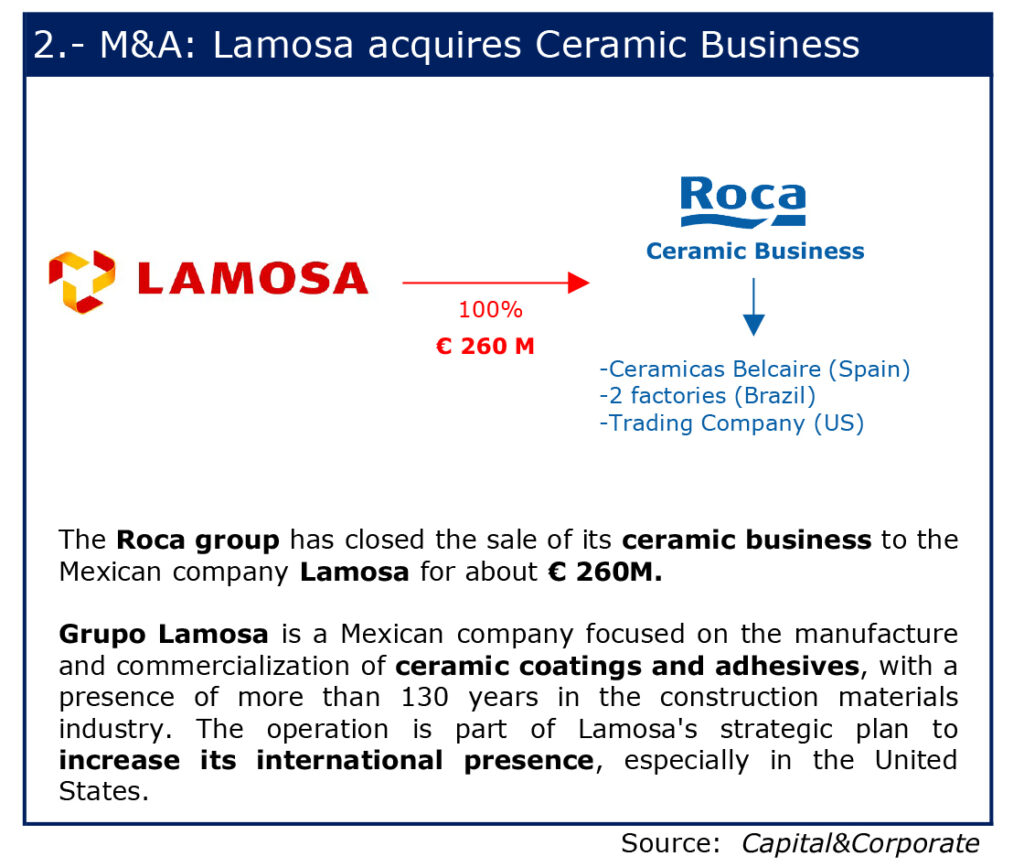

- The sale of Roca Group’s ceramics business to Lamosa, a Mexican company focused on the manufacture and commercialization of ceramic coatings

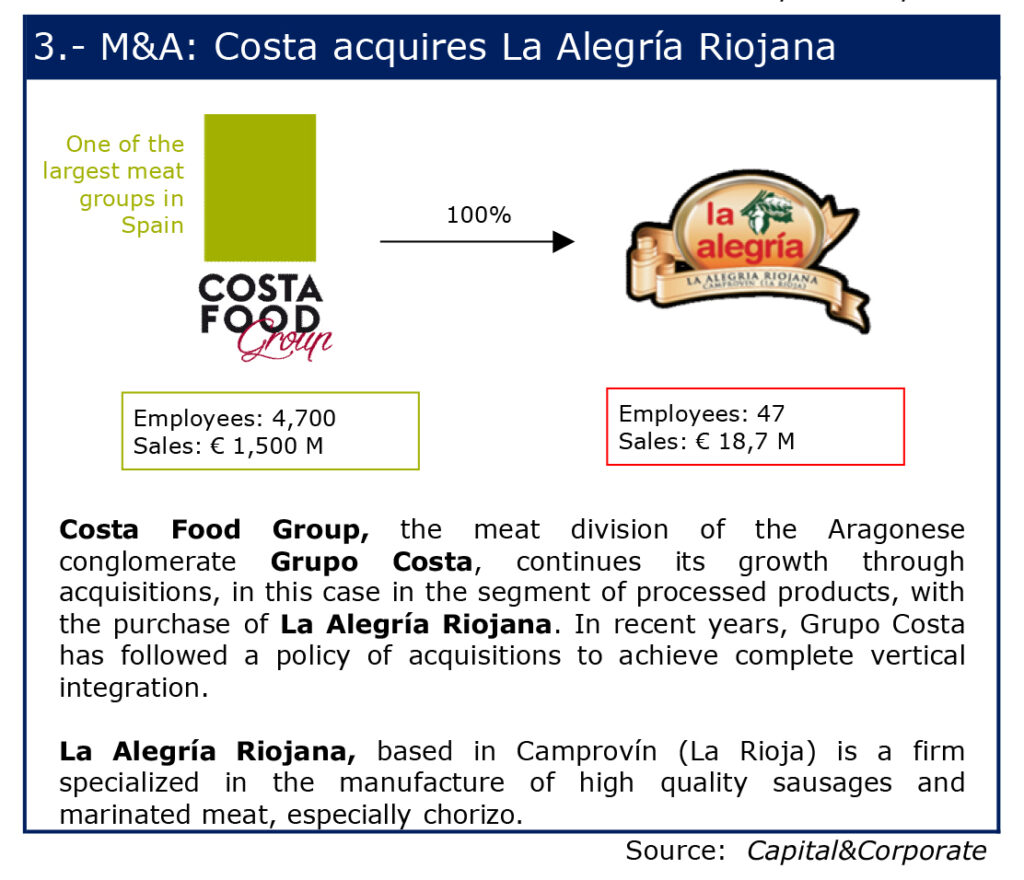

- Costa Food Group’s acquisition of 100% of La Alegria Riojana.

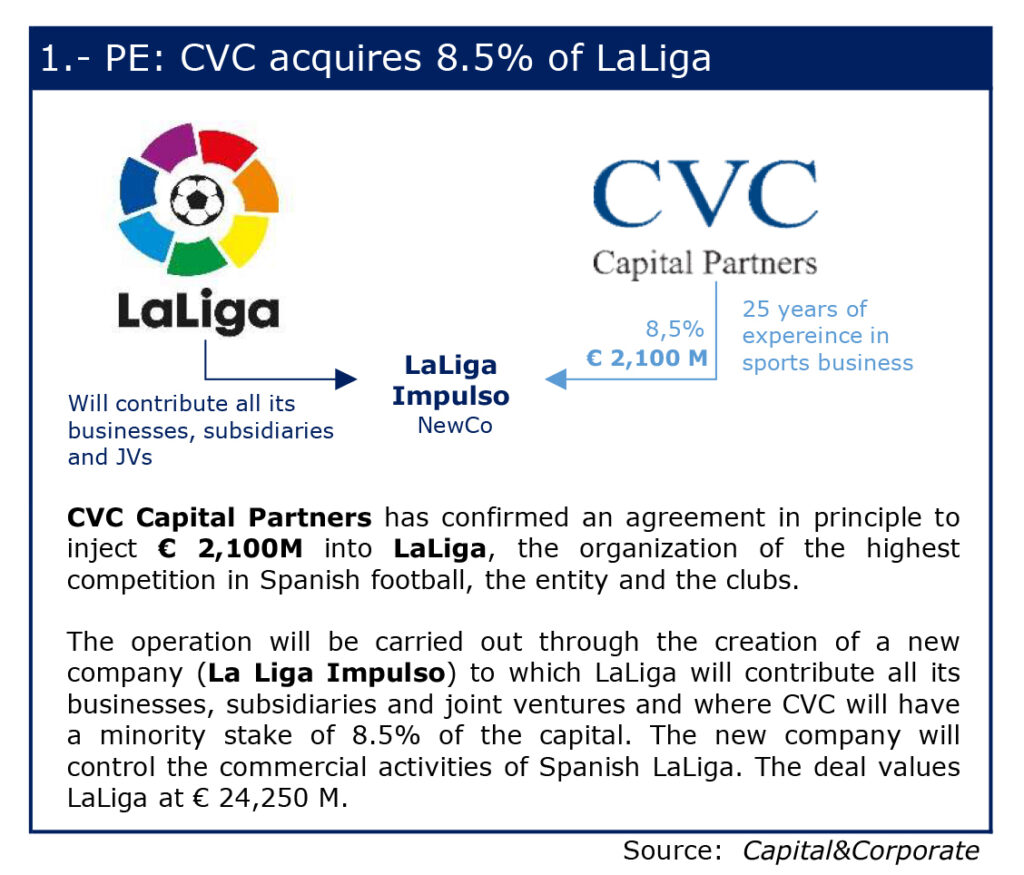

- CVC’s agreement to inject 2.1 billion euros into La Liga in exchange for 8.5% of a NewCo, valuing La Liga at approximately 24,250 million euros

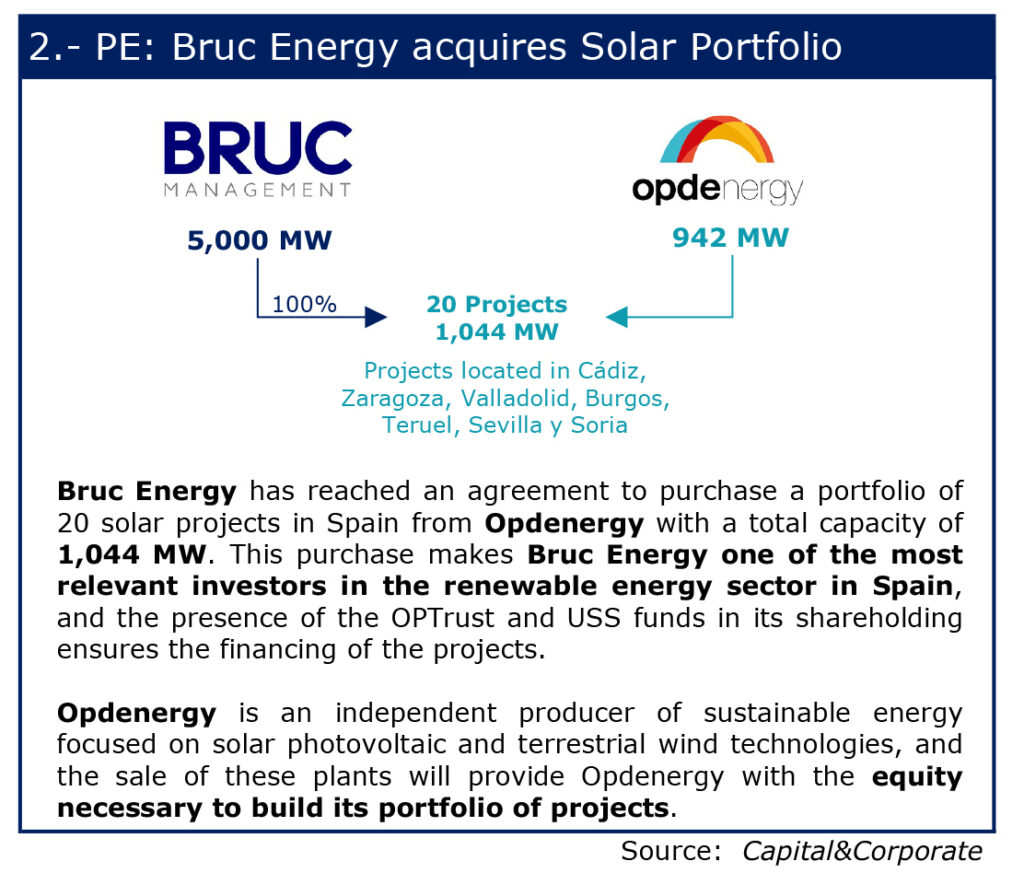

- Bruc Energy’s acquisition of the Opdenergy portfolio with a total capacity of 1,044MW

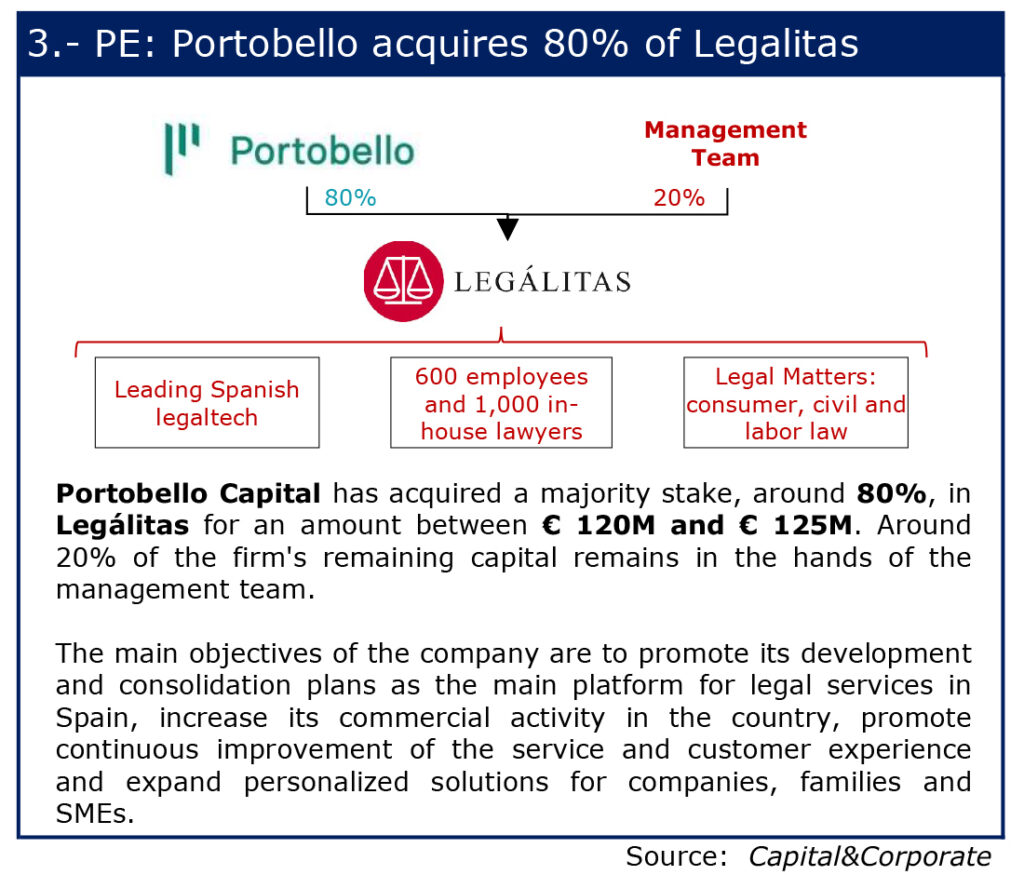

- And finally, Portobello Capital’s acquisition of a majority stake, around 80%, of Legalitas for an amount between € 120M and € 125M.

M&A August 2021

Private Equity August 2021

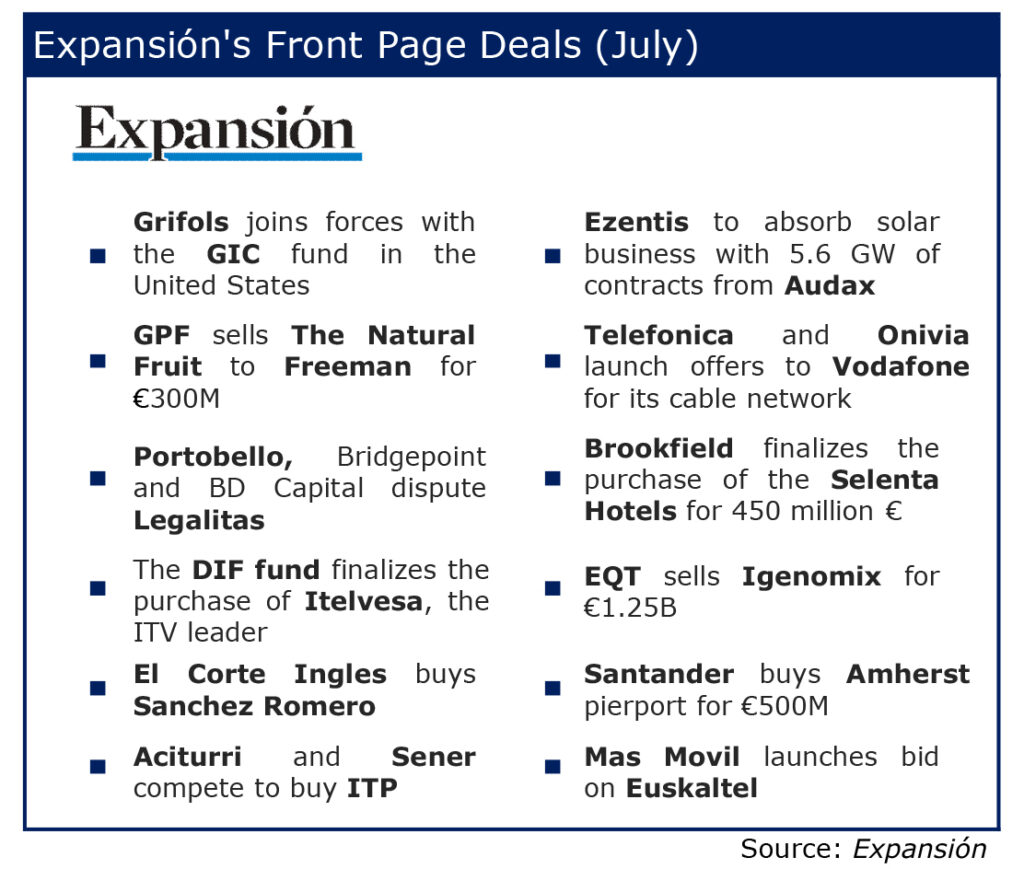

Three finance-focused media sources were analysed (Capital & Corporate, Expansión and The Financial Times) to observe which transactions were reported on. For July, these included:

Capital & Corporate: The newscast highlights the previously mentioned operations of Platinum Equity, Acciona and Solarpack, among others.

Expansion features the following headlines:

- Grifols joins forces with the GIC fund in the United States

- El Corte Inglés buys Sánchez Romero

- Brookfield completes the purchase of Selenta Hotels for 450 million.

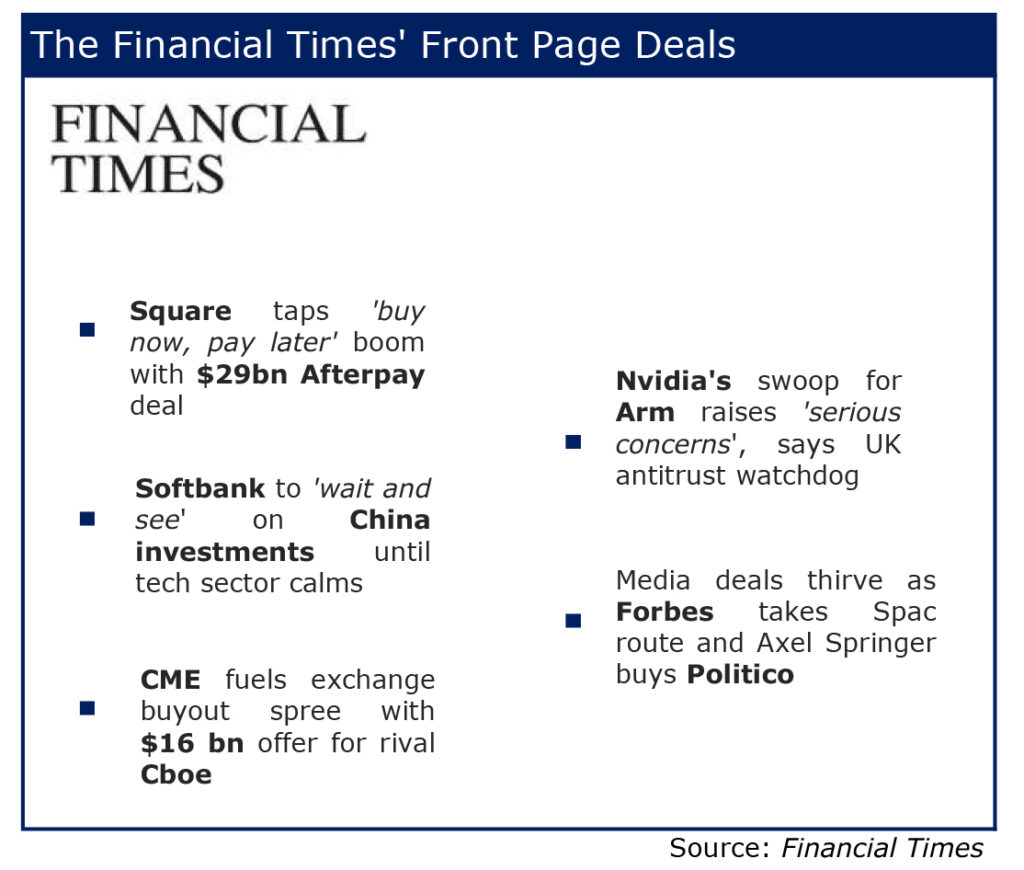

Regarding the global market, The Financial Times highlights the following news on the front page:

- Aon’s $ 30 billion deal with Willis collapses after being blocked by the US.

- Phillip Morris makes £ 1bn bid for inhaler group.

- SoftBank Invests $ 13 Billion as New Fund Accelerates Pace of Investments.

July 2021

For August, these included:

Capital & Corporate, features the transactions of Bruc Energy, Eiffage and Portobello, among others.

Expansión highlights the agreement carried out by La Liga and the CVC fund, among others.

And the Financial Times highlights the agreement reached by Square and Afterpay for $ 16bn and the IPO of Forbes magazine via Spac.

August 2021

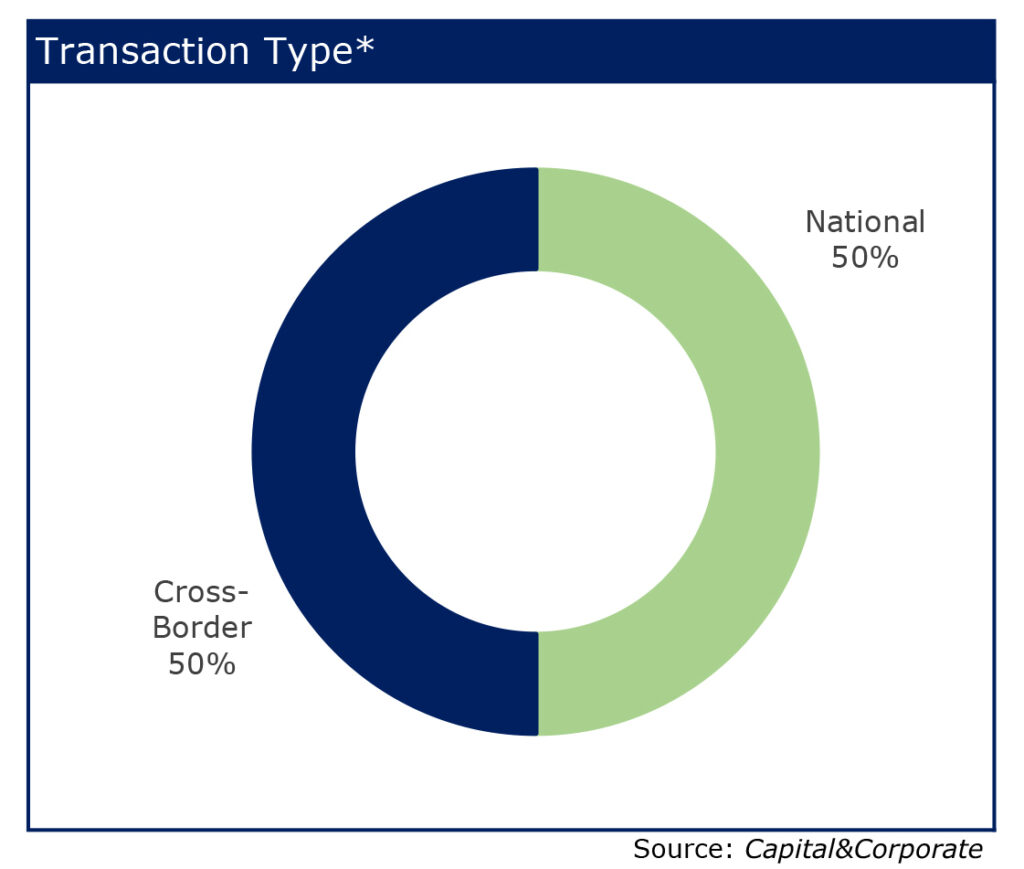

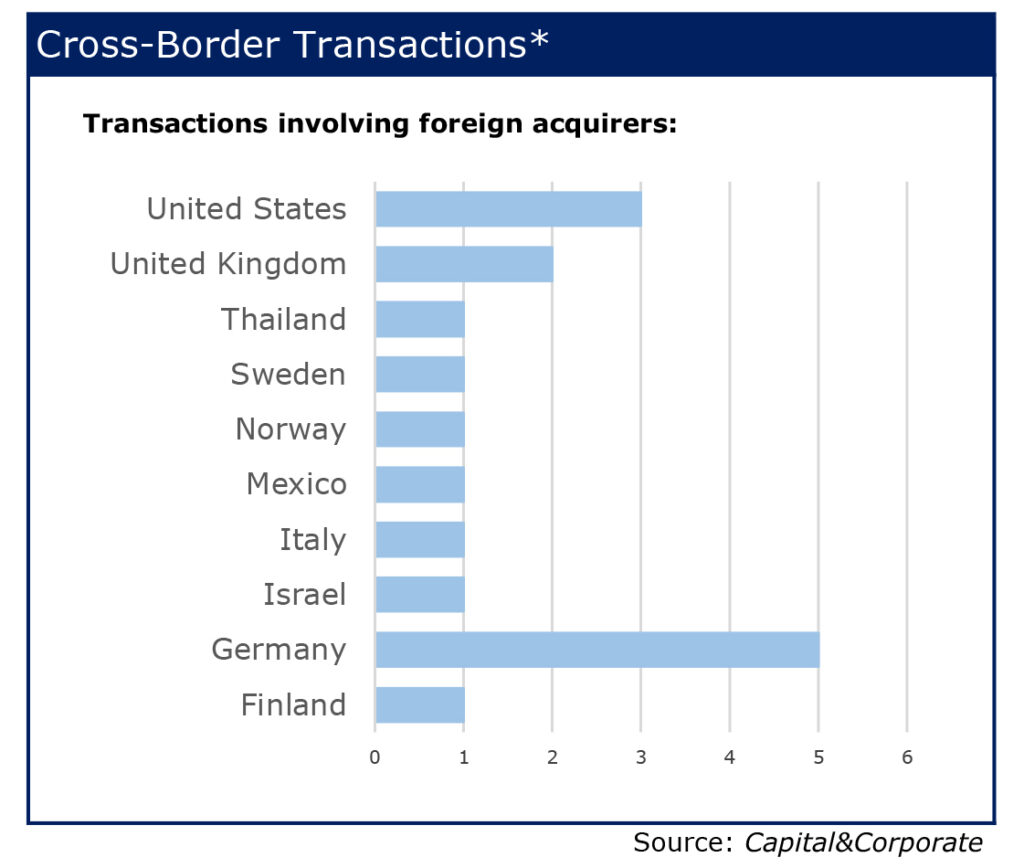

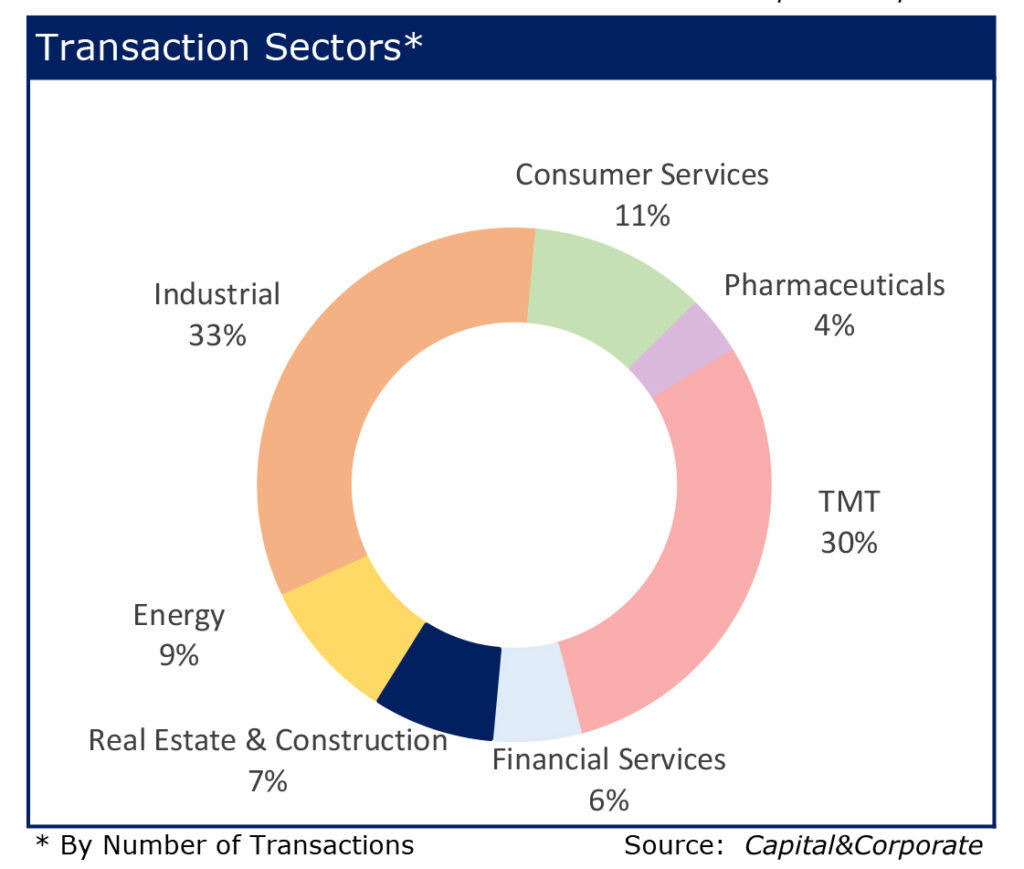

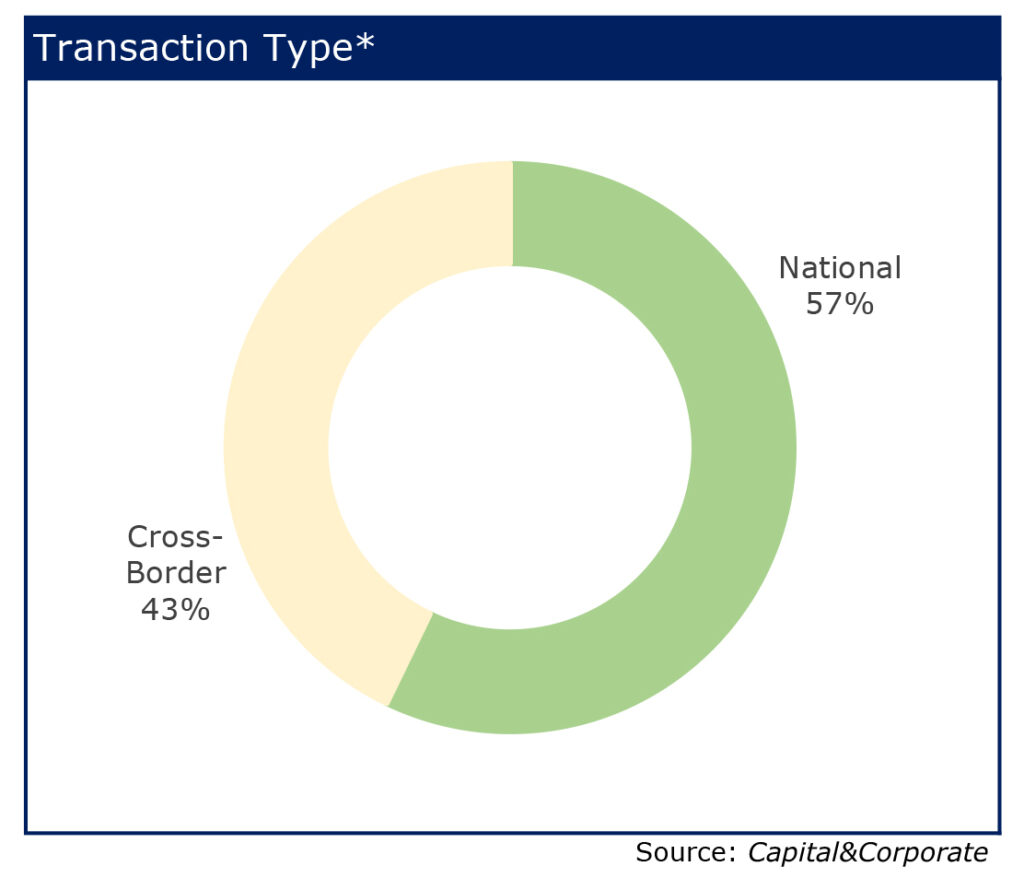

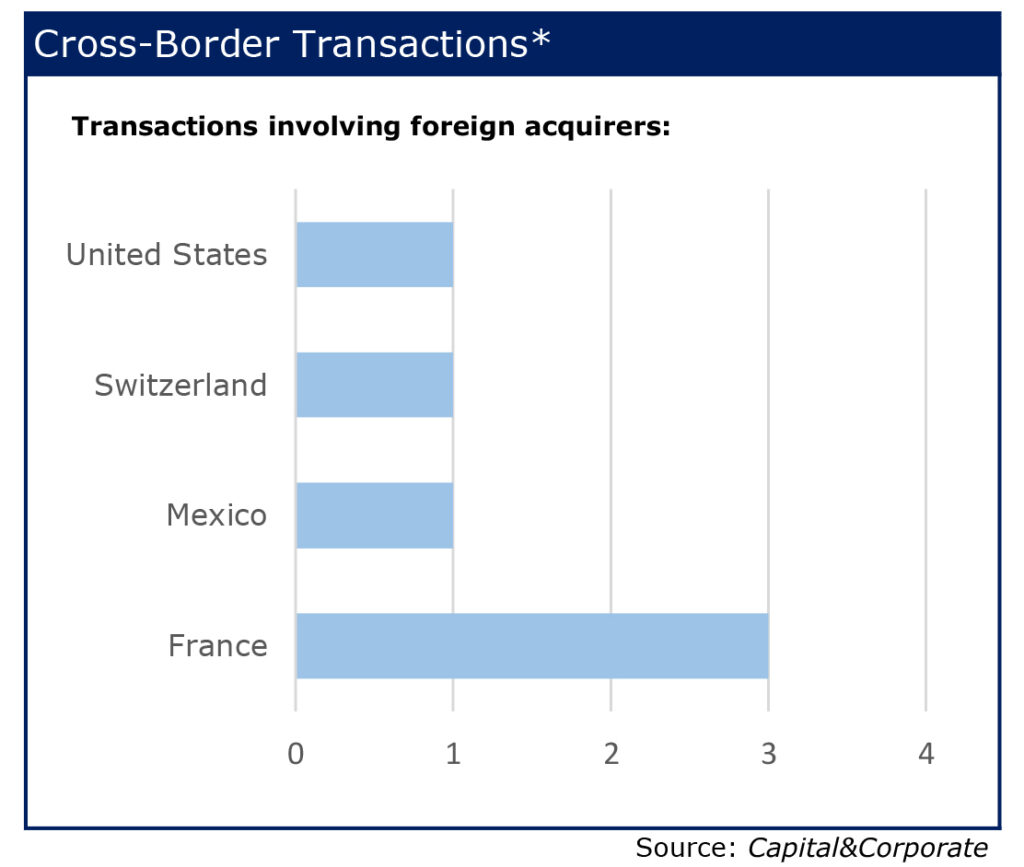

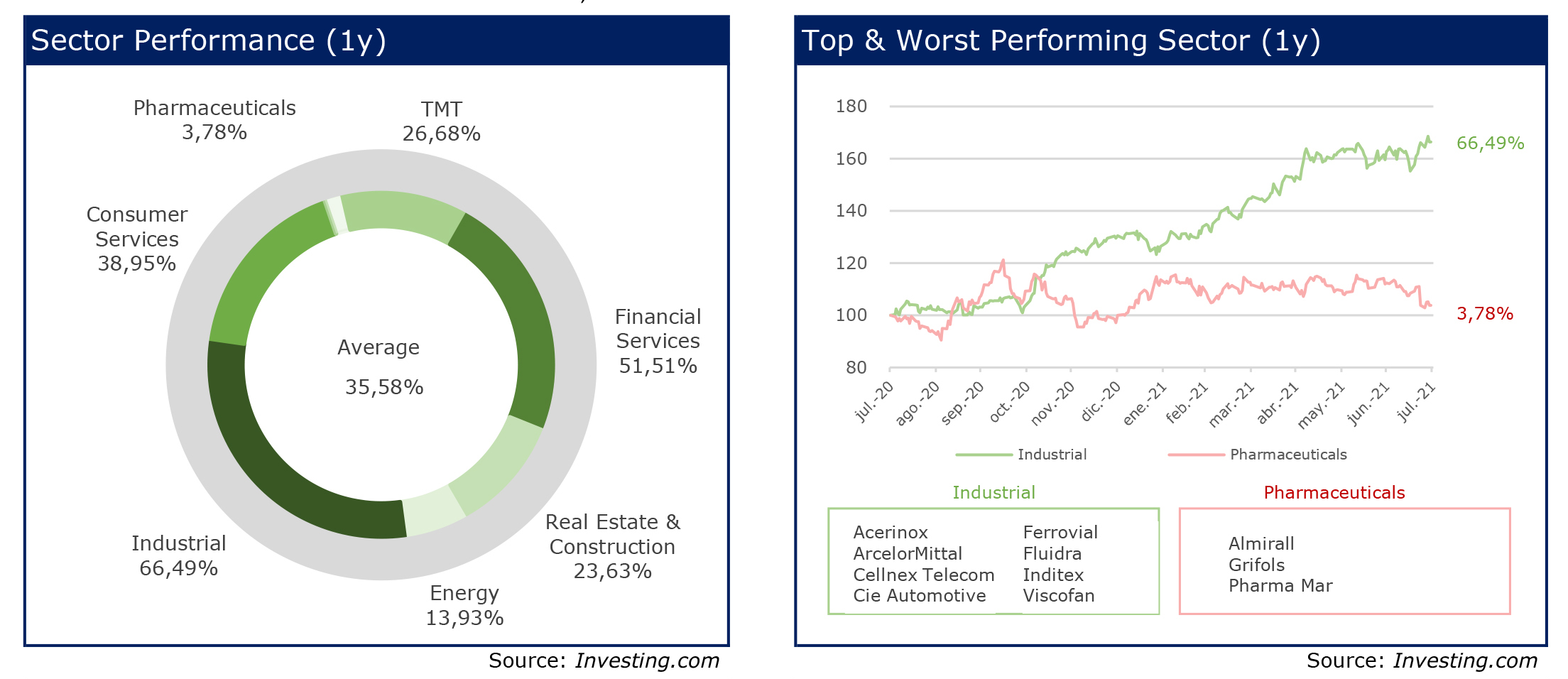

There were 54 transactions that took place in the Spanish market during the month of July according to Capital & Corporate, and from RS Corporate Finance, we can observe that 50% of these transactions involved a foreign part and the other 50% were domestic transactions. Of those that involved a foreign acquirer, the country that invested the most in Spain was Germany, followed by the United States and the United Kingdom. The sectors that have seen the highest number of transactions have been the Industrial and TMT sectors, representing 63% of the sample.

July 2021

During the month of August, there was a 7% increase in domestic transactions compared to July. Of the foreign transactions, the country that most invested in Spain was France. The industrial sector is enforced for the second consecutive month as a sector of activity, accounting for 59% of operations in August.